Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

With little in the way of events over the holiday period, I’ll keep this week’s report brief…

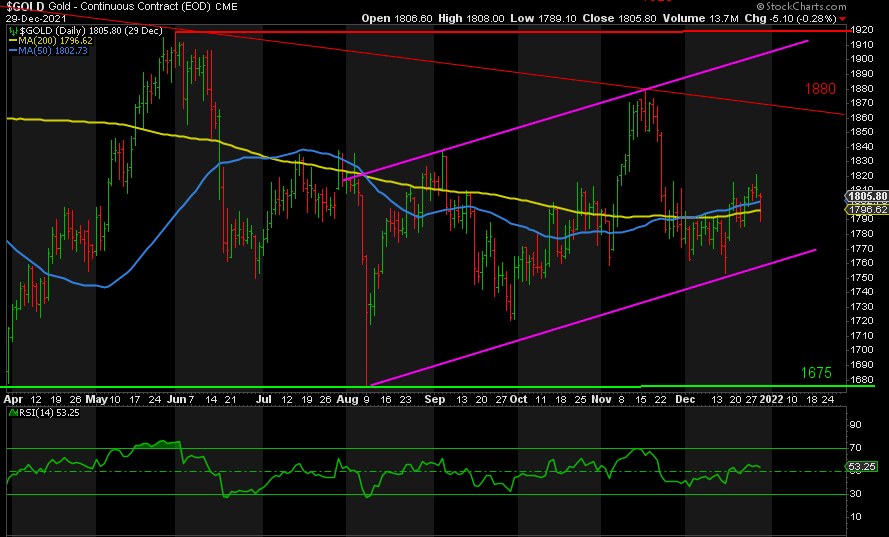

GOLD

Gold is currently trading at 1815. If we close here, it’ll be a higher high and the highest close since November 19 at 1852. That said, we’re still trading around the moving averages. A break above 1880 would go a long way to confirming that the bottom is in. But the risk of a dump in stocks remains a potential catalyst for further downside.

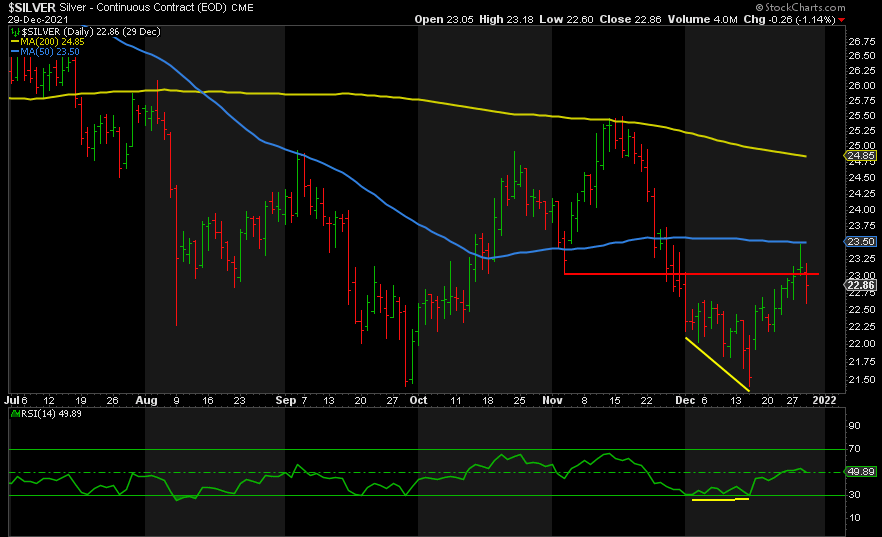

SILVER

As forecast, Silver ran into resistance at its 50-day moving average following its rally off a positively divergent double bottom and a break of resistance at ~22. Support is now at 22.60. A break above the 50-day moving average followed by a higher low would go a long way to signaling a green light for the rally to the 30s next.

