Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Another snooze week for precious metals and miners. At the risk of repeating myself, I’ll go through the levels I am watching, including the dollar. But I’ll begin with the risk of a Fed policy error and a potential sharp drop in stocks.

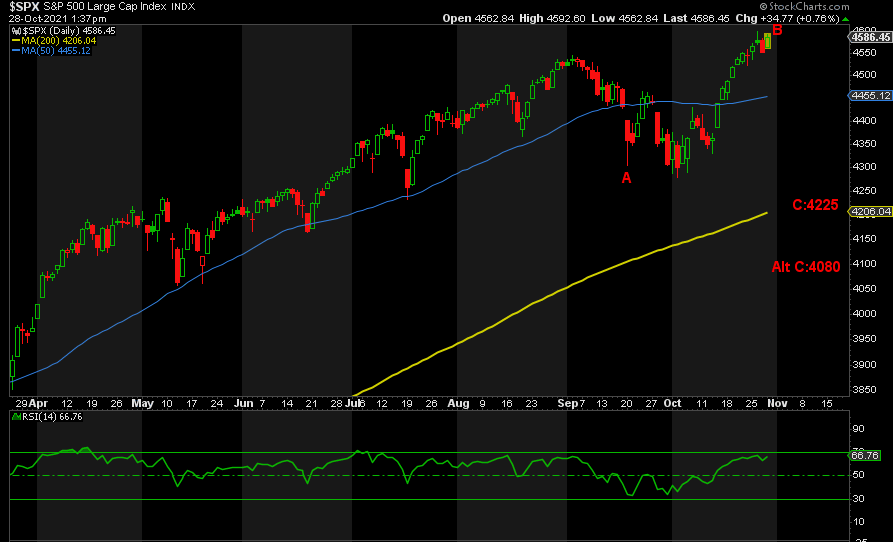

S&P

With all of the major central banks around the world tapering QE or raising interest rates, or both, a similar move by the Fed in the coming weeks could precipitate the dump in stocks I am waiting for. The Bank of Canada just joined the list of central banks tightening liquidity today, and if the data is supportive, the Fed is likely to follow suit soon. The only support for stocks is liquidity, imho. Pull that and watch equities drop in search of the next Fed put. My targets on the downside for said put are at least 4225, the 200-day moving average, or worst-case, 4080 or so. This is important for precious metals and miners, because once the Fed reverses policy in response, or before, Gold and the rest will explode higher… finally. However, ahead of that, the initial dive in stocks is likely to weigh on precious metals and miners.

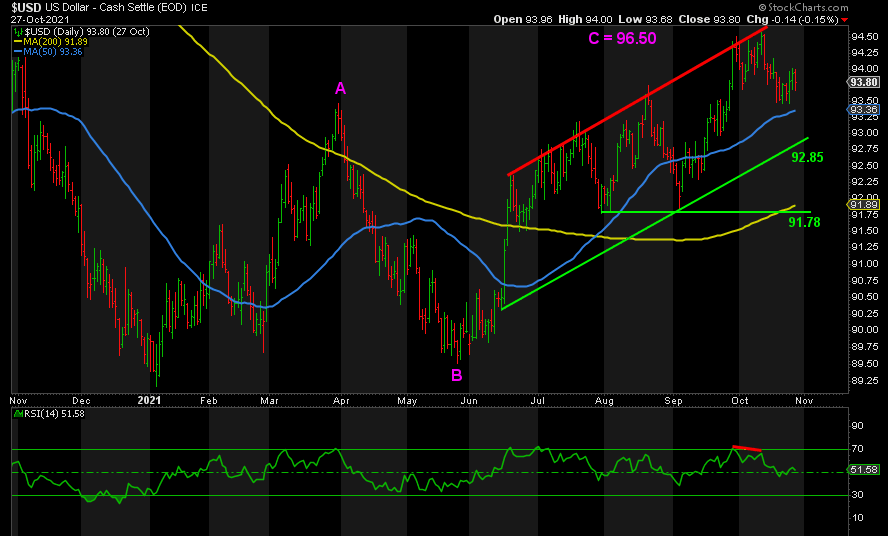

DXY

The DXY broke support at 93.50 and that opens up a move down to 93 or 92.85 for the bottom, imho. From there, my target on the upside remains 96.50. If stocks dump, watch the dollar rally. Once the DXY peaks and begins to fall, or before, Gold and the rest of the complex will take off. However, the DXY has yet to bottom and rally, so expect further downside in metals and miners first before the launch thereafter.

