Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

In a podcast with Tom Bodrovics at Palisades Radio this week, I discussed among other things the pending change in the calculation of the CPI going forward. The plan is to reduce the “Owner’s Equivalent Rent”, or “OER”, which reduces the overall CPI going forward. It comes on top of favourable year-over-year comparisons that should lead to lower CPIs ahead. This is important because reducing inflation is suddenly the primary focus of the Fed and the White House after the Fed previously called it “transitory”. The Fed is still planning on getting the CPI down to 2% on a year-over-year basis, and now it looks like they could get there—or at least a lot closer to it—sooner rather than later. The headline December number was 5.7% and it’s expected to fall to 5.5% in January.

This could have huge implications for the Fed’s monetary policy going forward. They have suggested that two more rate hikes of 25 basis points are still ahead and, based on ostensibly strong employment data last Friday, that they could even increase rates further than previously planned. Powell clearly signaled at the FOMC last week that once they’re done tightening, rates will remain higher for longer. But what if inflation falls even faster than anticipated? Chair Powell could take a victory lap and begin hinting at a “pause” in rate hikes. Imagine what that would do for the markets. The mere mention of the word “pause” would likely send stocks soaring, yields lower, the dollar lower, and Gold and Silver would blast off in wave 3.

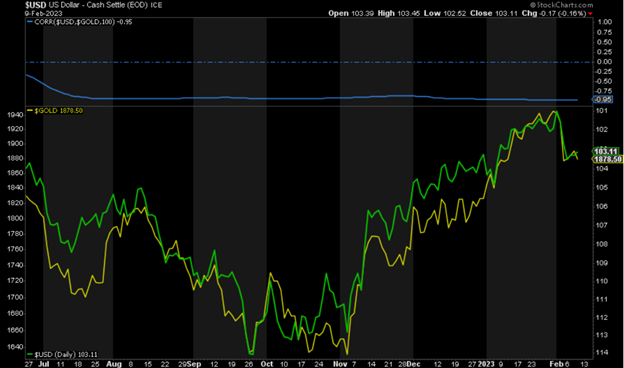

Meanwhile, the inverse relationship between the DXY (Dollar Index) and Gold remains near perfect. The DXY has finally lifted its face off the floor following the Fed’s pivot to slower rate hikes at the November FOMC.

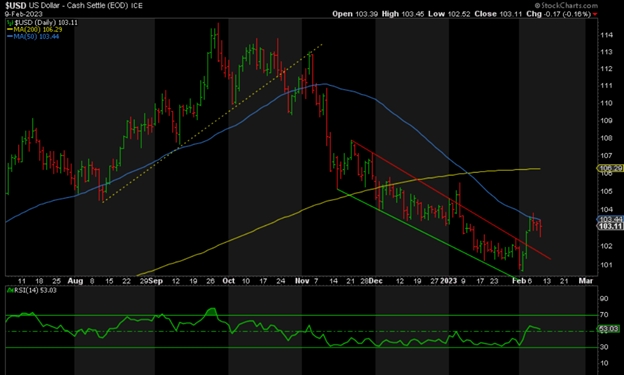

It is now in a corrective A-B-C pattern upwards. It has completed wave A and likely wave B too.

The daily chart shows that the DXY is being capped by the 50-day moving average. But if wave B has indeed ended and we’re in the final wave C of this correction, I expect a break of the 50-DMA soon and ultimately a move up to the 200-day moving average around 106—and possibly higher—before it peaks.

GOLD

This DXY rebound has already weighed on Gold and Silver, given the inverse relationship, and a further rally to 106 or higher means we have not seen the lows yet. This is not surprising given the steepness and size of Gold’s rally.

Gold has gained $357, or 22%, from the low of 1618 the day after the FOMC pivot to lower rate hikes. It has clearly broken the bearish flag or ending diagonal to the downside.

Just as the DXY appears to be correcting higher in an A-B-C, Gold is a mirror image, undergoing its own A-B-C correction to the downside in Wave 2. It looks like the final wave C down has begun, and the targets for the final low are 1820, 1800, and worst-case 1750. 1800 is where wave C = A in size.

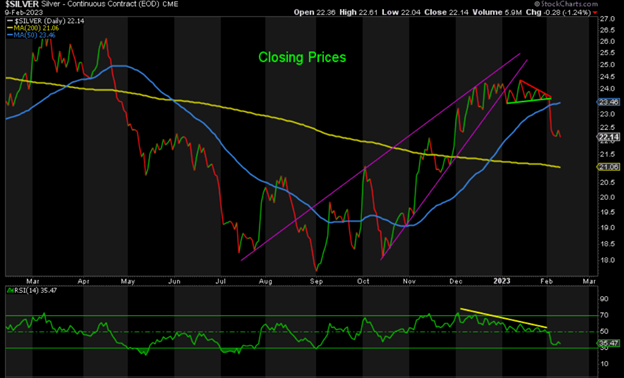

SILVER

Silver topped out at 24.77 on an intraday basis and 24.50 on a closing basis. Now it’s heading down towards the 200-day moving average around 21, with the possibility of an extension to 20, before heading higher again. Given Silver’s relative underperformance to Gold recently, I wouldn’t be surprised if even Silver outperforms when the next rally takes hold.

In summary, I believe DXY is rallying into a peak around 106 or higher before heading down to even lower lows in the 90s. As the DXY rises, Gold and Silver will continue to fall further. But once the DXY peaks and the metals bottom, I expect a rally in Gold to new record highs next and Silver to head up towards 30. This will be aided by inflation accelerating to the downside and the Fed inching towards a pause in rate hikes soon. The CPI numbers are due for release next Tuesday at 8:30 a.m. EST.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.