Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

I’ve been rather quiet on Gold recently because it has been more or less stranded in a range of 1900 to 2000 since mid-March. This is interesting given the volatility in almost everything else:

-

DXY hits its highest level since March 2020

-

10Y yield reaches almost 3%, its highest level since December 2018

-

2Y yield at 2.65%, its highest level since December 2018 also

-

Mortgage rates have soared to their highest level since the Great Financial Crisis in 2007-2008

-

10Y real yield hits zero for the first time since March 2020

-

The S&P is still struggling between 4100 and 4800

-

The Nasdaq is around 13600, closer to the bottom of its recent range of 16200 to 12600

-

Oil prices hit their highest level since 2007

-

Copper is setting new record highs; the entire commodity complex has not been far behind

But it is the lack of action in Gold despite the rise in real yields that captures my attention the most. Real yields and Gold are inversely correlated. When real yields rise, Gold falls, and vice versa when real yields fall. The inverse correlation between the two breaks down from time to time, as it did for much of 2018 during the U.S.-China trade war, but they always reconnect.

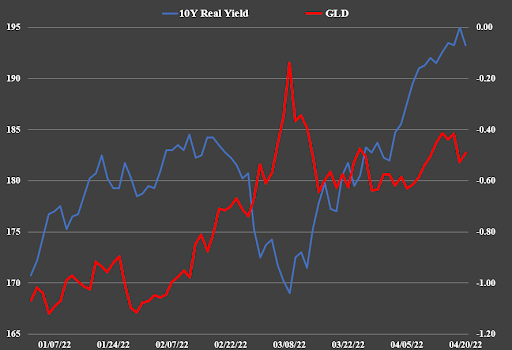

The chart above shows the 10-Year real yield and the Gold ETF GLD since the start of the year. The real yield axis is on the right, and the GLD price on the left.

The real yield rose from -0.97% at the start of the year to a peak of -0.42% by mid-February. Strangely, Gold rose at the same time. In other words, they rose together, which is atypical but not extraordinary in the short-term.

But then real yield dumped again to -1.04% on March 8 and Gold rose to a peak of 2082 that same day. Then the real yield rose to -0.61% on March 16 and Gold fell to a low of “1900”. This is what one would expect to happen: real yields fall, Gold rises, real yields rise, Gold falls. But this is where it gets confusing.

From March 16, the real yield continued to rise almost straight up to zero for the first time since March 2020, as shared above. But Gold didn’t fall. Quite the opposite, it rose to a peak of 2000, and now they’re falling together. Again, breakdowns in the relationship between the two, especially in the short-term, are not uncommon, but it is noteworthy that real yields rose from a low of ~1% to their highest level since the repo-driven crisis in 2020 and Gold is still $150 off its January 3 level and has come within pennies of the all-time high of 2089 in August 2020.

The key point is that they always reconnect. Either Gold goes south in a big way to match the rise in real yields or real yields fall again and Gold heads up to new record highs. With real yields around zero, you can guess which scenario I see playing out.

Given the extreme volatility in the markets since the Fed began its latest tightening cycle, as outlined above, something has to break soon. Financial markets are reaching extremes that could precipitate a systemic collapse or another reversal by the Fed to more stimulus, just as in December 2018. Note that various markets are tagging levels last seen in March 2020, December 2018, and 2007-08. What happened next in each of those circumstances? The Fed turned on the printing presses. I fully expect them to do so again. It’s just a question of when. My best guess is around the September to October timeframe, typically the worst time for stocks. The alternative is the collapse of everything.

When the Fed pulls its next 180, watch real yields plummet and Gold, Silver, and the miners go parabolic, imho. In the meantime, we could suffer more downside. 1900 is the key support level in Gold that needs to hold in order to avoid a deeper dive. Whether it holds 1900 and we go straight up or we get a bigger drop and then head higher, the ultimate destination is the same, just as it was post March 2020, December 2018, and 2007-08.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.