Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Ahead of Powell’s big speech on monetary policy at Jackson Hole on Friday, where everyone and their dog expects Powell to reiterate the Fed’s hawkish stance on monetary policy, I want to look at where Gold stands.

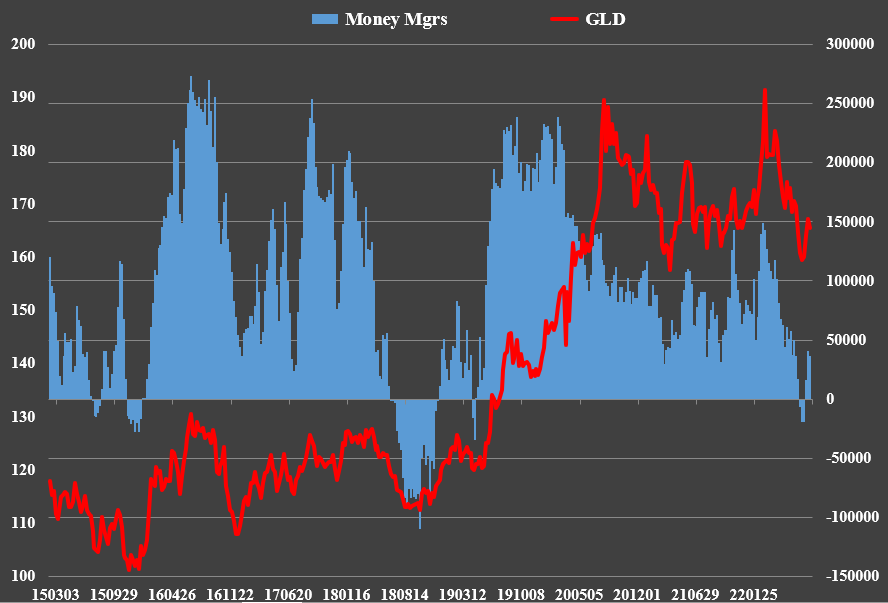

The sentiment is as extreme bearish as it was at the 1675 lows.

Funds went slightly long again as Gold rose to 1824 but have been cutting those longs as Gold fell back. Banks added back some shorts but are now tapering them again. Both positions are, on balance, bullish.

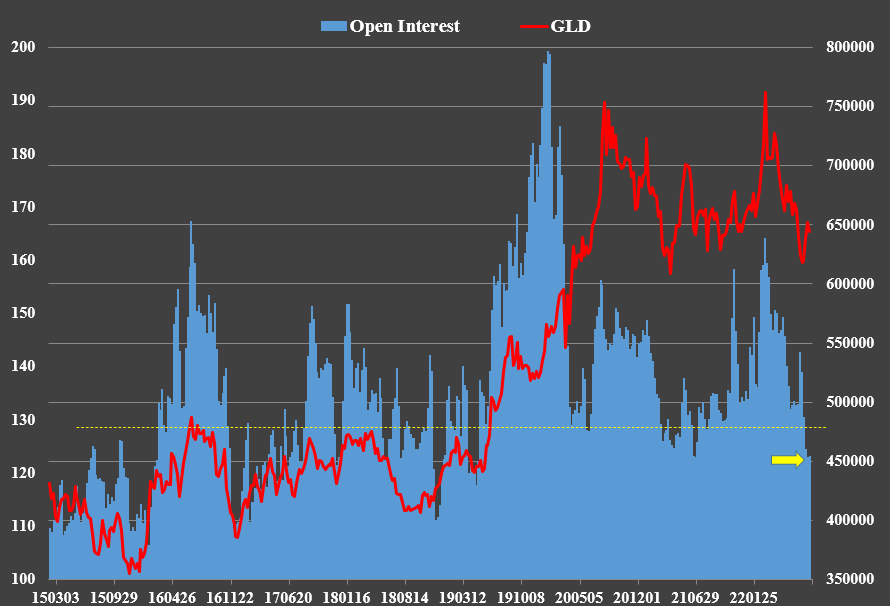

Open interest is at its lowest level since May 2019, when Gold was in the 1300s. Again, bullish.

