As of August 24, gold bullion1 has gained 27.13% YTD and 39.74% YOY. Gold mining equities (SGDM)2 are up 38.85% YTD and 61.54% YOY. This compares to 7.55% YTD and 11.96% YOY returns for the S&P 500 TR Index.3 Silver has posted outsized gains, climbing 49.03% YTD and 50.00% YOY.

Gold is a Mandatory Portfolio Asset

Now that gold has powered over $2,000, it's an excellent time to take stock of what has been accomplished by the monetary metal and what may lie next. As for my Gen-Z "Glow Up" reference (and more below), conversations with my 16-year-old daughter are a constant reminder that I, too, like the gold market, need some updating and modernization.

Most importantly, in our view, it has been established as a baseline that a diversified asset portfolio must include an allocation to gold. We believe this statement is justified by the fact that gold is now the only monetary asset that is priced by a liquid-free market and not directly correlated and partially controlled by central bank (i.e., government) policies and market interventions.

Without once again judging the merits of the exceptional monetary debauchery and fiscal stimuli of 2020, and regardless of an investor's views on credit and equity market valuations or prospects for inflation, there is no other liquid asset which accomplishes what gold does in the way of portfolio insurance and purchasing power protection.

High Key Currency

Gold's superior track record as a currency has been demonstrated over 100-, 50-, 20-, 5- and 1-year timeframes. Almost 50 years since de-coupling with the U.S. dollar (USD) and throughout the advances of electronically transmittable fiat currencies, gold has relentlessly retained its luster. While there have been corrections during gold bear markets, most notably versus the USD as it became the chief global collateral asset, gold has savagely outperformed as a store of value, as shown in Figures 1-3.

Figure 1. Purchasing Power of Main Currencies in Gold

Over the past 20 years, these five major currencies — U.S. dollar, Euro, Yen, British Pound Sterling, Swiss Franc — have all lost purchasing power value when compared to gold bullion.

Figure 2. Gold in Various Currencies Indexed: 5 Years (2015-2020)

Over the past 5 years, gold has increased in value relative to these five major currencies — U.S. dollar, Euro, Yen, British Pound Sterling, Swiss Franc.

Source: Bloomberg. Data as of 7/31/2020.

Figure 3. Gold in Various Currencies Indexed: 20 Years (2000-2020)

Over the past 20 years, gold has increased in value relative to these five major currencies — U.S. dollar, Euro, Yen, British Pound Sterling, Swiss Franc.

Source: Bloomberg. Data as of 7/31/2020.

We are at a loss to explain why salty investors with long-term horizons refuse to classify gold as its own unique portfolio allocation. Gold's track record, along with the diversification and correlation statistics, all stand on their own.

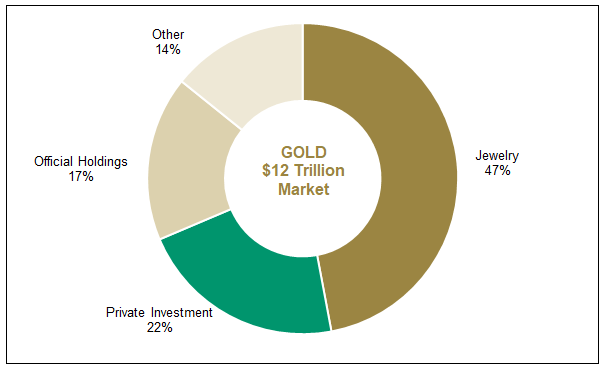

We should also highlight, once again, the massive size and liquidity of the gold market, which we estimate to be over $12 trillion and $100 billion traded per day, respectively. Of this total, approximately $3-4 trillion can be accessed by private investors as physical gold in stored bar formats, coinage or gold mining equities, while most of the balance is owned by central banks or used as gold consumed in jewelry or industry.

Figure 4. Gold is a $12T Market…Trading More than $100B Per Day

Source: World Gold Council. Based on a gold price of $1,950.

Figure 5. Daily Notional Gold Volumes

Source: Bloomberg. Data as of 6/30/2020.

Update on Fundamentals

We believe gold is well-positioned versus its risk-free counterpart U.S. Treasuries on both a short- and long-term basis. While bonds may be effective cash-parking vehicles for quick-triggered investors, they currently submerge investment portfolios with negative real returns and also expose their owners to plenty of inflation risk. Global debt and deficit to gross domestic product (GDP) ratios are near record highs while real interest rates are anchored below zero through market intervention.

