Overvalued Stocks are Ruining the Economy - Rory Hall (13/9/2017)

September 13, 2017

From our perspective, the the corporate stock buybacks have been doing major damage to corporate America. If these companies were not buying their own stock for the past three years their “price” would be half or less than it is today. Who in the right mind believes Amazon’s stock is worth upwards of $1,000 per share? What is this based on?

The damage corporate stock buybacks has done to the economy can not be over-emphasized. If the “C” level executives are simply “recycling” company stock and driving the price higher they are unable to reinvest in the company. This means no new equipment, no new hires, no R&D and the list continues. This is destructive to the economy. Nothing progresses.

Now we see the S&P littered with overvalued stocks. This is not going to end well and as the economy continues to rot-on-the-vine as “C” level executives have played a significant role in creating this ongoing illusion.

By any measure, the stock market is expensive. But the market is a collection of stocks. Instead of focusing on the market, we can also analyze the stocks that make up the market.

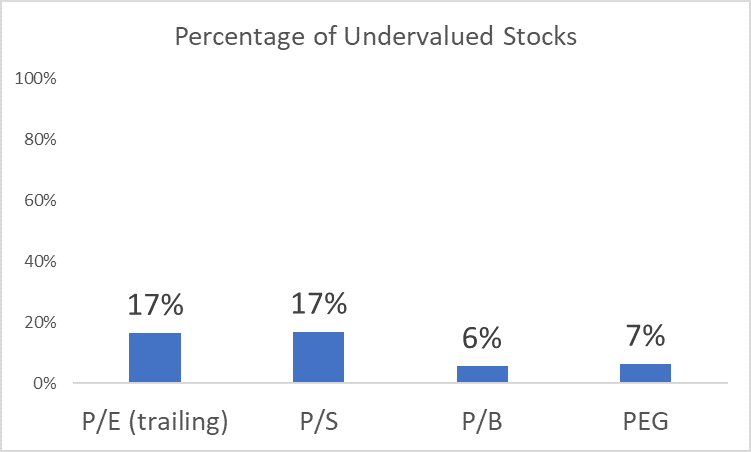

The chart below shows the number of individual stocks that are undervalued. As you can see, there aren’t many cheap stocks.

This chart is based on the stocks that make up the S&P 500 Index. Using all the stocks in the market provides similar results.

No matter how you measure value, less than 20% of the stocks in the market offer value. Source

The above commentary and chart, from Banyan Hill, provide even more support for my thesis. I can not say that corporate stock buybacks are the single source of the economic rot. However, according to the number of undervalued stocks, it seems the overvalued stocks, fueled by QE and buybacks, have in fact created their fair-share of damage.

At the end of the day it will not matter. The only thing that matters at this point is what we are doing about it to protect our families from what appears to be an inevitable outcome. We all have to make our own decisions, we are simply providing another guidepost along the trail.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.