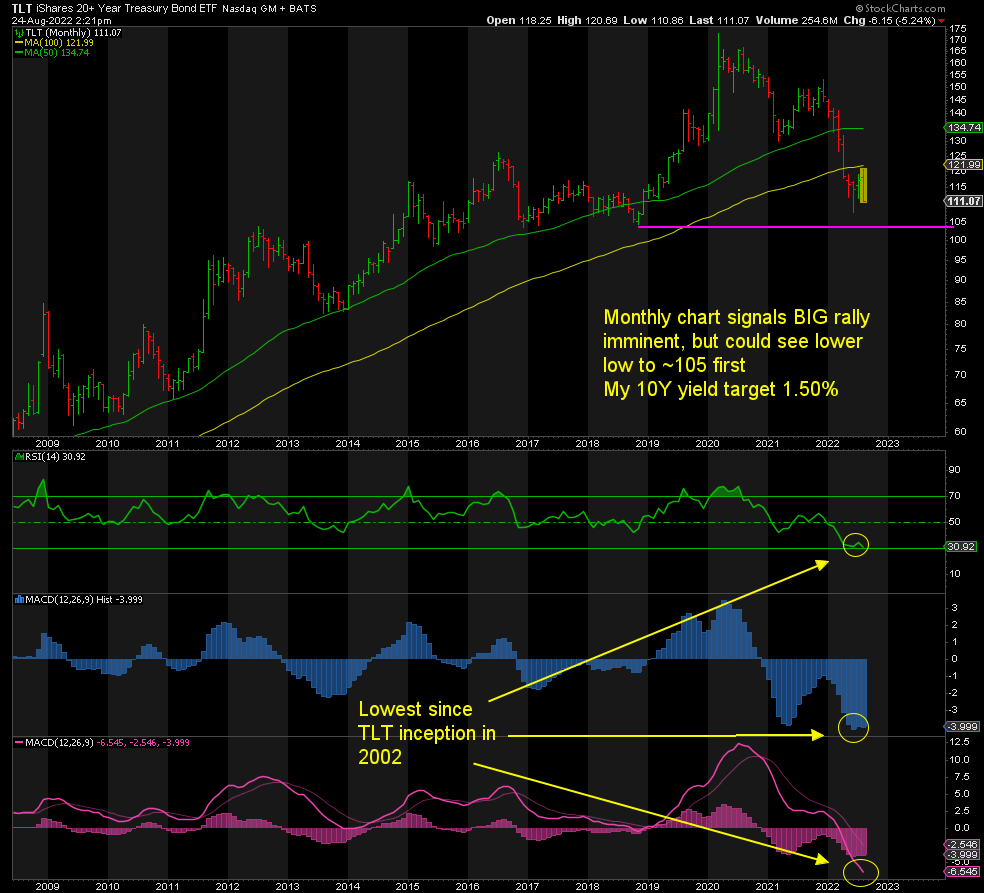

Bonds may have a little further to go on the downside, but they’re getting ready to take off, imho, with yields heading much lower:

