Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

As if the year 2022 wasn't already shaping up as a dangerous and volatile year, what if we throw in some soaring food prices and food shortages, too?

Since mid-2020, we've been writing and warning about inflation, stagflation, and the economic stress that would persist following the Covid lockdowns that, unfortunately, have continued into late 2021. One of the tricks that the central bankers have utilized to manage inflation perceptions is the overuse of the word "transitory" when it comes to price inflation.

If anything, this theater has proven to be excellent fodder for these weekly posts, and we've written about it often. Here are just a couple of examples:

And now, finally, both Fed Chair Powell and Treasury Secretary Yellen have been forced to admit that the current inflation is NOT transitory. See below:

It's time to retire the word transitory on describing inflation, says Fed Chair Jerome Powell during Senate testimony on the economy https://t.co/DxfjyS7Jpr pic.twitter.com/WzW2rzqt1B

— Bloomberg (@business) November 30, 2021

Treasury Secretary Janet Yellen is "ready to retire the word transitory." https://t.co/IrRzd4SMx9

— FORTUNE (@FortuneMagazine) December 6, 2021

So far, at least, the most significant price inflation has been limited to industrial commodities and finished retail goods. While these cost increases have been painful to consumers, the impacts have been manageable.

What happens, though, if price inflation suddenly spills over to the global food supply? Not everyone urgently needs a new washer/dryer, and that cost can be put off for a while. But not food. Everyone needs food every day, and if food costs suddenly soar, we've got a problem.

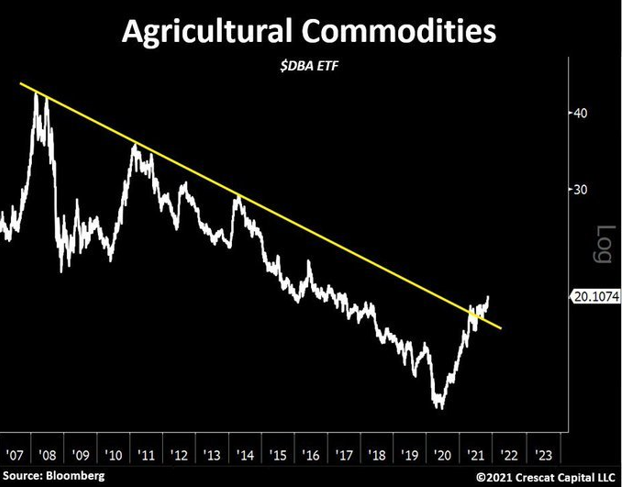

So far, agricultural commodity prices have avoided the sort of price spikes we've seen in the industrial commodities. Could that be about to change? First consider this chart from Tavi Costa at Crescat Capital. Are agricultural commodity prices beginning to break out?

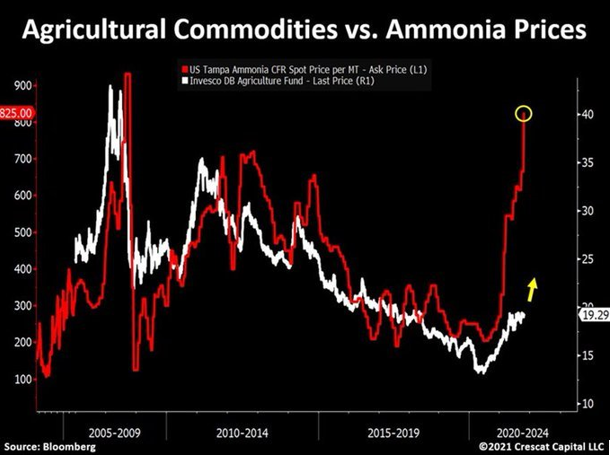

Next, consider the meteoric rise in the cost of anhydrous ammonia, which is a key fertilizer. If farmers use less fertilizer due to its cost or its scarcity, then yields per acre will decline and supply will contract.

Fertiliser maker Azomures in Romania, a State company, halts production. Warns of food shortages in 2022. #gas pic.twitter.com/l19ea7RRop

— Alexander Stahel (@BurggrabenH) December 6, 2021

And then one more chart from Tavi. Note the historical correlation between ammonia prices and commodity prices. This is definitely a case where causation leads to correlation!

(And we haven't even mentioned yet how any sort of drought next summer could impact prices. Throw that log onto the fire and we'll really have a problem on our hands.)

Now think for a moment about how all of this connects. For example:

- Not only are soybeans a source of protein for humans, they're used as feed for all sorts of livestock, too. Thus, higher soybean prices lead to higher costs for nearly all protein.

- Corn is also a livestock feed, but consider how many processed foods use corn syrup as a sweetener. So higher corn costs trickle down to nearly all processed food costs.

- Wheat is pretty self-explanatory. Bread is a global staple, and wheat flour is the key ingredient.

Throughout 2021, "the gold market" has ignored soaring inflation and the sharply negative, inflation-adjusted or "real" interest rates that have followed. It has been assumed that this "transitory" inflation would make the negative real rates transitory, too.

But now even Powell and Yellen have been forced to admit that inflation is NOT transitory and, as you've just read, inflation may be about to get much worse. Perhaps it's not just gold and silver that have been "on sale" in 2021. With the dangerous and volatile year of 2022 pending, you might be wise to stockpile a few other necessities, as well.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.