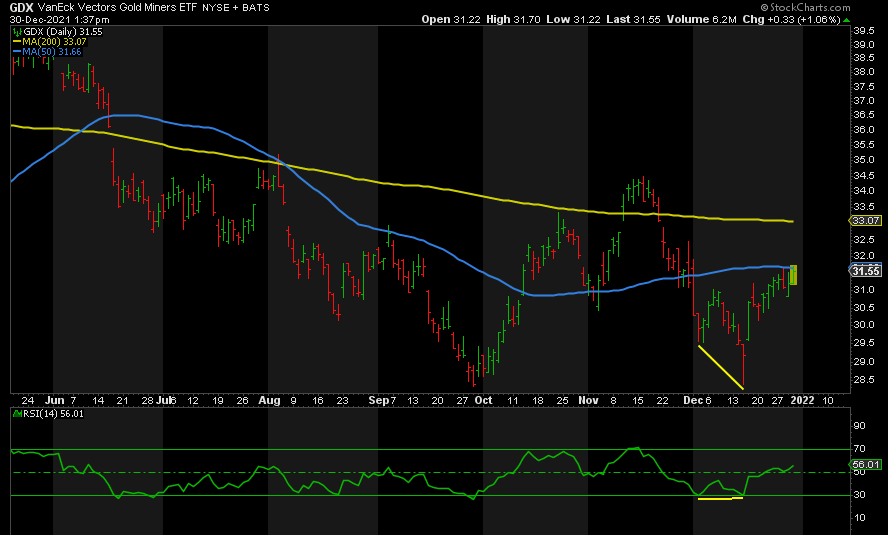

GDX

Same story, different asset. GDX has run into resistance at its 50-day moving average. Above there awaits the 200-day moving average providing resistance at ~33. The all-clear signal I’m looking for is a break of above the prior high of 34.50. Support at 30.84 and 30.15.

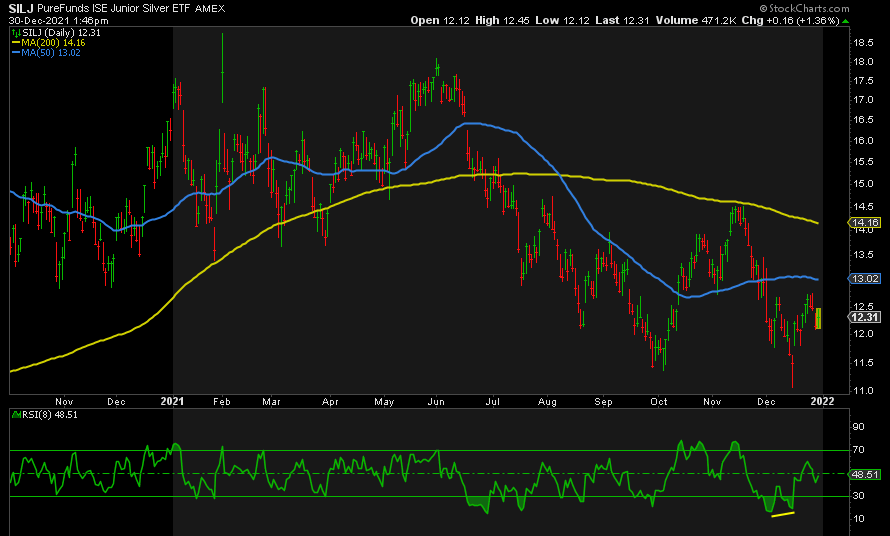

SILJ

SILJ hasn’t even reached the 50-day moving average but I certainly would rule out a test of it. 12.76 is resistance ahead of that. Support is at 12.08 and 11.81. Again, I am looking for a higher high above the 50-day moving average, then a higher low, and then a break of the previous high of 14.50 to set us up for the rally to 25-30.

At the risk of being a broken record, I am patiently waiting for dump in stocks, oil, bond yields, and a reversal in Fed policy to more QE to truly kick off the next rally in metals and miners. It’s inevitable, imho, perhaps driven by another general lockdown as in March 2020. The only alternative is a systemic collapse of everything.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.