Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

I’ve been emphasizing recently that when yields peak and fall, so goes the DXY, and monetary metals and miners go north in a big way. Well, we’re almost there.

Sven Henrich captured it perfectly in the 2-Year Treasury Yield, which is in a Bear Flag formation, and typically this signals a big move down next, once it breaks 4.84 support.

This is the same chart, but now you can see the various momentum indicators. All are negatively divergent to the previous peak on November 7 at 4.22%. The RSI is also extreme overbought at 78, and the MACD Histogram is even more negatively divergent in the final move up in yields. All while in a Bear Flag. Said simply, the odds favor a big drop ahead.

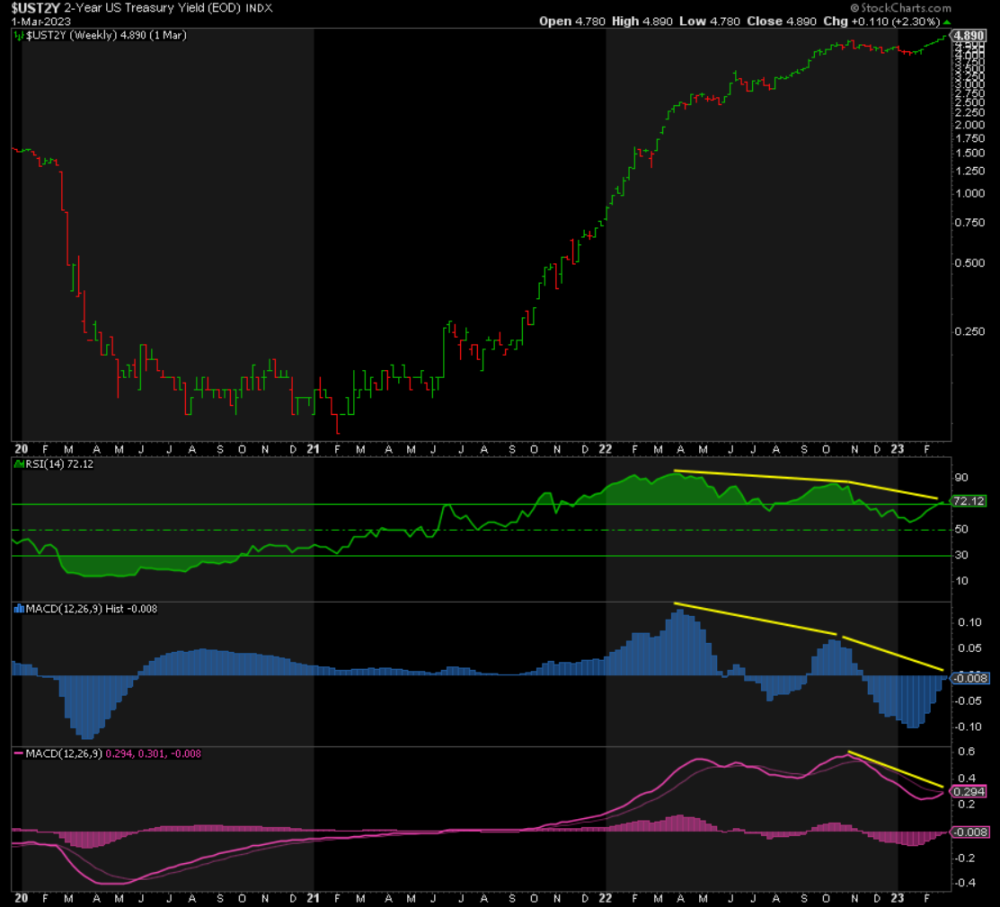

The weekly chart is even clearer. We have multiple negative divergences across all indicators, with the weekly RSI at an extreme overbought 72.

Then there is the DXY…

Note the consistently positive correlation between the 2Y yield and DXY, and now it’s at 0.72 and rising. Also note that in the past month, as the 2Y yield has risen, the DXY has also moved up in lockstep.

The point being that ‘when’ the 2Y heads south again, it’ll likely take the DXY down with it.