After 10 years of tepid economic growth, we now enjoy record-high asset valuations and suffer from minuscule cap rates. And yet, from the banking provisions and economic statistics, we read the worst is yet to come. Massive inequality is fueling populism globally, which in turn generates election victories for those political parties promising even more "tax and spend." These factors combine to load a tightly coiled spring which could launch us into uncharted monetary territory at any time. We are currently comfortable with JOMO (Joy of Missing Out) on financial market activity and will be increasing our recommended gold sector allocations in the current environment.

More specifically, we believe the gold price has gravitated back to its historical correlations to the rapid growth of M2 money supply,5 towering U.S. deficits, and the exploding size of the Federal Reserve balance sheet (which can henceforth serve as a rough proxy for USD currency that has been printed by Modern Monetary Magic). Gold prices should gravitate into the mid-$2,000s based on these factors and the announced roster of monetary and fiscal programs, not considering the acronyms to come.

Figure 6. We Predict that Gold Prices Should Gravitate to Mid-$2,000s

Source: Bloomberg. Data as of 8/24/2020.4

Gratifyingly, we at Sprott are seeing evidence that some investors are finally ushering gold out of the realm of a fringe trading asset and toward a necessary portfolio allocation. Based on our estimates, roughly 20% of investors we cover allocate to gold and at approximately a 1-2% allocation level. We are quite early in this adoption process, and believe it entirely possible that circa 40% of investors will eventually nominate gold as an asset class at an average 3-5% allocation. That would generate $2-3 trillion of buying/market appreciation, which likewise would drive gold into the mid-to-high-$2,000s.

The Challenge

The penultimate, and somewhat unappreciated, qualification of gold is to attain complete "fungibility." A study of gold's major weaknesses is required to understand the importance of this concept.

Currently, gold does not qualify as a "Highly Liquid Quality Asset" under proposed Basel III banking guidelines. Without getting into the minutia, under the current proposal it has been assigned a "Required Stable Funding" ratio of 85%, 17 times the equivalent capital charge for U.S. Treasuries! We understand that the main reason for this determination by the European Union (EU) finance ministers was the lack of transactional data reported on a global basis to evidence the qualities of gold's underlying liquidity, which appears to exceed that of government bonds by some margin.

Complicating matters is the lack of standardization of the various forms of gold bullion specified for delivery purposes across global financial markets, i.e., 100-ounce, 400-ounce or 1-kilogram bars. All denominations are stored in different vaults and currently need to be moved around for settlement in an archaic fashion more appropriate to a market of spoilable goods.

The limitations of physical gold were thrust into the limelight by the recent spike in the EFP (Exchange for Physical) contract. The EFP, which usually trades in the range of $4-5 per ounce, spiked in March to over $69 as driven by the increased demand for physical gold in North America both for settlement on leveraged COMEX contracts and to satisfy the demand for allocated physical bars and coins — while the refinery and gold transport system was COVID-19-handicapped. As a side note, we acknowledge that there is an indisputable movement by gold investors toward allocated physical gold, a positive development in our view.

Much as we experienced schadenfreude at seeing gold's principal commercial bankers — who used the futures versus physical arbitrage as their profit playground for decades — get spanked by this spike to the aggregate tune of some $500 million by our math, the resulting scrutiny by regulators and reduced trading liquidity isn't good for gold. A modern, highly liquid monetary-based market like gold should not be shackled with these limitations and the physical gold market must be upgraded ASAP.

There are multiple objectives for a new set of physical gold standards: speed and cost of settlement, trade reporting, regulatory oversight, ease and cost of storage, trading costs, etc. All of which are constrained by aged systems of the various players involved in the gold trade, whose sus-pect behavior is motivated more by protecting existing profit centers than by making gold a better and more widely-owned asset. It's a classic case of making more from each tree than increasing the size of the forest.

Gold's New Aesthetic

We believe that standardization and tokenization is the next critical step for gold. A single standard, and a single token would achieve the optimal result. The headline goal should be that inspected and insured gold can be held in qualified vaults and registered on a central ledger. Ideally, this would avoid the need for movement of the physical, unless required for tax purposes.

