Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

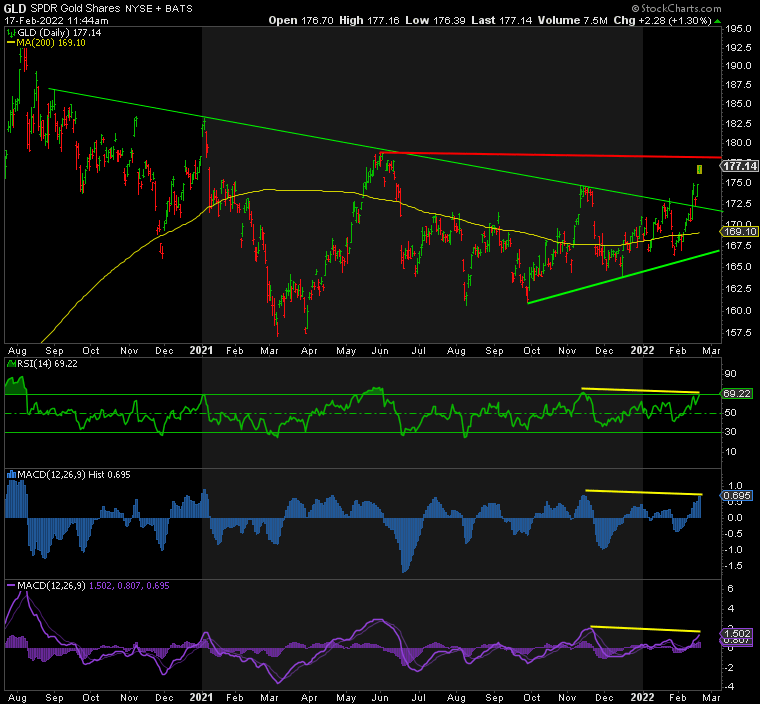

GOLD

Gold has broken out to the upside. It has finally taken out resistance at 1880, the peak back in November, and hit its first major higher high since August 2020. However, it is now extreme overbought and this new higher high is negatively divergent. This signals the risk of “at least” a ST pullback before testing critical level of 1920, the peak in June 2020. Former resistance is now support around 1850.

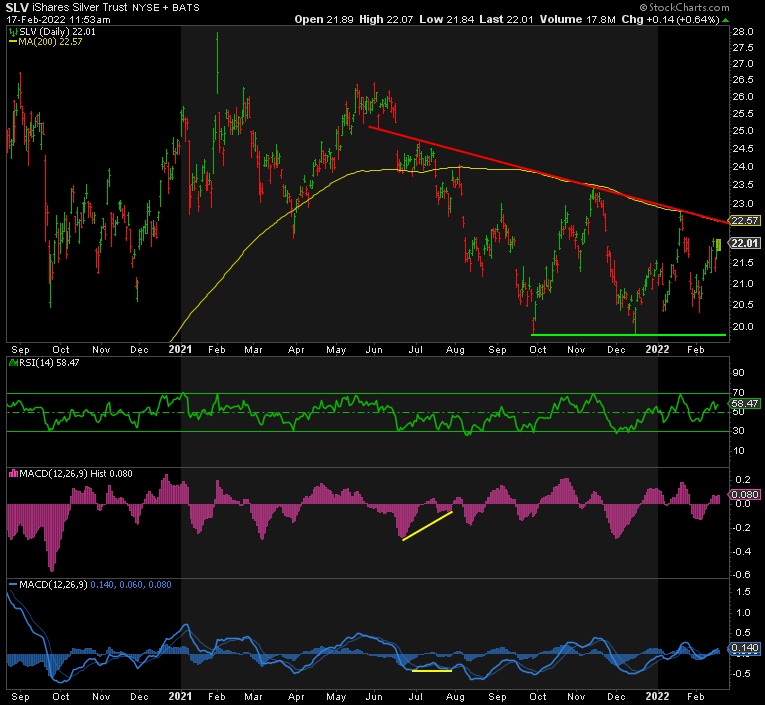

SILVER

Silver is lagging Gold so far. This is normal in a bull market. However, this means that Silver still has not taken out any major resistance or made a higher high. The red downtrend line and the 200MA are combined resistance that it needs to break at 24.40. The prior high of 24 must be taken out ahead of that. Support is 22 on the downside.

Looking to invest in physical gold? Check out our collection of gold bars and coins here.

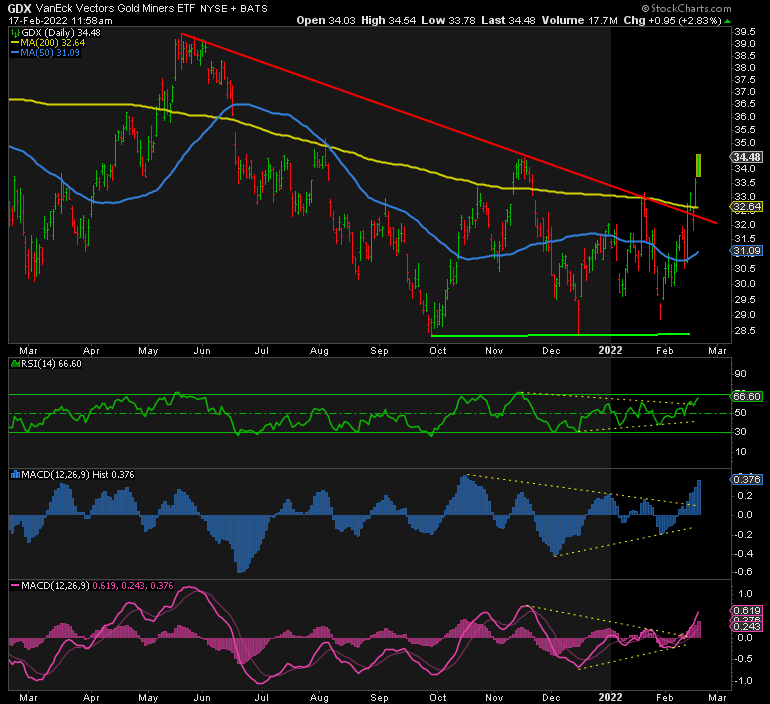

GDX

The bullish flag structure that I cited in each of the past 2 weeks has certainly come to fruition. GDX sliced through resistance at its red downtrend line and the 200MA and has broken the prior high of 34.48 back in November. However, it needs to close above 34.48. A drop back down below there would signal a fake breakout which is bearish. Plus, GDX is approaching extreme overbought territory and is negatively divergent to the prior high in November. Support is way below at 28.50.

SILJ

SILJ is trying to follow in GDX’s footsteps, but just as Silver is lagging Gold, SILJ is lagging GDX. It is struggling to get above its red downtrend line and is still well short of its 200MA. It is also extreme overbought. If it falls back here, this could be another fake breakout. Support is way below at ~11.

In summary, the action in both metals and miners is encouraging to say the least. But they’re extreme overbought in the short-term and in some cases, negatively divergent. This could signal a short-term pullback, or if considered a fake breakout, a bigger drop. The point being, keep the cork in the champagne bottle until we close above 1920.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.