Did you know? You can get the Sprott Money Weekly Wrap Ups, Ask The Expert, special promotions and insightful blog posts sent right to your inbox.

Sign up to the Sprott Money Newsletter here.

Last week, I shared my views on sentiment, technical analysis, and positioning with respect to Gold, Silver, and the miners in the short-term. I also shared my fundamental rationale for why I believe they are all going much higher once we hit bottom here soon. These are tools I use in my ‘FIPEST xM” process, which I established years ago by identifying consistent signals from each tool at every major peak and trough in an asset class over the past ten to twenty years. Given the sharp rise in real yields and the continuation of the dump in the dollar, let’s take a look at inter-market analysis, the “I” in my process.

NOMINAL & REAL YIELDS

Real yields, which are simply nominal bond yields less inflation, have soared recently. The 10-Year real yield has risen almost 40 basis points from a low -1.06% two weeks ago to -0.67% as I write today, Thursday. -0.67% is the highest real yield since June 2020, eight months ago.

Courtesy of Quandl.com (I have added today’s move in blue):

While inflation expectations have risen, nominal bond yields have tripled from 50 basis points back on August 6, 2020 to ~1.50% today, which is why real yields are soaring. The negative correlation between nominal bond yields and Gold is currently -0.8. It is clear from the chart below that when yields rise, Gold falls, and vice versa.

If you’re still not convinced, what peaked the day after nominal bond yields bottomed on August 6? Gold and Silver.

So how high could bond yields go? For this I turn to the 30-Year Treasury Bond. Why? You’ll see below.

The monthly chart of the 30-Year Treasury Yield above shows that each and every time it reached or slightly exceeded its 100-Month Moving Average, it has turned back down. This chart was so reliable, given its 30-year pedigree and the sheer number of tests, that I tweeted back in October 2017 that if the 30-Year hits that moving average—or better, goes slightly above it—then it’s a screaming buy. I also said that the yield would likely fall below 2% and possibly even 1.0%. The rest is history.

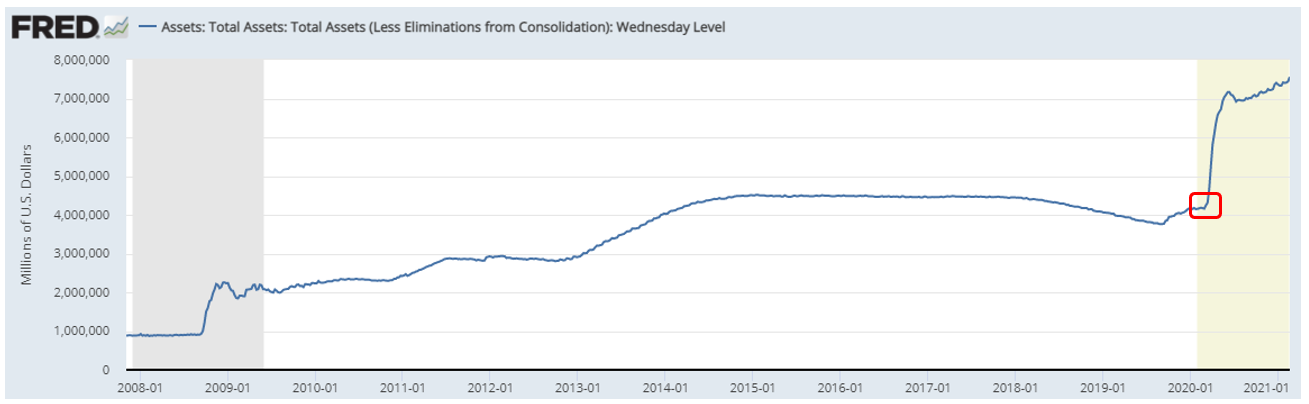

The point being that now we’re heading back up towards that moving average, which is currently around 2.75%, with the current yield at 2.32% and rising fast. Until this no longer works, I expect history to repeat itself and the yield to max out somewhere between 2.75-3.00% and then down it goes again. This would likely coincide with the Fed instituting its “Yield Curve Control” policy, or put simply, cap and drive down yields by buying US Treasury Bonds across the yield curve. In order to do this, the Fed would have to print new dollars to buy the bonds, increasing their balance sheet and further weakening the dollar. Just look back at what happened to the dollar since its peak in March 2020, when the Fed began printing trillions of new dollars.

Coupled with Biden’s new ~2 trillion fiscal stimulus plan, and likely more to follow if the IMF gets its way, this is only going to increase significantly, starting as early as next month. Without Fed intervention, the massive increase in bond issuance to finance more stimulus would push yields even higher, rendering the government insolvent based on the annual interest cost alone. They have no choice, imho. Add the probable introduction of Universal Basic Income, or UBI, and Fed intervention is not likely, it’s inevitable. It’s either that or the collapse of everything.

Inflation is already rapidly on the rise, we know this by just looking at grocery prices, oil prices, commodity futures. Additional stimulus on steroids only makes matters worse. A Federal Reserve cap on yields at the same time as rising inflation expectations means that there is an asymmetric risk to the downside in real yields. This only means one thing for Gold, Silver, and especially the miners. They’re going a lot higher, imho.

DOLLAR

All of this new stimulus and associated dollar printing by the Fed, also known as Modern Monetary Theory (“MMT”), does not bode well for the dollar’s future, even its global reserve currency status. But in the meantime, we could see a significant short-term bounce in the dollar. It has fallen a long way since its peak in March 2020:

The short positioning in the dollar is massively overcrowded. It seems the world is short dollars, but now they’re ripe for a short squeeze. Following a positively divergent lower low, the dollar has broken its downtrend and is now backtesting support. It looks ready to take off. Could we see a test of the February 2018 low of 88.15 first? Sure. But the data supports a significant bounce in the DXY “in the short-term”, especially if it breaks its 20-Month Moving Average in purple above.

Could this weigh on Gold and Silver? Of course. However, the dollar rising against weaker currencies in the short-term does not mean they couldn’t all fall together against Gold and Silver. Based on the continued decline in the DXY since September, synonymous with the decline in Gold made worse by rising real and nominal yields, it is possible that the metals and the DXY rise together once yields peak and fall again. The point being that yields are a bigger factor in the performance of precious metals than the dollar, imho.

In conclusion, I am watching both the 30-Year Treasury Bond yield and the 10-Year real yield for the coming peaks in both that signal the bottom is in place for Gold, Silver, and especially the miners, signaling new highs for all ahead.

The metals and miners will also likely be extreme oversold, the banks will have covered most if not all of their short positions, and sentiment should be in the sewer by then. Which is why the use of multiple tools pointing in the same direction is so powerful, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.