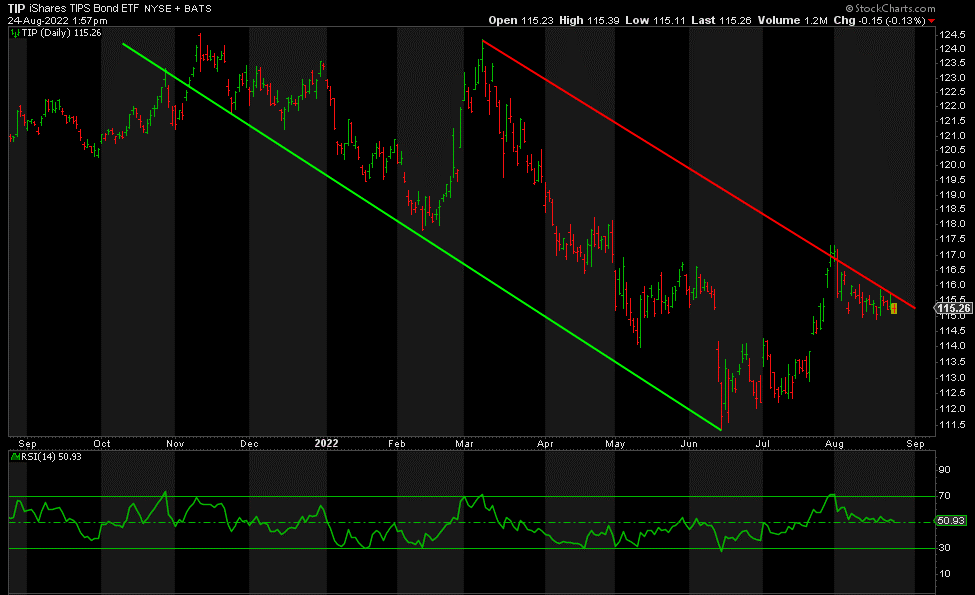

This is what I currently see in TIP, the inverse of real yields, a bullish channel/flag...

'When' we break that trendline resistance in red, TIP will rally in a big way, real yields will fall, and Gold follows TIP higher. Weekly and monthly charts are screaming to the upside.

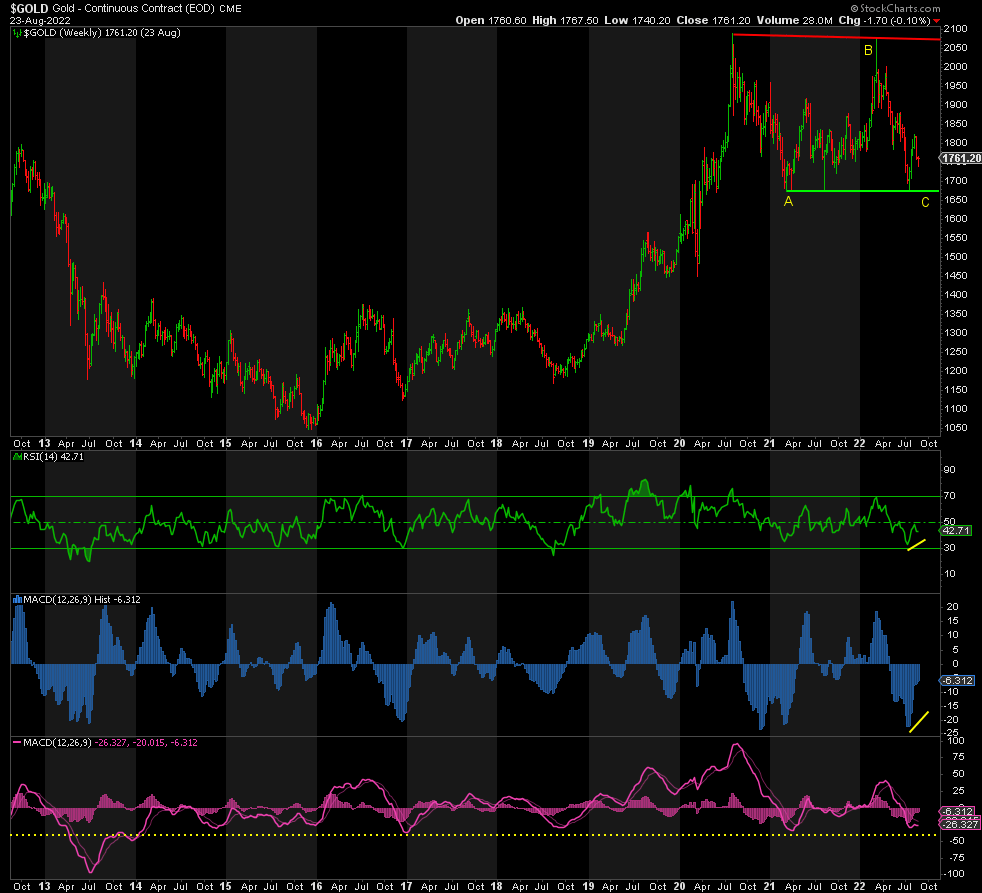

The charts for Gold suggest two primary scenarios. First the weekly chart:

We bottom in wave C of this correction since August 2020 at ~1663, where the size of wave C = A. There is a perfect set-up in both the RSI and MACD Histogram for such an outcome. The MACD Line would also register its lowest level since 2013, nine years ago. Talk about extreme oversold! More so than at 1045 in 2015, 1124 in 2016, and 1167 in 2018.

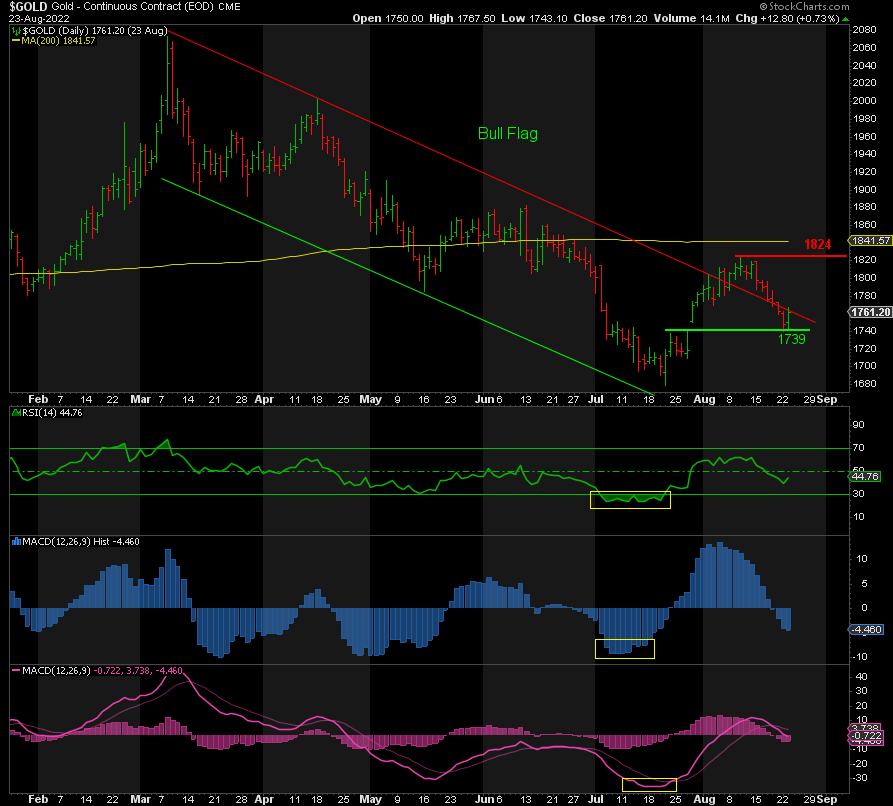

Now for the daily chart:

The alternative is that we have bottomed out in wave 2 at ~1740, coming off the high of 1824. This also just happens to be the 61.8% retracement of the rally from 1678 to 1824, standard for a wave 2. Next, we head upwards in wave 3, the money wave.

Either way, we’ve got a drop of a further ~$75 or the bottom is already in place. That’s a bullish risk/reward profile based on probabilities.

There is one more possibility of a far deeper dive in Gold in conjunction with stocks and higher real yields, but that is relatively small at this time. Only below 1650 does that becomes a higher probability.

All-in-all, everything is pointing north, except perhaps the most important factor, Fundamentals, and that means the Fed. The Fed persists with further tightening of monetary policy. We need to see at least a pause in rate hikes or an abandonment of QT to confirm that the rally to new record highs in Gold has begun. If Powell is less hawkish and more dovish than anticipated on Friday, the bottom could be in place.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.