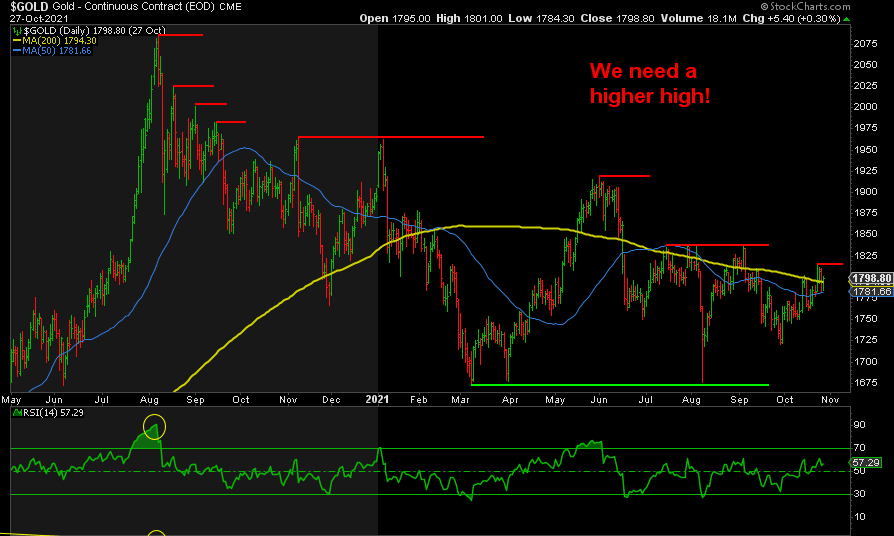

GOLD

Gold has not seen a higher high of note since its peak in August 2020. The trend is clearly down. We need to see a higher high above 1837 in particular, followed by a higher low, anywhere above 1675, before turning bullish, imho. Unfortunately, given my aforementioned comments, I am still looking for a positively divergent lower low below 1675 before Gold takes off and the rest of the complex follows. Worst-case is a drop to 1500, but anywhere below 1675 and we’re in the buy zone, imho.

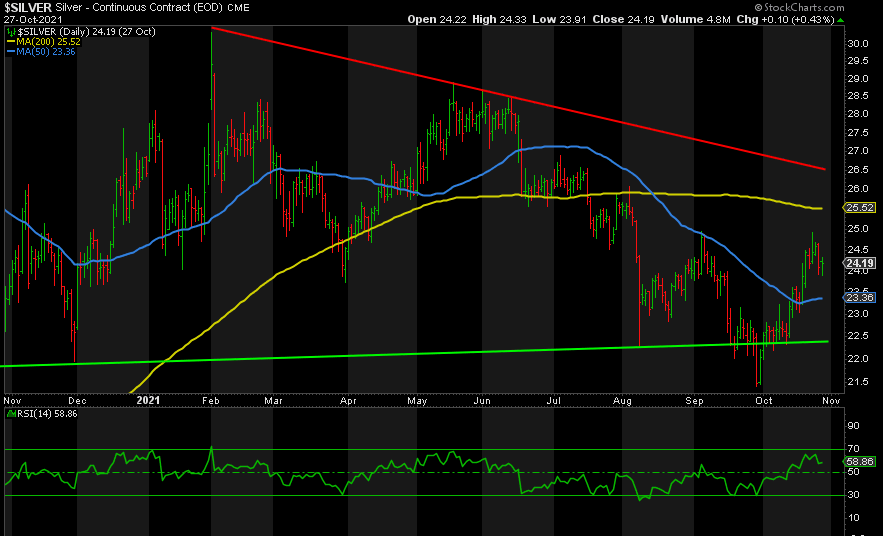

SILVER

As forecast last week, we tagged 25 and now we’re seeing the correction thereafter. While we could still test the 200-day moving average at 25.50, the risk is further downside. As long as support at the prior low 21.41 holds, the set-up is bullish. However, a break below there and 18 is back on the table as a worst-case scenario. Again, a higher low followed by a higher high and we could be off to the races.

