The year 2021 has begun poorly for us beleaguered precious metal investors, and it's enough to make you crazy, as nearly everything is moving in directions contrary to what common sense would predict.

I mean, think about it for a bit. Since the start of 2021, we've seen:

- Trump sign $900B in new stimulus

- An occupation of the U.S. Capitol building

- Political theater and impeachment

- Biden propose another $1.9T in new stimulus

- The Fed promised zero rates through 2023...again

- Economic data plummet as lockdowns prevail

And yet, the Dollar Index has bounced and the bond market has sold off. Therefore, both COMEX gold and COMEX silver are down YTD. You must be scratching your head and wondering why. Well, at the end of the day, it's not very complicated.

The internationally-recognized price of gold (and silver) is NOT based upon any sort of physical metal transaction. That's so 1960s. Instead, the price is determined through the trading of digital derivative futures contracts in New York and unallocated forwards in London. So the only way price rises is when demand for these derivatives outstrips the supply.

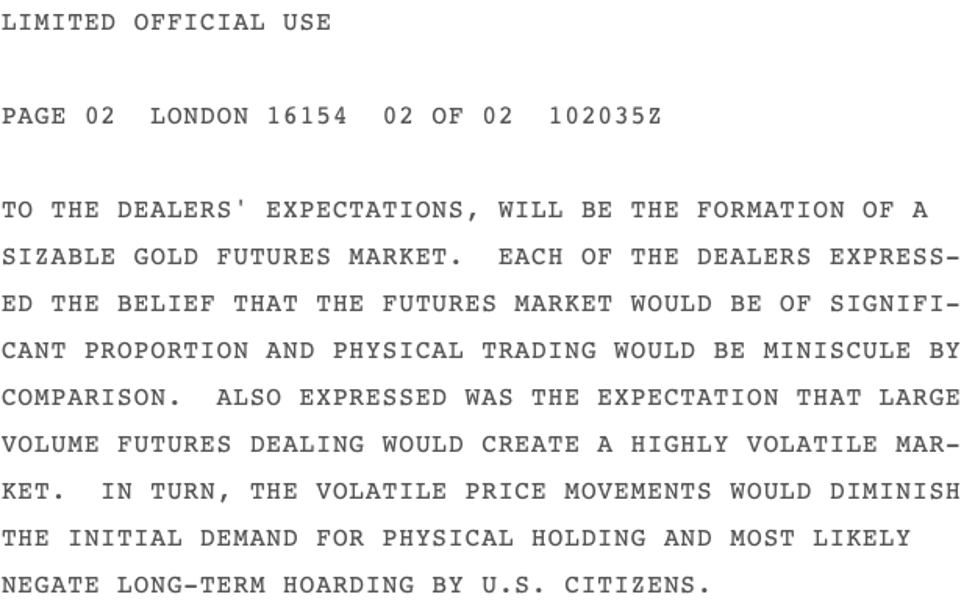

The big rally last summer was a period of Bank reluctance to add derivative supply, and price soared. Since then, Banks have felt more comfortable adding supply and prices have been driven consistently lower. If you don't understand WHY the pricing system was set up this way 45 years ago, perhaps you've not yet reviewed this cable dated December 10, 1974—just three weeks before gold futures began trading in New York:

https://wikileaks.org/plusd/cables/1974LONDON16154_b.html

While you should be certain to review the entire text, below is the key paragraph as it relates to physical gold and price:

Additionally, the trading of these derivatives in 2021 is primarily done through HFT algorithms. These Machines do not recognize the value of precious metal, nor are they designed to take into account the bullet points listed above. Instead, they only "see" movements in notional bond yields and forex, and then act according to how they've been programmed.

Therefore, you and I know that all of the bullet points above are EXTRAORDINARILY BULLISH for precious metal ownership. However, The Machines that determine price have no concept of this. So, what we'll await in 2021 is the moment when The Machine "fundamentals" switch again to our favor. And what will be the driving factor? When The Fed begins to implement Yield Curve Control.

This change in Fed policy, however, will come in stages. The first will be a mention of buying longer-term maturities within their existing QE program. If that doesn't work, they'll next actually start buying those 7-, 10-, 20-, and 30-year maturities. And if that doesn't serve to cap rates below a certain level, they'll codify this desire into a formal written policy change.

How long will it take for this to happen? We'll get our first hints on January 27 and the conclusion of the next FOMC meeting. In the summary and press conference that follows the meeting, look for statements such as this:

- "Some members favor extending the maturities being purchased through our current Large Scale Asset Purchase program”.

Perhaps Chairman Powell himself will utter something along the lines of:

- "The committee is concerned about the impact higher long-term interest rates might have on a recovering economy”.

Statements such as these will be your first sign that The Fed desires to cap long-term interest rates at/near the current levels. Perhaps this jawboning will be all that's necessary to drive long-term rates back down. However, if that doesn't work, expect them to actually change and extend the maturities of the treasury bond purchases as soon as March. And if that doesn't work, an official formalized policy change of overt Yield Curve Control will be enacted by summer.

Don't believe me? Then I encourage you to go back and read this trial balloon that was published by Bloomberg back in July of last year. Through this article, the reader was warned that The Fed's policy change toward "inflation averaging" was pending—and it was fully announced in late August at the virtual Jackson Hole conference. But be sure to note what was expected to be the second part of this policy change—Yield Curve Control.

In the end, and though 2021 has begun in frustrating fashion, it is still going to be a very interesting and positive year for precious metals investors. Prices will rally to highs beyond those seen last August. It's only a question of when that rally begins. At the conclusion of next week's FOMC meeting, we'll begin to be able to pin down the timeline.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.