Everything to Fall but the DXY or Powell will use Force

Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

We had the last FOMC meeting today, and the Fed raised rates another 50bp to 4.25-4.50%. This was already priced and was therefore a non-event. The accompanying statement was a surprise given the degree of hawkishness. It basically stated that rate hikes would need to continue to bring down still-elevated inflation, caused by a more robust labor market, higher wages, and the effects of the Ukraine war. But then Powell did it again in the conference call, essentially reversing the hawkishness in the statement.

At least when Greenspan talked out of both sides of his mouth, he did it with finesse. Powell’s confused and contradictory word salad made it almost impossible to understand what he was trying to communicate. Perhaps that is why markets basically ended up flat. No one knows what these guys are going to do next, nothing has changed, or the markets just didn’t believe what Powell was saying. At the end of the day, rate hikes will continue but at a slower pace. Nothing we didn’t already know.

In addition, the mere mention of a proposal to raise the inflation target from 2% compounded the dovish tilt, even though Powell stated it was something they would only consider in the “long-term”.

Deciphering the ramblings of the Fed, we know they plan to continue to raise rates but at a slower pace, with perhaps 50bp to 75bp at most before they’re done. But the nugget that stuck out to me in terms of importance was this comment from Powell:

“If markets ease financial conditions, the implicit notion there was that just means we’re going to have to do more to make financial conditions tight.”

In other words, the Fed needs financial conditions to reflect Fed tightening action, otherwise the Fed loses any shred of credibility it has left. In order to ensure this, Powell is saying that he will raise rates even further or increase QT, or both, if necessary to tighten financial conditions. What signals that financial conditions are tightening? Stocks fall and/or bond yields rise.

In summary, if the Fed is hawkish and stocks go up and yields go down, Powell will need to force stocks lower and yields higher. Given the muted response to what was perhaps the most hawkish FOMC in the Powell era, this doesn’t bode well for stocks in particular.

However, back on November 2nd, Powell was clearly dovish when he confirmed that the pace of rate hikes going forward would slow. The market ended flat back then too, essentially ignoring what he said. But the very next day, November 3rd, stocks and precious metals took off and the DXY accelerated to the downside. What if the same delayed reaction happens tomorrow or Friday when options expirations (“opex”) occurs?

Timing aside, given Powell’s hawkishness today, the risk is that everything but the dollar heads lower and the DXY goes higher over the next couple of days, and if not, the Fed will force it to happen.

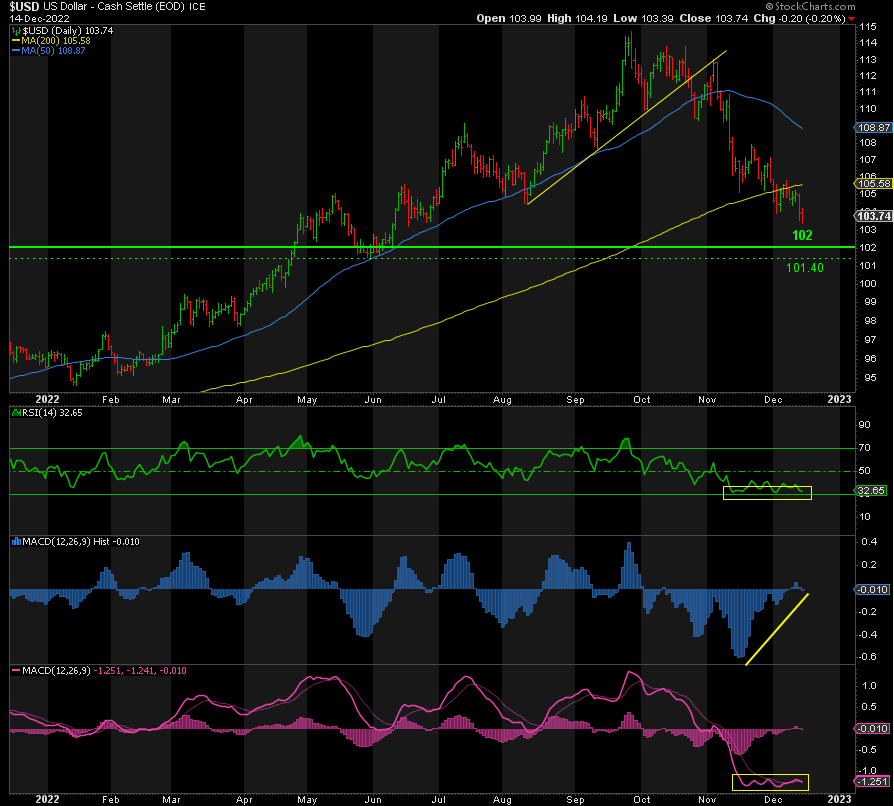

DXY

The DXY closed below 104 today. That support level is broken. This opens up a move down to 102, but we may get a small bounce first. It is already extreme oversold and positively divergent based on the MACD Histogram in blue. Again, I believe this signals a rebound to 108-110 in the next few weeks.