The process of setting more universal standards for gold has begun and is being led by the largest constituents in the gold ecosystem. Notably, the World Gold Council CEO David Tait is chairing a newly-minted FICC Market Standards Board working group for precious metals, and London Bullion Market Association (LBMA) CEO Ruth Crowell is setting up a digitization task force. We encourage their equivalents at the Chicago Mercantile Exchange (CME), the world's major vaults, and key regulatory and commercial banking unit heads to jump on board.

Once standardized, gold can be vaulted by qualified parties, which could also serve the function of guaranteeing the "good delivery" nature and purity of the bar. Enhanced providence procedures could be added to verify "ESG" (environmental, social, and corporate governance) qualifications and the source of origin of the bar to ensure that it has been ethically produced. Bars can then be added to a digital and fully encrypted ledger, which could only be traded and altered by qualified participants, who in turn will have satisfied regulatory requirements for end customers. Customer positions on the ledger could be held by qualified custodians, assigned CUSIP (Committee on Uniform Securities Identification Procedures) numbers, be moved freely within other financial accounts, and be traded on public exchanges, and, importantly, better optimized as a form of financial collateral. Finally, the ledger could freely interact with payment systems, allowing customers to pay for goods and services priced in fiat currency using fractional breakdowns of their gold ledger account balance.

Digital Gold

Do I sound too "Gucci"? The technologies required to provide the infrastructure for this goal already exist and are being operated on a small-volume basis. In no particular order, the following table provides a summary of several companies that have already developed new technologies covering the essential gold investing services needed on this new railway.

New Gold Technology |

Company* |

|

Blockchain ledger verification and transfer, and eventually, on exchange trading |

Tradewinds Markets |

|

Tokenization of physical gold |

Paxos |

|

Legitimate secure and web-based independent vaulting |

Royal Canadian Mint, Brink's, Royal Mint, Perth Mint, Singapore Bullion Vault |

|

Web-based customer-facing storage and trading platforms |

BullionVault, Goldmoney, OneGold |

|

Web-based, gold-backed payment system and card |

Glint |

*Sprott or its affiliates is an investor and interested party in Tradewinds Markets, OneGold and Glint.

The legal structure and regulatory oversight most commonly referenced for tokenization is a form of a warehouse receipt for an asset. The principal regulation involved is Anti Money Laundering, although applicable Know Your Client and exchange trading rules would cover the integrity of the system. From a regulatory and exchange perspective, we believe the concepts of digital gold are more advanced than those of cryptocurrencies.

Keeping it 100

Why does any of this matter to an asset that has outperformed all others year-to-date and over the long term, as shown in Figures 7-8? Because gold needs to become fungible, interoperable within financial accounts and more efficient for all investors to own. This will assist in both increasing the size of its audience and the participation rates of that audience. As per our earlier estimates, the prize is to bring the other $200 trillion-plus financial markets towards gold as a modern store of value, separate asset class and participant in the financial system. The resulting increased flows and participation rates should, in turn drive the gold price much higher. With $2,500 now in sight based on fundamentals, why not aspire to something much better?

Figure 7. Gold Has Outperformed Stocks, Bonds and the USD YTD... (as of 7/31/2020)

Source: Bloomberg. Data as of 7/31/2020. RHS % figures reflect cumulative returns for YTD period.

Figure 8. Gold Outperforms Since 2000

Source: Bloomberg. Data as of 7/31/2020. RHS % figures reflect average annual total returns for the period from 1/1/2000 - 7/31/2020.

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Index. |

| 2 | Sprott Gold Miners Exchange Traded Fund (NYSE Arca: SGDM) seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, the Solactive Gold Miners Custom Factors Index (Index Ticker: SOLGMCFT). The Index aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U.S. exchanges. |

| 3 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 4 | M2 is a calculation of the money supply that includes all elements of M1 as well as "near money." M1 includes cash and checking deposits, while near money refers to savings deposits, money market securities, mutual funds, and other time deposits. |

| 5 |

GOLDS Comdty measures the price of gold; M2NS Index measures M2 money supply which includes a broader set of financial assets held principally by households; FARBAST measures All Federal Reserve Bank Total Assets; FDDSGDP Index is the U.S. Treasury Federal Budget Deficit or surplus as a % of Nominal GDP.

|

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.