Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

We write and post these articles every Tuesday, and next Tuesday, April 25, brings the monthly COMEX option expirations. For fun, let's do something different this week and see if we can accurately predict/guess where prices will be by this time next week.

Price manipulation around COMEX option expiration is something we've been following at TF Metals Report for over a decade. If you like to track the gold price and are unaware of this phenomenon, maybe this post will alert you to follow the monthly shenanigans going forward.

In short, the prices of COMEX gold and silver are often "managed" into a spot where the option-writing Banks will feel the least possible financial pain at expiration. To find that "sweet spot", we can consult the option interest figures and then review them for disparities at different strike prices.

Next Tuesday, April 25, will bring option expiration and pricing at the COMEX close. Once the monthly options are priced, those "in the money" will settle in cash, so if we search for a spot where there are equal numbers of calls and puts, we'll likely find a price target for expiration.

Now understand that this is not a 100% accurate predictive guide. There will always be events that might preclude the Banks' ability to manage price to a certain spot on a certain day. For example, what if price is on a glide path to a target that a market-making Bank would prefer, and then out of the blue, some geopolitical crisis appears on option expiration day? What's that about "the best laid plans of mice and men often going awry"?

However, it has been my experience that, more often than not, you can begin to anticipate the closing price on option expiration day once you get about a week out. Which is where we are as I type. Which is why I thought this might be a fun post.

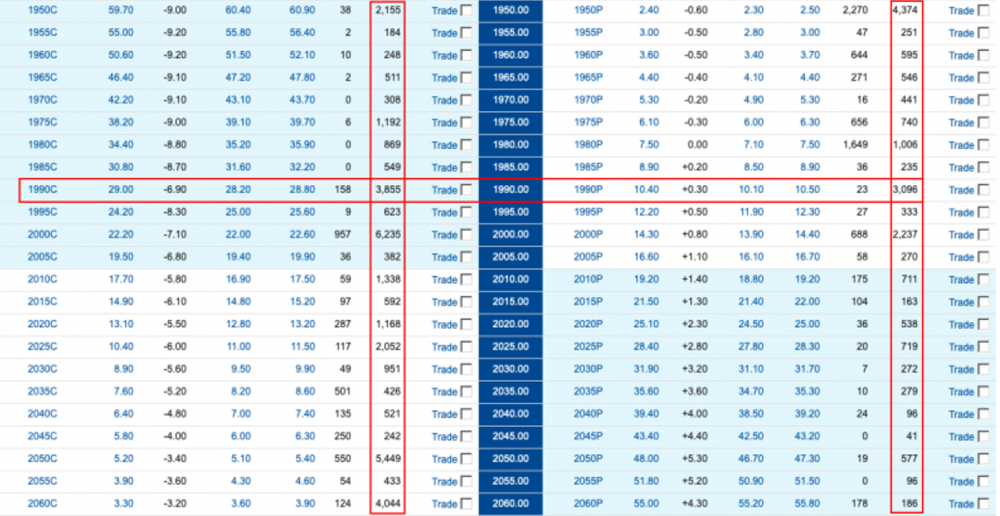

Let's start with COMEX gold. Even though the current front month is the Jun23 contract, there will still be a massive amount of options on that contract that will expire and price next Tuesday. The chart that you see below lists the open interest at each strike price as of Monday evening, April 17.

OK, what do we see here? The vertical red rectangles enclose the open interest of the calls in white and the puts in blue. Notice the massive imbalance in the total amount of open calls versus open puts above the $2000 strike level. For example, at the $2050 strike, there are 5,449 open calls versus just 577 open puts. It should be clear to you that there is a rather large incentive for a party that is short those calls to rig price below $2050 before they expire, thereby making them worthless.

Similarly, there are nearly twice as many puts than calls at $1950. This provides the opposite incentive to not maintain price above that level in particular at expiration. See how this works?

OK, then, so where's the sweet spot? To my eye, it appears to be at $1990. Notice that there is nearly an equal number of calls and puts at that level. Price could settle below $1990 without too much financial "damage", but anything above $2000 gets expensive. Therefore, let's watch that $1990 level into the COMEX close on Tuesday, the 25th, and let's just see how close we come to it. At this time, I would expect a settlement next Tuesday somewhere between $1990 and $2000. Mind you, that's a full 5+ trading days away as I type, so if we're even close, you should take it as a sign that this "sweet spot" stuff is noteworthy.

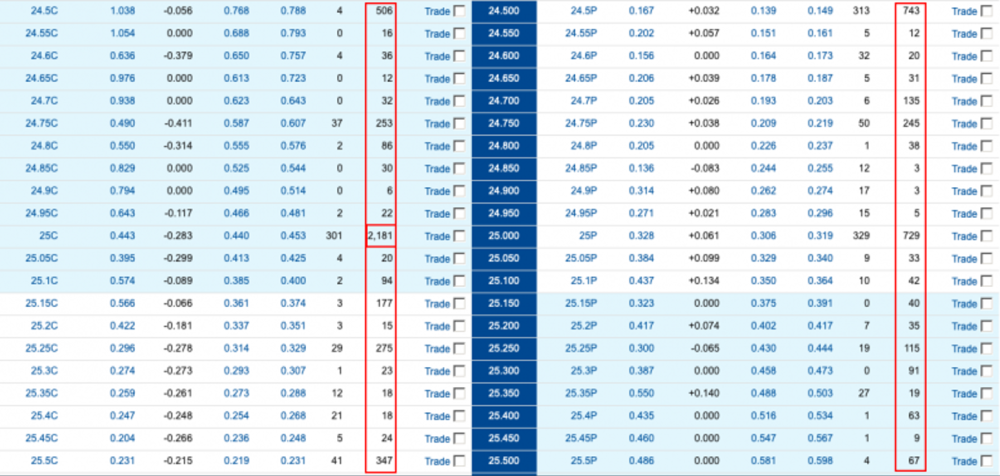

The May23 COMEX silver contract is a front and delivery month, and it will have options expiring on the 25th too. However, just as total futures contract open interest has been lagging, total option open interest is paltry too. As you can see below, there may be a sweet spot at $25.00, but the open interest numbers are so small that the settlement cost impact above or below that level is not that great. Regardless, let's watch to see if $25.00 acts as a magnet into and through the COMEX close next Tuesday and then see if price closes just below there.

OK, so there you go. Let's see what happens. We've got some time and anything is possible, but don't be surprised if, by the COMEX close next Tuesday, the price of Jun23 COMEX gold settles between $1990 and $2000 with May23 COMEX silver near $25.00. Option expiration shenanigans have always been a monthly feature of the COMEX, and this month should be no different.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.