Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

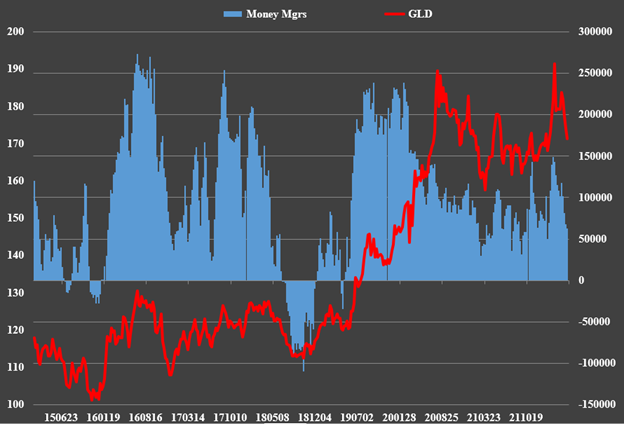

While Banks and Commercials ostensibly remain heavily short Gold, Hedge Funds have slashed their net long position to 62k contracts, just 33k above the low in March 2021 when Gold bottomed at 1675 for the first time.

And this was as of May 10, when Gold was at 1841. It has since fallen even further to 1797, meaning the Funds have likely cut their net long position even further. While this does not guarantee that a major low is imminent—the Funds could go net short before the bottom is in—it does signal we’re close to the bottom, especially with the daily RSI oversold near 30.

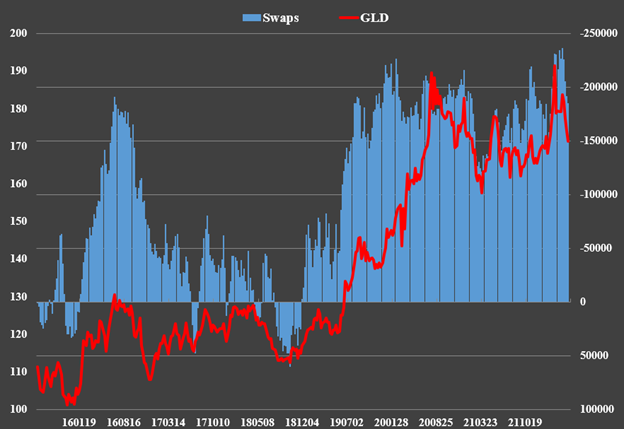

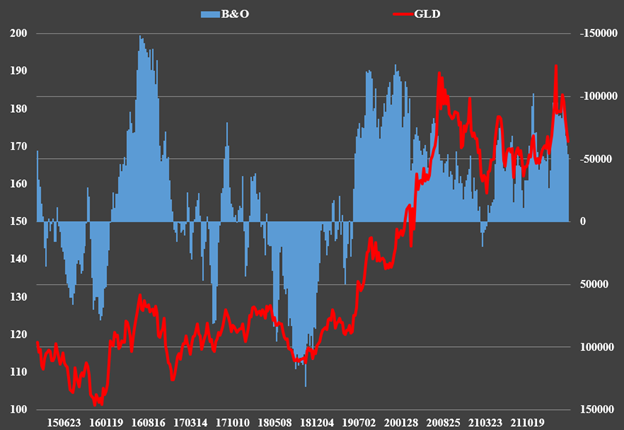

It also suggests something that I have suspected of the CFTC data on the banks’ positions for quite some time: They bury big net long positions in the Other Reportable category to give the impression that they are much shorter than they really are, shown in the SWAPS category:

This shows the net position of the Swaps and Other Reps combined:

Note how their combined net short position of 54k contracts is almost the mirror image of the Funds’ net long position of 62k.

The key takeaway is that the worst is behind us even if we have further to go on the downside, and the turn up in Gold is coming.

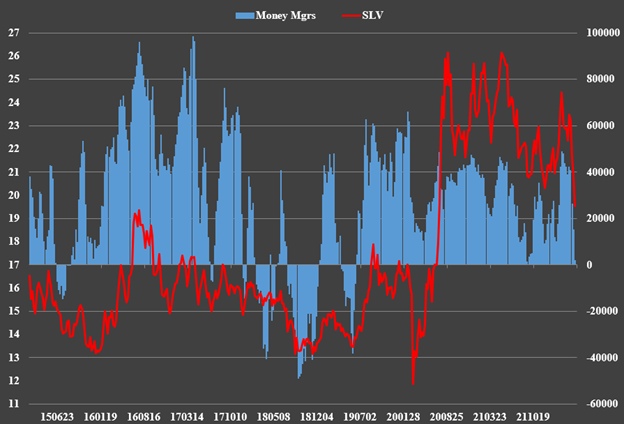

SILVER

Funds have their lowest net long position, near-zero, since mid-2019.

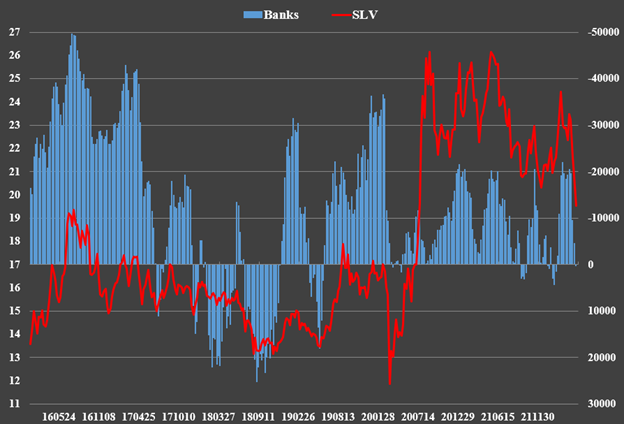

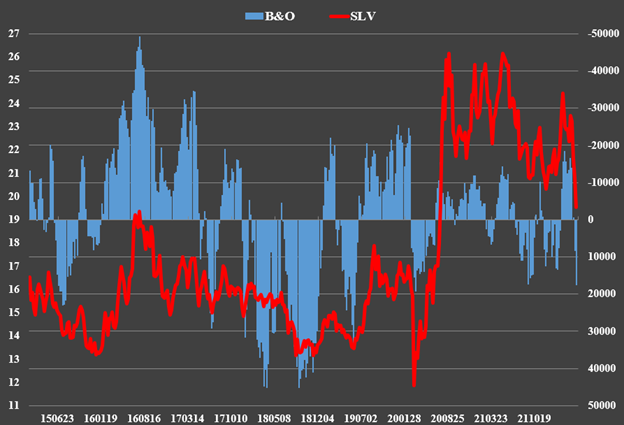

Banks are near zero too…

When Other Reps are added, they’re long!

In summary, positioning is sufficiently neutral for a major low or at least a healthy bounce. Funds can still go short and Banks long before we finally hit bottom in the prices of Gold and Silver, but either way, we have hit bottom or we have just one more dip to come.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.