February 9, 2018

The other thing with gold, which is what I’ve said for many times, China and Russia have infinitely more gold than people realize. Russia has around 40,000 tons of gold, China is not quiet as much but is not far behind. That’s the reality. They’ve been building enormous gold reserves for years. Why? Because they are building for a future.

If people think that gold and silver have no relevance any more then why is the price so massively, heavily manipulated in a southerly direction? London Paul, The Daily Coin

Some people in the Western world have heard of the Shanghai Cooperation Organization (SCO), not very many, and even fewer understand what it is and what it does. Hardly anyone in the Western world has ever heard of the EurAsian Economic Union (EAEU) which is headed by Russia and includes 4 other nations, Kazakhstan, Armenia, Belarus, Kyrgyzstan. Does that mean this alliance is weak or is of little importance? Absolutely not. The nations that form the EAEU will be rolled into the Belt and Road Initiative. Once these nations become part of a much larger alliance and their economies began to benefit from these economic and social ties, these nations will be on par with nations like Greece or Spain or any of the smaller European nation states.

What is overlooked is the mineral wealth these nations are sitting on. The land within the heartland is extremely rich with minerals. Once the technology becomes available to these nations and the minerals are mined and brought to market the potential economic growth will be massive. It has been estimated that more than 70% of the global natural resources, including oil, gold and diamonds, are held within the heartland. If you’ve got gold, you’ve got money. If don’t have gold you’ve gotten a problem – Alasdair Macleod

Gold is coming back to the monetary system. It never left the monetary system it’s just not been used in everyday transactions for a number of years. This is going to change and according to London Paul, The Sirius Report, he believes the blockchain will allow this to happen. I would tend to agree that blockchain technology will be used to bring gold and silver, and possibly other assets, back to their rightful place as backing for currency or as currency itself.

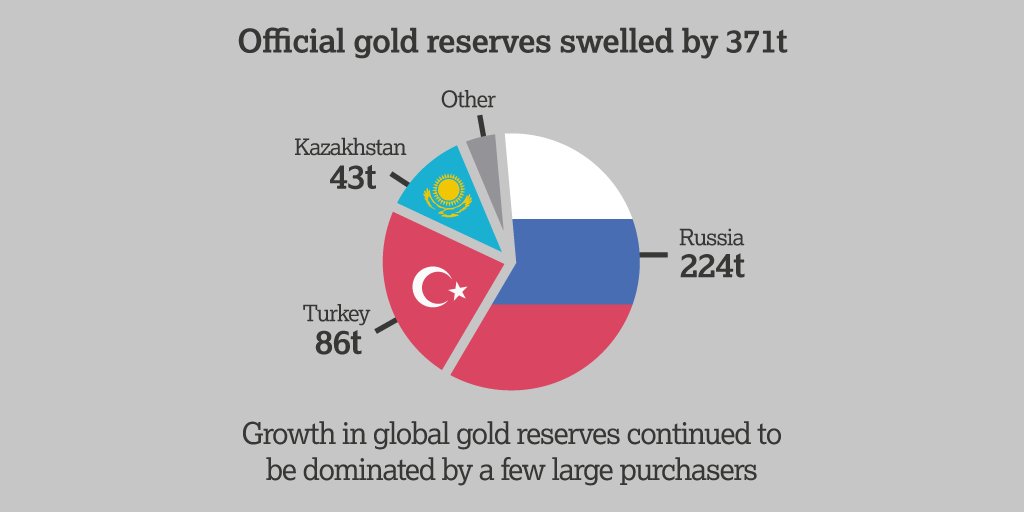

Chart courtesy Schiff Gold

These paper markets in London and New York will blow-up when the paper price of gold drops to zero or when just a fraction of the investors insist upon receiving physical gold in return.

The reality is London and New York markets are slitting their own throats with their market suppression of the gold and silver price. Undoubtedly higher gold and silver prices are coming. Eventually, there’s likely to be an arbitrage between the West and East prices and that’s going to become a reality.

What is coming is the ascent of sound money and the death of the U.S. dollar and in essence that’s what this much vaunted asset reset is all about. Basically, fiat money dies and sound money returns. London Paul, The Daily Coin

This in-depth conversation covers gold and silver from a global perspective along with the role of cryptocurrencies and blockchain, both today and their potential use in the future. London Paul paints a very realistic picture of gold and silver as money along with other assets backing currencies around the world. What benefit will this have to humanity? Will the debt based system finally be washed away? Only time will tell, however, it seems like there are nations around the world that are working towards a different type of system than the one that is currently in place.

The author is not affiliated with, endorsed or sponsored by Sprott Money Ltd. The views and opinions expressed in this material are those of the author or guest speaker, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Comments