Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

In my recent article, “Timeout Due After Big Gains”, I pointed out the increasing risk of a short-term pullback in precious metals and miners. I based this on the strong rally off the low in March, momentum indicators becoming overbought, and sentiment verging on extreme bullishness. In other words, “data”. Then, I tweeted this on Tuesday:

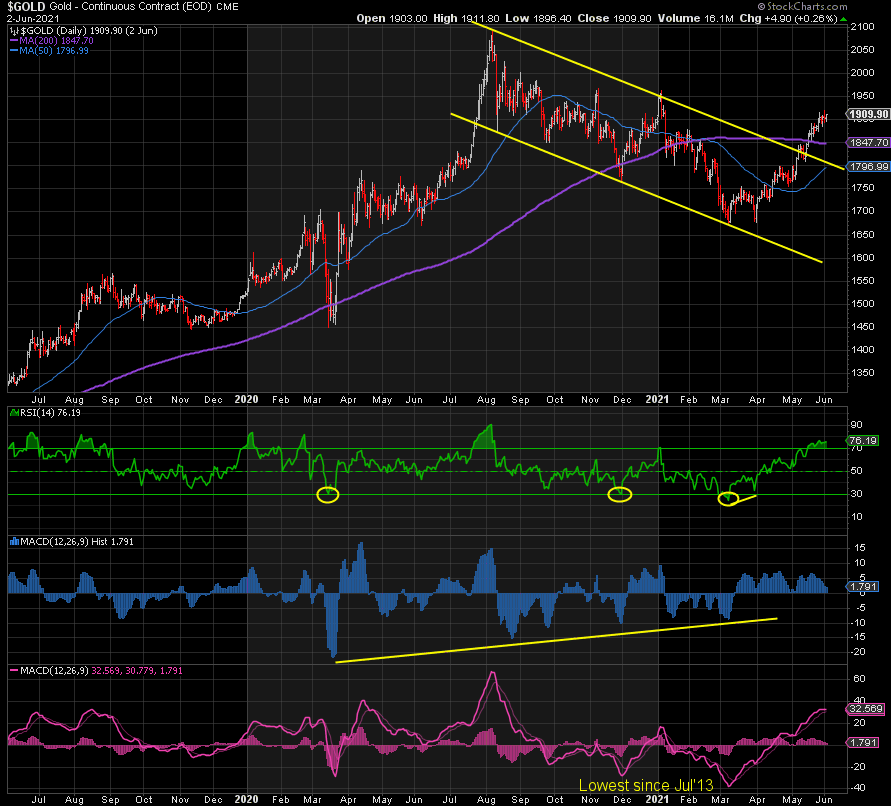

This was in response to a barrage of tweets citing that Gold is a bull market and therefore the RSI is not overbought. While it’s true that the RSI can become “embedded” above 70 for a time in a bull market, such as when Gold soared to 2089 in August 2020, this is the exception, not the rule. When the RSI hits 70 or above, it is overbought, and the vast majority of the time, price falls thereafter, especially when accompanied with negative divergence. So, the odds were heavily in favor of a pending pullback. What happened next?

At the same time that I said it was overbought, I said that sentiment was extremely bullish. I got several heated responses to that, too, saying that there was no sign of extreme bullishness and that everyone is waiting for a pullback that may never come. What was ironic about this was that these replies were actually confirming how bullish everyone was.

Whenever I go against the herd, I get these types of responses, which just reinforce my expectations. The herd is wrong far more often than not, especially after big rallies or drops. I can cite numerous examples of this over the years. This is why it pays to ignore the noise, focus on the data, and stand your ground in response to emotional outbursts. Emotion is the death of all portfolios.

Develop your own process based on data by just going back and looking at the conditions prevailing at all the peaks and troughs in any asset, identify consistencies, and then apply what you’ve learned going forward. While not 100% accurate—nothing is—it will significantly improve the performance of your trading and investments. If nothing else, it will eliminate emotional attachment to positions or forecasts. The best aspect of this approach is that it’s not rocket science. Anyone can do this. Unfortunately, most don’t.

So what’s next?

GOLD

We have already reached my target of 1872, and now we have two scenarios to watch for…

- The abc correction is done, the bottom is in, and we head back up to new highs above 1920 next.