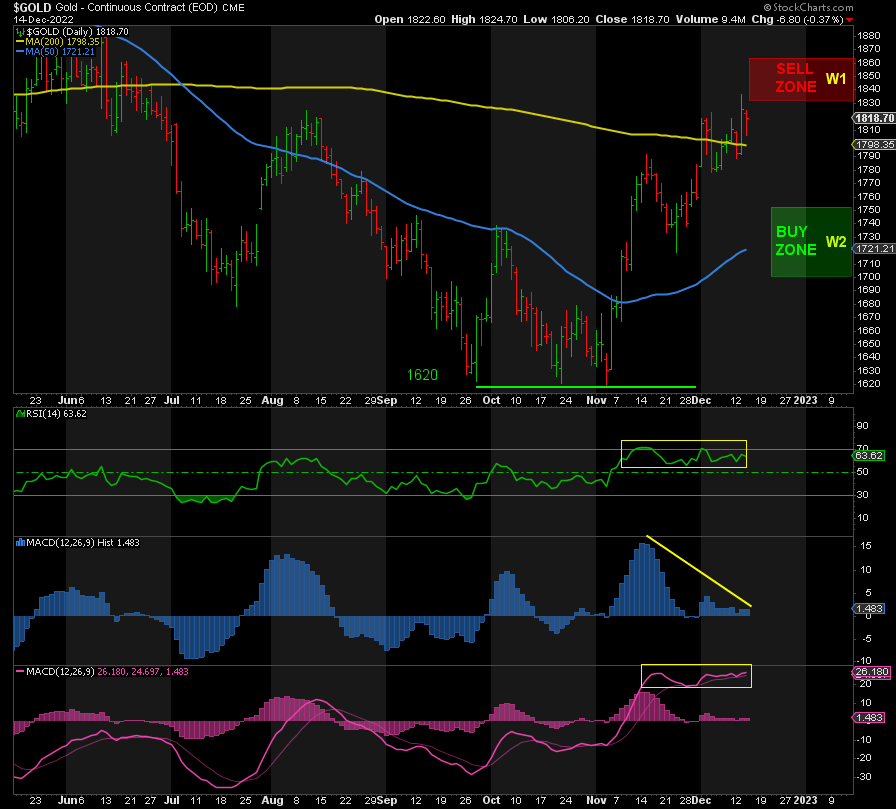

GOLD

It should be no surprise that Gold is the mirror image of the DXY. Overbought and extreme bullish with a negatively divergent MACD Histogram in blue. While DXY has remaining downside to 102, Gold has upside to 1850-60 before it capitulates. When it does, I’m looking for the overdue pullback to fall to 1750 at a minimum and 1700 maximum in Wave 2. From there, back up the trucks for what happens next: Wave 3!

