Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

We finally got the breakdown I was looking for yesterday, aided by the hawkish FOMC minutes, with follow through today, assisted by the far higher than expected ADP numbers today. Let’s see what the Non-Farm Payrolls do tomorrow.

Although the fundamentals may have been the trigger, the breakdown in Silver, in particular, and the rally in DXY, were a foregone conclusion, in spite of the emotionally charged chatter to the contrary. Why? Here is some of the “data” with respect to Silver ahead of its drop…

Starting with the obvious:

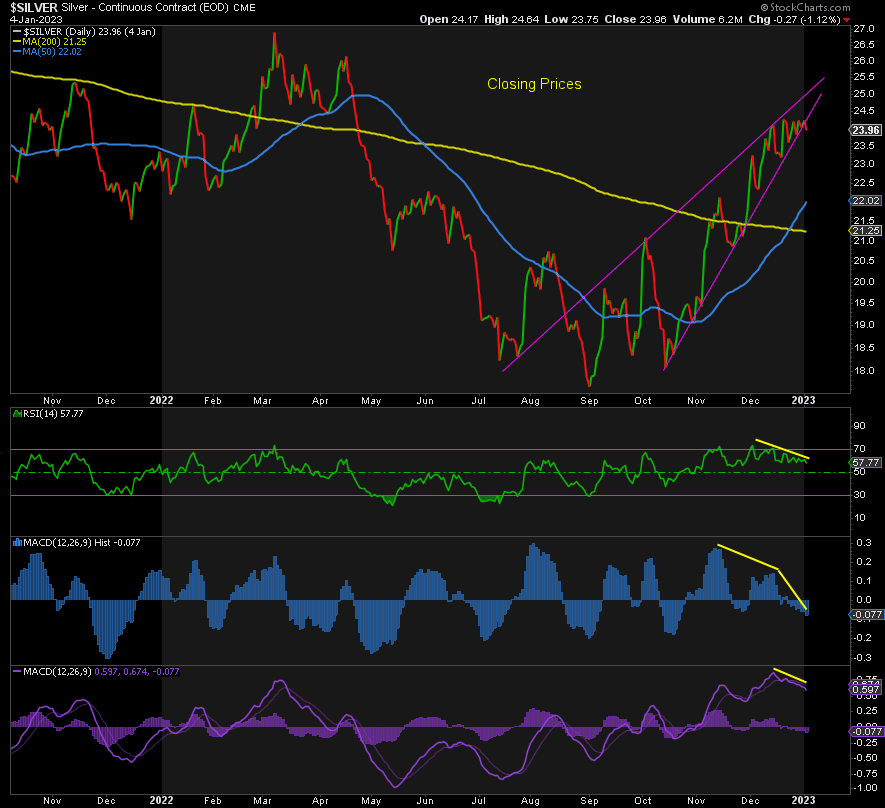

Multiple negative divergences across all indicators. Momentum was falling as the price continued higher on an intraday basis (Silver actually peaked back on December 20, on a closing basis). This is a telltale sign of trouble ahead. Momentum typically leads price.

Ending diagonal / bear flag formations approaching an apex. Silver would have to decide to go one way or another imminently. The divergences coupled with these bearish formations strongly favored the downside.

Despite all ‘hope’ that everyone was short and this was a classic short squeeze, sentiment confirmed the exact opposite: The vast majority were all piled up on the long side of the market, making Silver ripe for a squeeze to the downside.

Then there was the DXY. Again, hope clouds rational thinking and talk of DXY and Silver rising together was catching on when there was no evidence of that occurring. Quite the opposite:

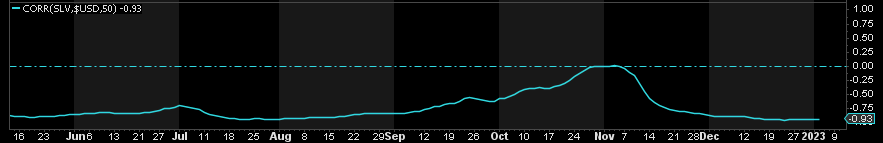

Silver still enjoyed a near perfect inverse relationship to the DXY, with a correlation coefficient of -0.92.

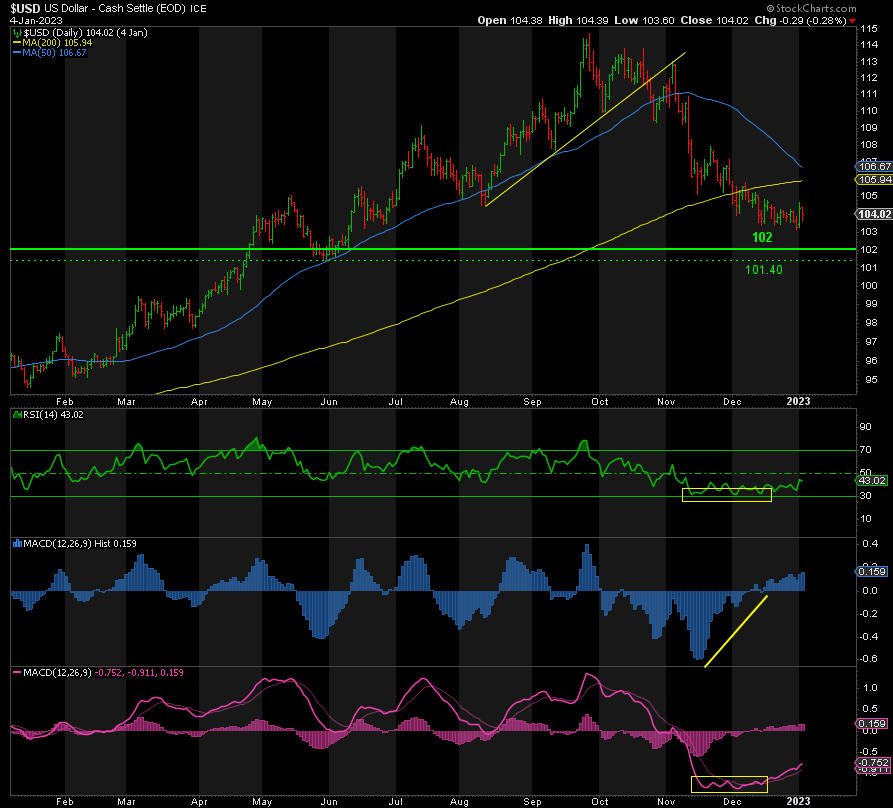

As for the DXY, it has been long overdue a rebound and that is what the Fed triggered:

The multiple ‘positive’ divergences, the mirror image of Silver, signaled this rebound was coming. It’s now at 105 as I type.

As for Gold and the miners outperforming Silver on the way down, this should not be a surprise. The Gold:Silver Ratio telegraphed this two weeks ago, as did the Gold:GDX ratio. Just as Silver outperformed Gold on the way up, it is now underperforming Gold on the downside. This is called ‘beta’ and it works in both directions. The miners had been underperforming the metals on the way up and therefore are outperforming them on the way down, at least for now.

So where do we go from here? Silver and Gold have a lot of bullish sentiment to work off but they can do that sideways to down for a while. The DXY has a date with 106-110 next before it heads even lower again imho. The break of an ending diagonal typically leads to a ~50% retracement from whence it started and peaked, i.e. 18 and 24.77 in Silver, namely 21.40.

My targets on the downside remain as follows:

- Gold: 1750-1700.

- Silver: 23-21.

- GDX: 27-25.

Should we get there, I’ll be buying within these ranges, given the pending wave iii of 3 to follow, the money wave!

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.