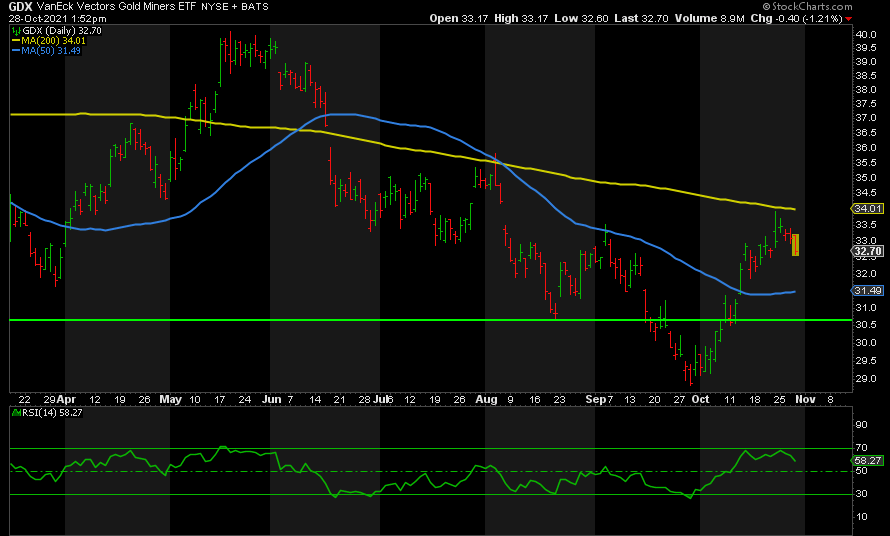

GDX

GDX mimicking the moves in Silver. It tested its 200-day moving average and failed and is now heading south. The 50-day moving average could act as support, but if we break there, 28.83 must hold to avoid a deeper dive. As long as we hold that level, the next higher high should signal the bottom is in. Below 28.83 and 25 is possible next, worst-case 20. But once we do inevitably break up, I am looking for new record highs in GDX exceeding the 2011 peak.

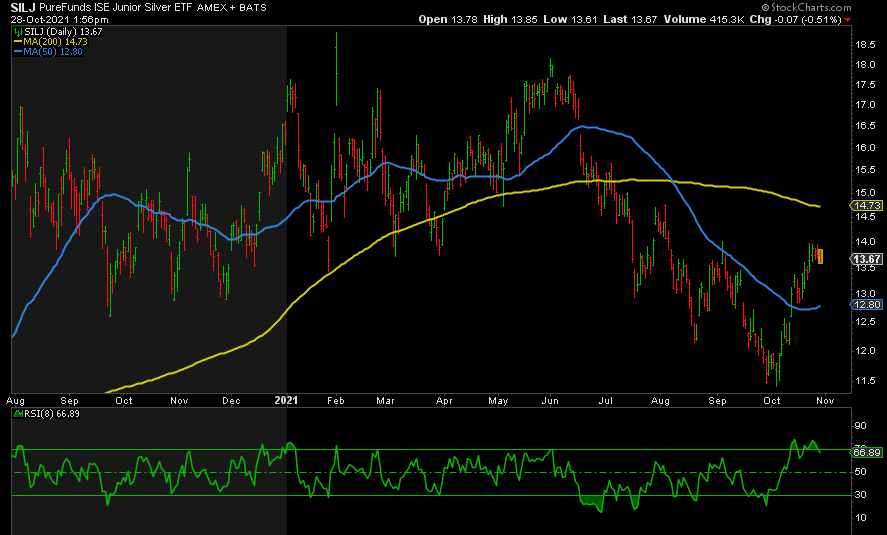

SILJ

While I don’t rule out one more shot higher in SILJ to its 200-day moving average, there’s a greater risk to the downside, imho. Again, the 50-day moving average could provide support, but 11.40 must hold to maintain the bullish set-up. Wherever we bottom out here is a screaming buy, imho. SILJ will outperform everything else on the upside as it underperforms the rest on the downside. A break of 14 and the 200-day moving average will provide the green light for a 3x to 4x move in months, imho.

In conclusion, we have had a nice rebound across the complex off the lows, and while we may not have seen the peaks yet, I expect further downside in the weeks ahead for metals and miners before the inevitable turn when stocks dump, the Fed reverses policy to massive stimulus, and the DXY peaks and falls. When that happens, buckle up Shatner style.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.