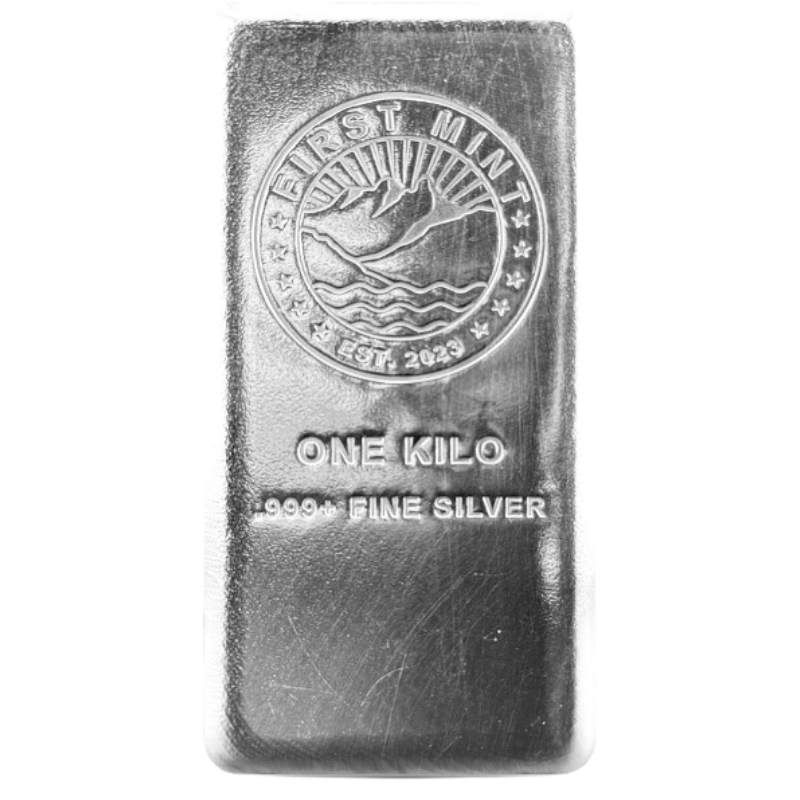

Top Picks For You

Top Pick

As low as

$1,155.43 USD

Special Price

As low as

$39.18 USD