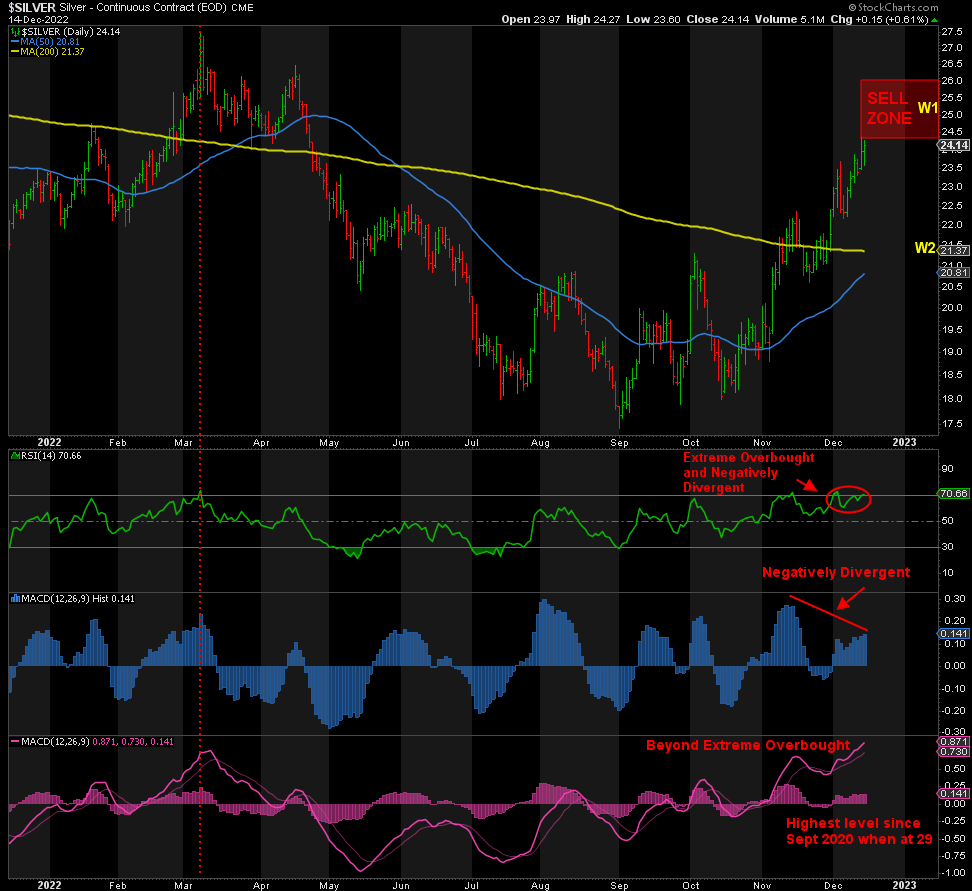

SILVER

The Gold:Silver ratio continues to signal that it is primed to rebound. It is extreme oversold and positively divergent across all indicators. This means that Gold is getting set to outperform Silver in the next few weeks or months.

Silver is extreme overbought and negatively divergent per the RSI and the MACD Histogram. The MACD Line is at its most overbought condition since Sept 2020 when Silver was at 29! It’s also its most extreme bullish since the peak in March at 27.50. It is ripe for a big correction but may still go a little higher. If Gold does make it to 1850-60, Silver could hit 25 or even a little higher before it dumps in spectacular fashion. I say this because the Gold:Silver ratio signals that when Gold falls, Silver will fall much faster.

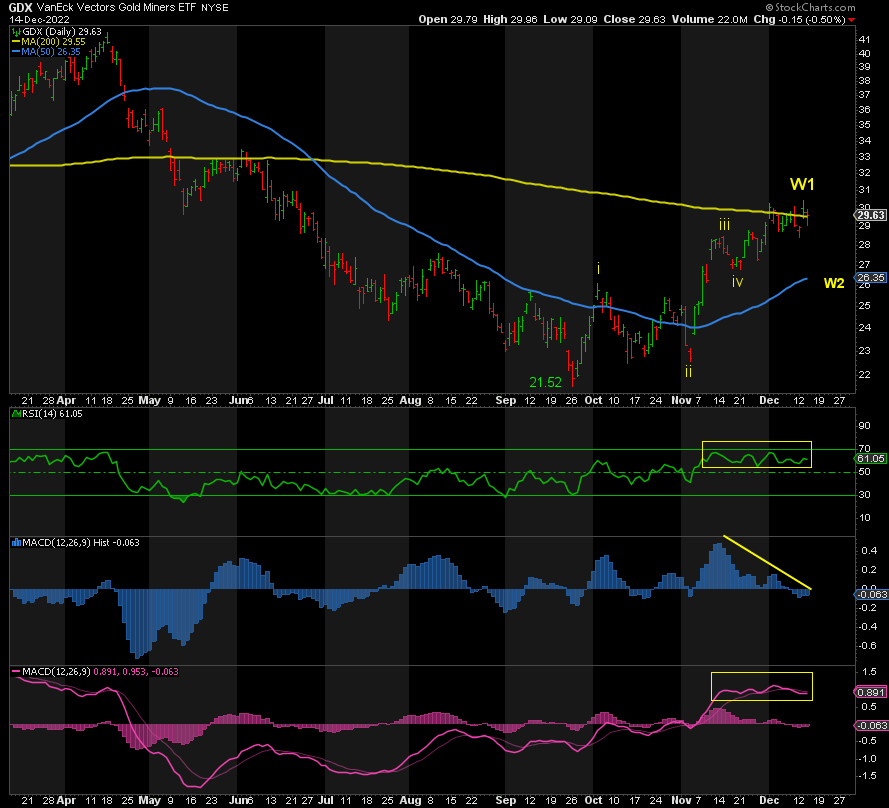

GDX

Miners have lagged the metals recently. GDX is still struggling with the 200-DMA. It is bouncing around in overbought territory and negatively divergent per the MACD Histogram in blue. Aided by Gold, I still think it can hit 31-32 before gravity takes over and heads down to ~26 and the 50-DMA in Wave 2. Then get your shopping list ready for Wave 3.

SILJ

Silver is stuck in two minds right now. It’s a coin toss in the very short-term. Momentum is already waning in both the RSI and the MACD Line, while SILJ mimics GDX as it struggles with the 200-DMA. Meanwhile, the MACD Histogram is clearly negatively divergent signaling lower levels to come. That said, we may have one more higher high or it goes straight down. Either way, it’s just different routes to the same destination: to 10 and the 50-DMA at a minimum, imho. SILJ is very volatile in both directions. Whatever the next low turns out to be, that will likely be Wave 2, and then it’s all systems go for far higher levels to come.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.