September 8, 2017

Next week’s Bank of Canada policy conference appears set to deliver standard talking points. Not a single free market economist has been invited and a BOC spokesperson confirmed that the alternative-financial press is also being shut out.

The BOC event, titled Monetary Policy Framework Issues: Toward the 2021 Inflation Target Renewal , takes place during a critical time for Canada’s central bank.

Bank of Canada economists emerged from the 2008 financial crisis red-faced, after having failed to predict the event in advance, despite the clear warning signs and having some of the country’s most respected practitioners on staff.

The BOC then had to bail out Canada’s big five banks, whose solvency the monetary authority is charged with overseeing.

Questions regarding Poloz’s “trickle down”economics

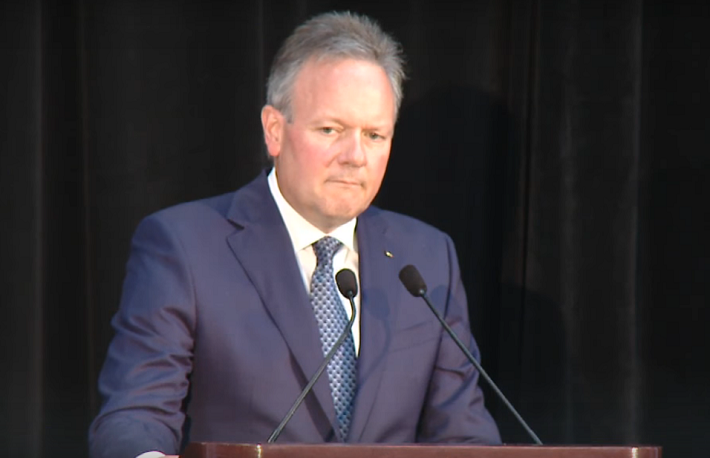

Things do not appear to have improved much under the reign of Stephen Poloz, its current Governor.

The Bank of Canada ranks last among the G-7 central banks in terms of its gold holdings, this during a time of record high Canadian household debts and one of the planet’s biggest housing bubbles.

There are also increasing questions regarding Mr. Poloz’s “trickle down” economics strategy, which consists of leveraging “considerable economic stimulus” to boost asset prices, in the hope that a resulting “wealth effect” will trickle down to the poor and the young.

Government-financed academics, officials and a government financed NGO

A quick look at the presenters at the upcoming event reveals the usual “broad range of opinions” that Canada’s central bank consults.

The 20 panelists, almost all of whom are financed or regulated by government, include:

- Four Canadian government employees

- Eight academics from Canadian universities, which draw the vast majority of their funds from government.

- One presenter from a Canadian think tank that received a reported $30 million in government money

- One representative representing Canada’s big banks, which were bailed out by governments during the last financial crisis.

Bank of Canada officials were unable to identify a single presenter who had published a paper about a free market thinker (Eg. Ludwig von Mises, Murray Rothbard, Nicolai Kondratieff or Carl Menger etc....) during the last ten years.

Dearth of free market thinkers

In fairness to the Bank of Canada, free market thinkers have been essentially banned from public discourse in Canada.

Universities refuse to hire them and major “business” think tanks such as the C.D. Howe Institute and the Fraser Institute, are stuck fighting rear guard actions against the state, and are thus forced to spend a huge proportion of their meager funds on technical specialists, who try to come up with creative arguments for relief from various regulatory clauses.

The upshot, is that the best they can hope for are incremental successes in holding back a ravenous state, which now eats up half of the country’s income.

That said, according to Tim Moen, leader of the Libertarian Party of Canada, the Bank of Canada has never once asked for the names of possible panelists or outside opinions. Redmond Weissenberger, president of Mises Canada, also confirmed that he was not asked for input either.

The BOC’s favorite media sources

The good news is that the Bank of Canada’s event will be covered by a select group of mainstream media. They will no doubt compensate for the fact that the alternative financial press has been shut out of the conference due to a “lack of space.”

Poloz’s favorite “by invitation only” news sources include:

- The Wall Street Journal

- Market News International

- Bloomberg News

- The Financial Post

- The Toronto Globe and Mail

- Reuters

- The Canadian Press

(Full disclosure, this writer has contributed to several of these publications).

The other good news is that parts of the event will be podcast.

Canadians are also invited to tweet any questions that they might have to @wewillansweryouifwefeellikeit.

Questioners will of course need to be able to frame technical queries about “dynamic stochastic general equilibrium modelling” and the differences between the BOC’s half dozen key inflation indicators into 140 characters or less.

The best news of all though is that the BOC’s platoon of government and academic theorists have developed a model that shows that this can be easily done.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Comments