Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

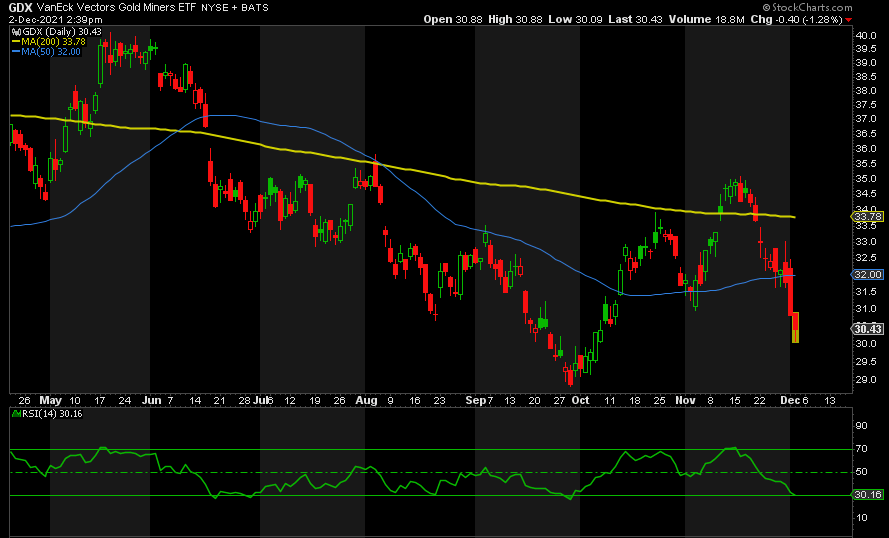

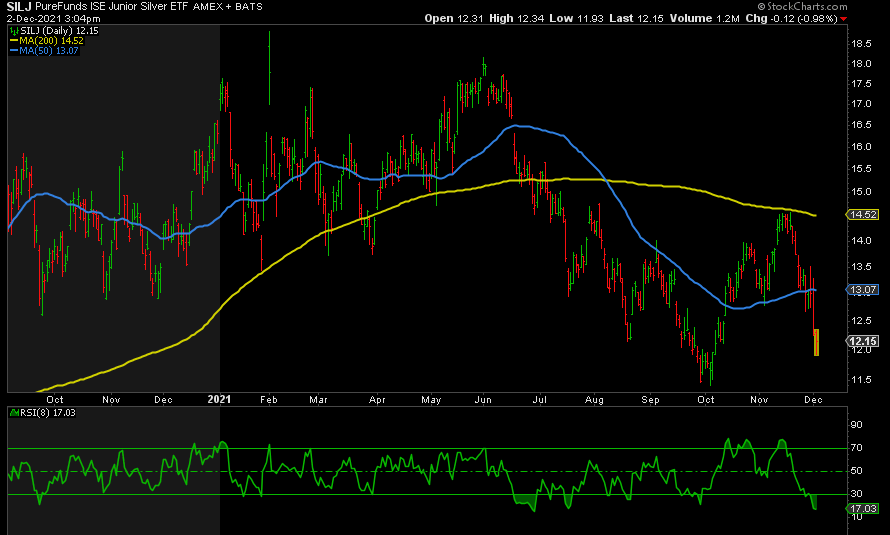

There’s been a clear bifurcation between the metals and miners over the past nine days. Gold has been drifting lower from 1815 to around 1760 as I type. Silver was no different, slipping from 23.70 to 22.20. But GDX has been hammered down from resistance at 35.10 to almost 30. A drop of 18% that bears no resemblance to Gold’s performance, which is rather strange. SILJ has also dropped 18% from 14.57 to support around 12. The drop in the S&P from 4740 to 4500 may be a clue. Gold is less impacted by stocks because it knows what the Fed will do if stocks drop in any meaningful way. That said, I believe the miners are presenting us with a great dip-buying opportunity.

The last time GDX was this oversold was back on September 29, when it bottomed out at 28.83. Since its peak at 35.08, it appears to be in an ABC correction with A ending at 31.64, the B bounce to 33.03, and C ending around 29.60 where wave C equals wave A in size. I’m looking for a bounce here before a positively divergent lower low but higher than the September 29 low of 28.83. Then up we go.

SILJ is even more oversold, but that is to be expected from the Silver miners. This just means that when SILJ takes off next, it is likely to outperform GDX. It is also displaying the same ABC structure. Wave C equals wave A at 11.60, which could present itself as a positively divergent lower low following a short-term bounce. This would also be a higher low than the 11.41 bottom on October 5.

Only a break of the prior lows of 28.83 and 11.41 in GDX and SILJ respectively would negate the possibility of a sharp rally higher to follow soon.

More broadly, as I shared a week ago, I am expecting stocks, oil, and bond yields to rebound imminently, then dump to even lower lows thereafter. The bottom comes when the Fed steps in. The only question is whether or not both metals and miners go down with the ship before taking off or, knowing that the Fed’s intervention is inevitable, they ignore the mainstream malaise and head higher. Either way, it’s only a question of when, not if, both metals and miners shoot higher.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.