- This abc correction is just the first wave A of a bigger ABC correction, with a ‘B’ dead-cat-bounce next, and then we head down to lower lows in wave C. We won’t know the targets on the downside until we get the peak in B.

I’m leaning towards the latter, because we haven’t tested any major support and because of what I’m seeing elsewhere, such as in SILJ. My targets on the downside remain as follows:

1844 is now also the 200-day moving average as well as the prior high. 1800 would represent a back-test of former resistance, now support, represented by the upper yellow line in the chart below. It is also the 50-day moving average. But there is a risk that we get an overshoot to the downside to 1750-70 that turns out to be a fake breakdown, and then up we go.

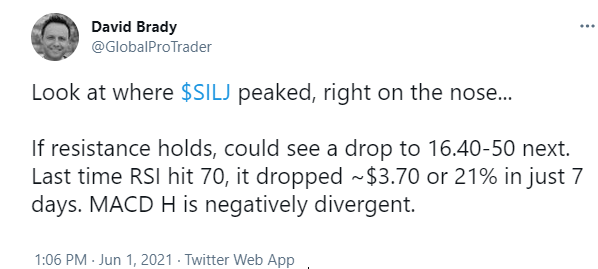

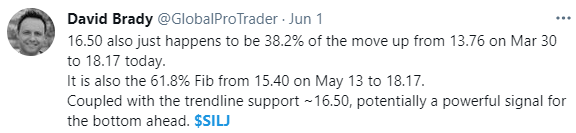

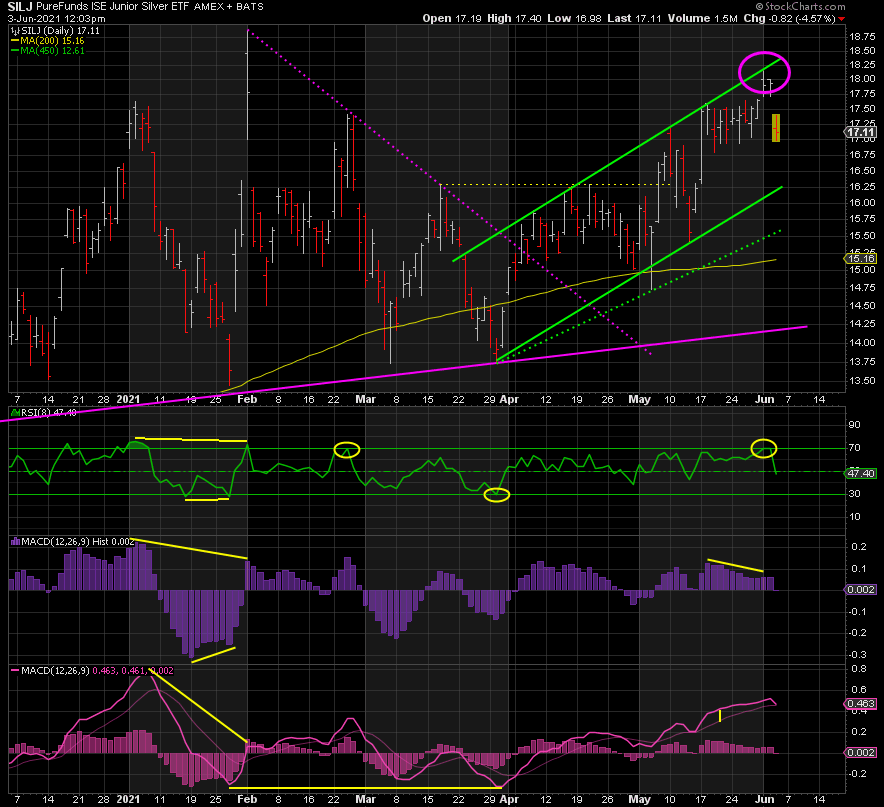

SILJ

So far so good…

The key point being that you must respect the data until proven otherwise. We got the expected pullbacks, but it may or may not be done just yet. If not, this could prove to be an extremely fortuitous gift ahead of the rally. I remain uber-bullish once this pullback is complete.

The more you know, the more wisely you invest.

Feeling inspired to invest in silver? Browse our selection of silver bars, coins, or our exclusive Sprott Silver.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.