It appears that there is no longer any reason at all to own gold in any form. Didn't you hear that there's now a Covid vaccine and that the Biden/Yellen combo will solve all future debt and deficit issues? So, sell it all and buy stocks and Bitcoin. At least, that's what The Banks hope you do.

What a truly exasperating past few weeks this has been. Of course, I know that price actually peaked at $2080 over 100 days ago, but it's the past 16 days that have been the most excruciating. And now we are getting absolutely smoked this week on no new news and in spite of option expiration. What we now have is an utter liquidation of December positions—driving at times up to $5 of backwardation versus the spot price—all in the name of Covid Cures and an alleged removal of concern over a contested election. All of which is laughable, but none of that laughter can keep price above the 200-day moving average.

And why the race to liquidate? Again, who needs gold futures at this point? Covid has been cured, everyone is back to work, the economy is booming, The Fed is going to hike rates and all debt/deficit issues have been solved. Didn't you hear the news? No? You missed those headlines? Curiously, so did I. Instead, could this simply be overt price manipulation, where The Banks "dissuade" all parties from any consideration of standing for delivery in December?

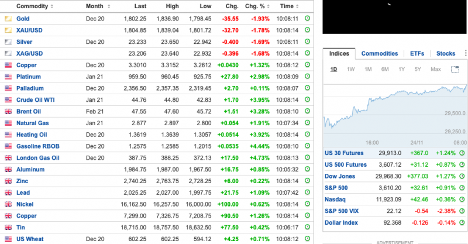

Maybe you think I'm just a crazy conspiracy theorist who only leans on "manipulation" when prices go down? Maybe you have a better explanation of why everything else is up on a lower dollar today…EVERYTHING EXCEPT GOLD AND SILVER.

And so, why the sudden urge to smash price and force a liquidation event that coerces as many parties as possible to NOT stand for COMEX delivery next month? Actually it was just last week that we discussed the pending December delivery period in our weekly post. You should be sure to read it now if you missed it: Ahead of December COMEX Deliveries

For additional clarity, please understand these three points:

- While COMEX option expiration always has an impact, this current selloff has placed nearly as many put options into the money as there are now call options out of the money. Thus, this is not the rationale for a smash this time.

- There is not a new liquidity crisis. The DJIA just hit 30,000 today, and as noted above, nearly everything EXCEPT COMEX gold and silver is up today. Dow Tops 30k (After Flood Of $14 Trillion In Global Liquidity)

- While the recent $920,000,000 fine levied against JPMorgan for precious metals market manipulation was nice to see, it hasn't taken JPM out of the precious metals business. In fact, the fine was less than what the bank made trading and "servicing" precious metals over just the past twelve months. Exclusive: JPMorgan dominates gold market with record $1 billion precious metals revenue

So what's really going on this week, and why are the COMEX digital metals being driven sharply lower?

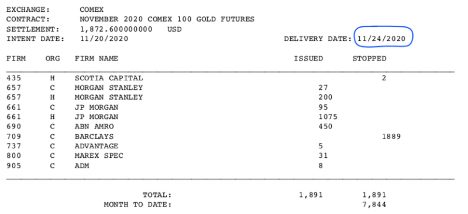

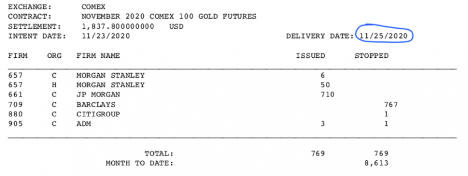

For TFMR subscribers last Saturday, we explained the likelihood that on Friday a "customer" of Barclays had jumped the queue and ponied up $350,000,000 for the immediate delivery of 1,889 Nov20 contracts. Well, guess what? It appears possible/likely that the same entity hit them again on Monday, putting up about $150,000,000 for 767 more.

(We know all of this new open interest and immediate delivery was a BUY, because all of the stops are with one bank and all of the issuances are spread out between multiple suppliers. If it had been an immediate trade to SELL 2,656 contracts, there would instead have been one issuer and multiple stoppers.)

So why on earth would someone suddenly rush to put up $500,000,000 in order to get immediate delivery of 8.26 METRIC TONNES of gold from the COMEX? Why not wait for December? Why not buy it in London? (Again, please refer to our post from last week that's linked above.)

And then at the same time, price is smashed—again on NO NEWS and while the dollar, the TIP, and bond market are mostly flat. Put it together and those dots certainly seem to connect.

So you unexpectedly flush price on a simple PMI datapoint yesterday. You keep the momentum going down all day. You get the Asian trade gapping things lower last evening. You keep the heat on in London. You get The Specs in NY to panic flush again on COMEX and suddenly price is below the 200-day MA. Here comes your sycophant media to proclaim that gold is now at its lows since July and now EVERYONE wants to sell—completely forgetting why they ever bought digital gold exposure in the first place.

But I suspect that YOU haven't forgotten why you own gold and silver. I know I haven't. And in the end—before Covid and QE∞ and all the election madness—our target for 2020 was precisely where price sits right now as I type. $1800. And while we have met and even exceeded our price targets this year already, the overall situation for The Banks has certainly deteriorated, thus the need for this massive liquidation flush just before December deliveries begin.

I will remain steadfast and resolute in the face of this. I know why I own and store physical precious metal and a few select mining shares. Nothing that has occurred since yesterday...or August 6...or January 1...has changed that. I hope you're able to have a great day regardless of the usual criminality and shenanigans.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.