Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

The year 2021 was a challenging year for precious metal investors and a particularly disastrous year for those of us who make a living trying to forecast precious metal prices. So what went wrong and how can we do better in 2022?

Let’s start with this: COMEX gold began 2021 at $1906. As I type on December 21, it's trading at $1790. That's a drop of $116 or about 6%. COMEX silver is even worse. After beginning the year at $26.50, it's currently trading near $22.50 for a loss of about 15%.

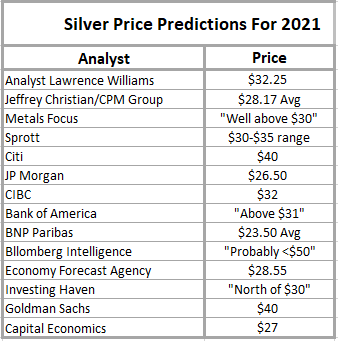

After a run of four pretty good years, my TFMR annual "macrocast" for 2021 was a disaster in terms of price prediction. But I wasn't alone. Check this list of major Bank and sell-side analyst predictions for silver in 2021. While I'm not sure I want to keep company with these people, we certainly all find ourselves sharing the same boat.

Now, you could be cynical and play the "nobody knows anything" card or you might also state that trying to forecast prices in a heavily manipulated market is a fool's errand. And perhaps you'd be correct to some degree. But for yours truly, this was the first annual forecast in five years that I absolutely blew. Maybe my streak was simply due to end?

- As 2017 began, we were told that the election of Trump would crash gold prices due to a soaring dollar, a surging U.S. economy, and a bursting of the bond bubble. This narrative seemed ridiculous at the time, and we were right...it was. And we wrote about it on January 17, 2017: Questioning The Generally Accepted Narrative

- The following year, even more supposed experts were calling for triple-digit gold prices and a resumption of the bear market. They were proven wrong. At TFMR, we expected prices to be steady and rising instead, as three themes would support prices. This was posted on January 4, 2018: The Three Themes of 2018

- In early 2019, all of the eight-figure Wall Street economists were insisting that gold would crash as the Fed hiked rates as many as four times in 2019. These same clowns expected the yield on the U.S. 10-year note to rise to 5%! This was utterly ridiculous for reasons we've discussed here for the past decade. Instead we figured that 2019 would play out a lot like 2010, and we forecast "the best annual gains since 2010" in this post, dated January 14, 2019: 2010 + 9

- And in 2020, we knew the macro conditions that prompted the breakout and renewed bull market of 2019 would continue. Thus it was entirely logical to predict another 20% rise in COMEX gold and an even greater percentage rise in COMEX silver. What we couldn't have anticipated was The Covid Crisis, and as such, price overshot our goals by considerable margins. In the end, COMEX gold posted a gain of 25% and COMEX silver rose by 48%: 2020 Foresight

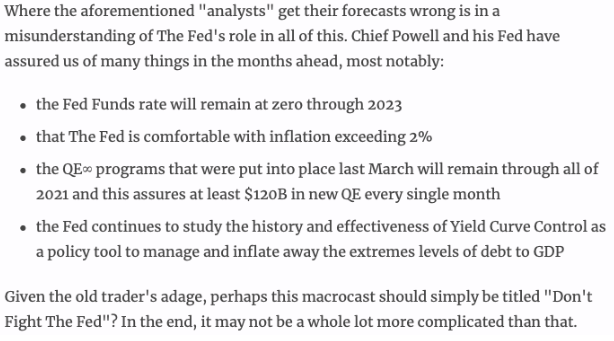

So what happened? How and why did many of us get 2021 all wrong? That's a perplexing question, because so many of the macro conditions that we discussed in the 2021 macrocast played out as expected. See this screenshot from the 2021 report that was published in early January:

And I think what I got wrong was underestimating my own advice written in the screenshot above. Don't Fight the Fed! What do I mean by that?

As inflation surged and real interest rates plunged in April, the Fed began to claim that all of these issues would be "transitory", and they maintained this position all the way to December.

- Inflation spiking? Don't worry, it's transitory.

- Supply chain bottlenecks? Don't worry, it's transitory.

- Soaring commodity prices? Don't worry, it's transitory.

- Plunging real interest rates? Don't worry, it's transitory.

And you know what? Everyone believed them! Well, not everyone...but the hedge fund managers and institutional traders that make up the majority of the "Large Speculator" buyers of COMEX gold and silver futures clearly believed them. And so, even with all of the traditional and fundamental factors flashing BUY GOLD in 2021, gold and silver prices actually fell.

So why did prices fall? In the end, it's really not that complicated. In COMEX precious metal futures, there were simply more sellers than buyers. And why were there more sellers than buyers? Because the traditional buyers fell for the lie from the Fed that all of the gold-positive developments were "transitory".

Now here comes the fun part. As mentioned earlier, Powell and Yellen both swore off the term "transitory" earlier this month, so the year 2022 looks to be a puzzle to be solved through the simple answer to a few binary questions:

- Will the Fed taper and tighten in 2022?

- If they do, will this lead to lower inflation and higher real interest rates?

- If they don't, will inflation persist and worsen while the all-important "inflation expectations" surge to catch up?

Answer those three questions correctly and you'll be well on your way to a successful 2022 forecast.

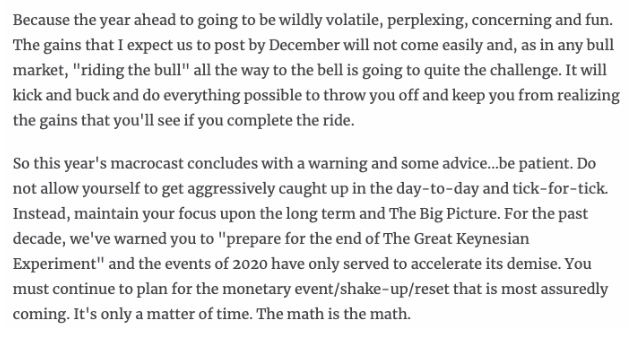

We'll have our latest annual forecast for you in a few weeks. For now, though, let's close with one more screenshot from the 2021 macrocast. While the quality of our price predictions may vary from year to year, the "advice" below is timeless.

Happy Holidays, everyone. I hope you are able to rest and relax. However, be sure to come back in a few weeks energized and ready to tackle what will be an incredibly volatile and challenging 2022.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.