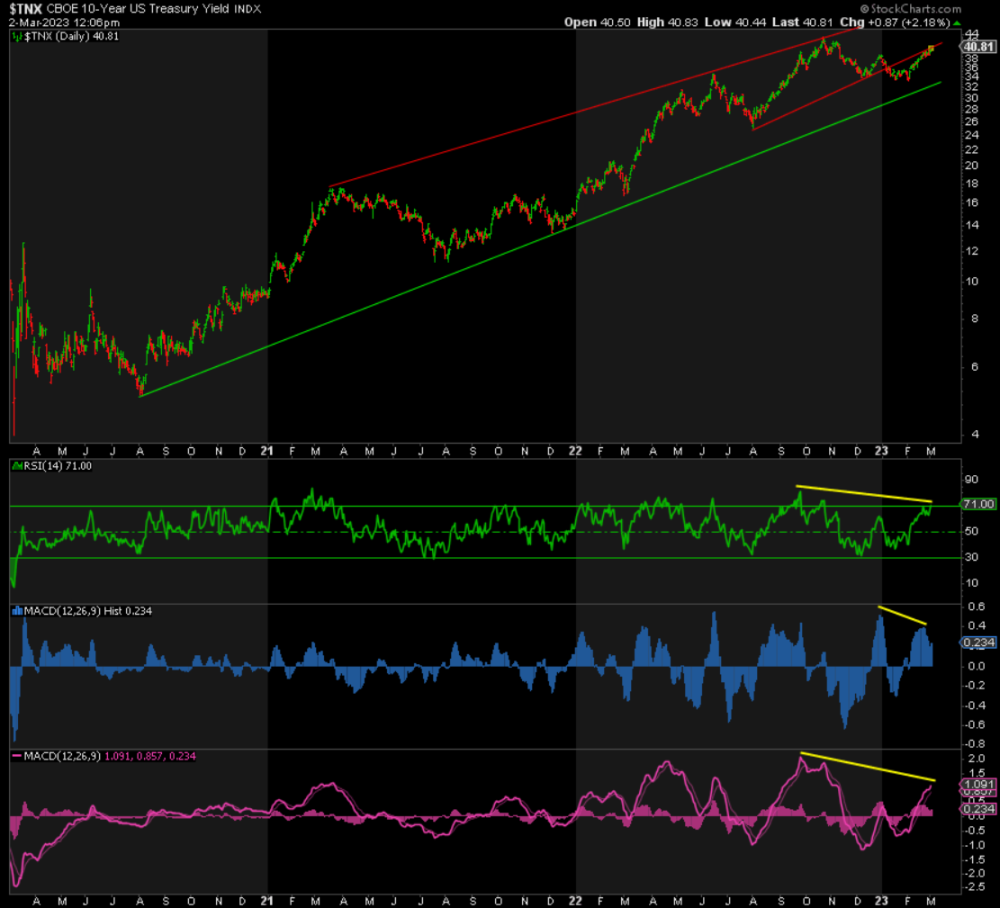

Switching to the 10-Year Treasury Bond:

Like the 2Y Note, it’s in a bearish flag formation, it’s negatively divergent across all indicators, and the RSI is extreme overbought at 71.

The weekly chart basically says the same thing with one key difference: It has already broken down out of its Bear Flag and is now backtesting the former support line, now resistance. It could go as high as ~4.11%, imho. But given the negative divergences, the odds favor a rejection at resistance and down we go.

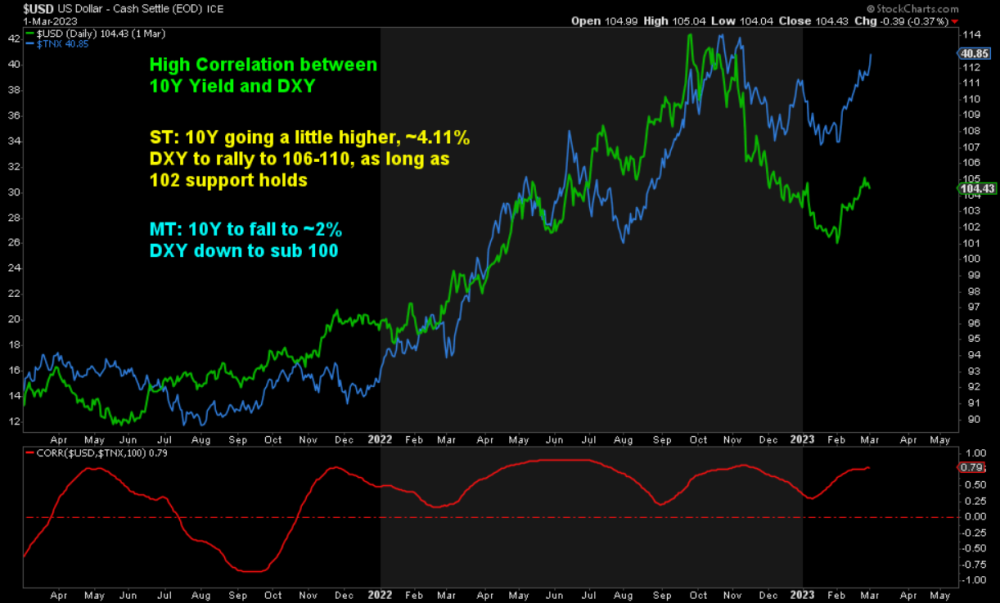

As for the correlation between the 10Y Bond and the DXY, it is even higher than the 2Y-DXY correlation:

Again, this means that if the 10Y peaks and falls, it will likely take the DXY down with it.

So what has this all got to do with monetary metals and miners?

The Bond market and FX market are the two biggest markets in the world. The markets for Gold, Silver, and the miners ‘combined’ are infinitesimal by comparison. The dog wags the tail in this case, which means if bond yields and the DXY fall, up go the metals and miners. It is that simple.

My forecast for the 10Y yield is a drop to as low as 2% next, above the low of 0.40% in March 2020 but far below current yields. I also expect the DXY to fall below 100 once it’s done with its bounce. Just to make this crystal clear, I don’t believe yields nor the DXY are done rising just yet, but the risk-reward going forward is dramatically skewed to the downside, imho. ‘When’ yields and the DXY tumble, Gold, Silver, and the miners will enjoy a rally even bigger than the recent 20% or $357 rally in Gold from the 1618 low. It’s only a matter of weeks or a few months before this happens, imho. Gold, in particular, tends to anticipate these moves in advance, which could mean it happens sooner rather than later. My next target on the upside for Gold is 2250.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.