Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

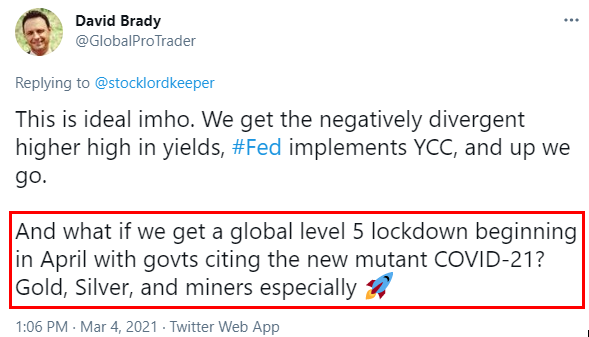

I first suggested the risk of another lockdown in April back on March 4, despite mainstream optimism citing "herd immunity by April":

From the Wall Street Journal:

Ontario, and possibly all of Canada, is likely heading into another lockdown starting this Easter weekend. If this does occur at the same time other countries around the world enter new lockdowns or are already in lockdown, the probability soars of a repeat of the rally in precious metals and miners following the March 2020 lows. Back then the combination of massive fiscal and monetary stimulus ($3 trillion in three months), rising inflation expectations, falling real yields, and most importantly, the closure of refineries and mines around the world sent Gold, Silver, and the miners to new highs and a new record high in Gold. I would not be surprised to see the exact same thing happen this time around, perhaps even more so, with rumors that several of the major Mints around the world will close during the lockdown. Should that occur, demand would soar for the physical metals while supply virtually disappears. Economics 101 tells us that prices would explode.

Given that Bullion Banks have been racing to clear their short position at the fastest pace since October 2016, the prices of paper futures are likely to catch up to physical prices also. Of course, this assumes that the COMEX survives the next rally. Precious metals and miners appear to sense this is coming this morning, with decent rallies off their lows this week.

That said, the risk of lower lows before takeoff remains. At the very least, we should get a pullback following the five waves up. However, if Gold breaks and closes above 1800, the probability that the low is already in place increases dramatically. Here’s what I’m seeing for Gold, Silver, and the miners…

GOLD

Resistance at the prior high ~1760 and 1800.

Support in the 1670s and below there 1630-1650 for a positively divergent lower low.

SILVER

Resistance at the 200-day moving average ~24.75 and 100-day moving average and downtrend line ~25.60.

Huge support level for a possible triple low at 22. Above there, Silver still hasn’t closed below 24.

GDX

Resistance at 33.80, prior high of 34.50, 35.20, and the 200-day moving average at 37.15.

Support at the prior lows of 31.65 and 30.60.

SILJ

Resistance at 15.40 and 16.30.

Big support level at 13.75, possible triple low.

CONCLUSION

With five waves up off the lows in Gold and Silver; massive new fiscal stimulus that will have to be financed by more #QE from the Fed; the prospect of refinery, mine, and Mint closures associated with renewed lockdowns; extreme bearish sentiment; bullish flags; and the Bullion Banks near neutral in their positioning; following an eight month decline; the risk-reward is dramatically to the upside, imho, whether we see those lower lows or not. My “minimum” targets on the upside are 2100 and 33 in Gold and Silver respectively.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.