Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

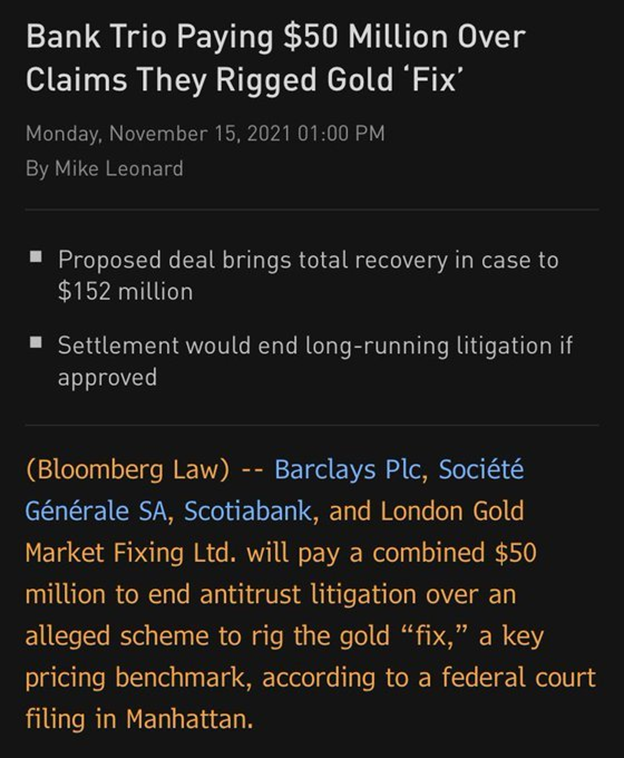

In what has become a steady stream of fines, settlements, and convictions, there was more news this week on the gold price manipulation front as multiple bullion banks reached a settlement regarding their manipulation efforts around the London daily price fixing.

And what is the London daily price fixing? It's an arcane and opaque process that determines the globally-recognized wholesale price of gold. How and why this system is still allowed to operate in the year 2021 is beyond me...but that's also beyond the point.

What you need to know is that this week's settlement is just another in the long line of criminal and civil actions taken against the bullion banks and their traders over the past few years. Here are just a few examples:

- Three J.P. Morgan precious metals traders charged as criminal probe continues

- Scotiabank Fined $127 Million for Price Manipulation, False StatementsScotiabank Fined $127 Million for Price Manipulation, False Statements

- JP Morgan Chase admits to US market manipulation and agrees to pay $920m

- Ex-JPMorgan metals traders must face racketeering charges: judge

Again, that's just a few examples. For your latest news, let's see what has come out this week.

Aha! Here's a collection of bullion banks agreeing to pay a $50,000,000 fine because of their history of manipulating price into that key London daily wholesale fix.

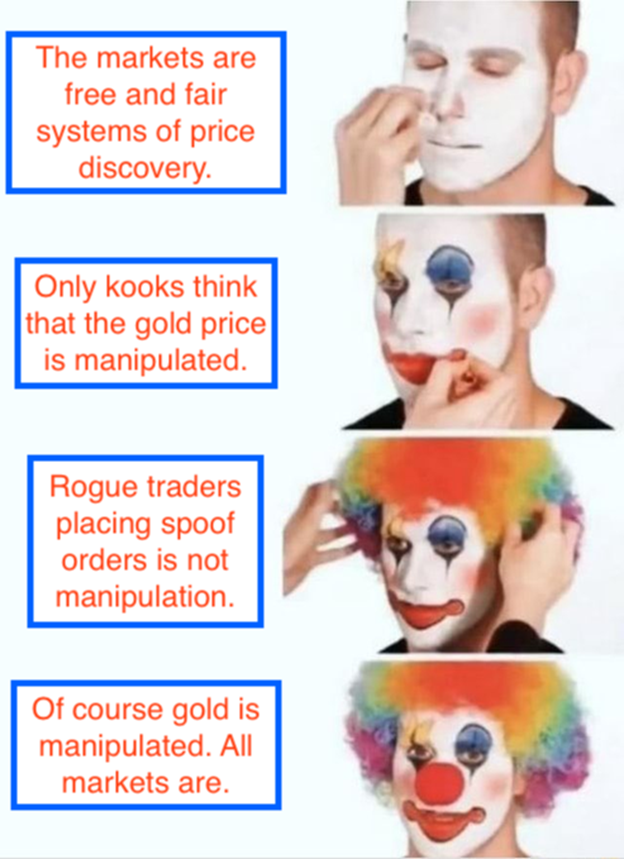

What's funny is that so many supposedly respected "analysts" in the gold community still cling to the belief that somehow the gold price is NOT manipulated, despite years of evidence to the contrary. It's as if some folks are so entrenched in their belief system of free markets that any development that reveals the truth causes these characters to burrow their heads even deeper into the sand.

But I digress. Who cares what those people think? Their opinions are not important, and arguing with them is akin to arguing with someone who believes that the world is not round or that the sky is not blue.

What IS important is understanding that the price you see discovered through the trading of phony-baloney, plastic-banana derivative contracts is nothing but a sham, a fraud, and a charade. Since the destruction of The London Gold Pool in 1968 and the closing of the "gold window" in 1971, the central banks and bullion banks have promoted a system where all sorts of synthetic, pretend gold is offered as a substitute for the real thing.

Look around you and what do you see? You've got:

- Futures contracts that are never delivered and are backed by nothing but the margin cash of the Bank and Spec traders.

- Unallocated accounts that are promoted as a low storage fee alternative to the real thing. Well, common sense tells you that if the storage and insurance fees are low, there must not be a full allocation of real metal sitting in any vault.

- Countless ETFs that allegedly hold physical metal but instead only offer flimsy claims of accounting and audits. And besides, it's not as if you, the regular investor, can access any of the gold that's supposedly held in London. Only the "authorized participant" bullion banks have that privilege.

All of this synthetic gold dilutes the supply/demand equation and creates the appearance of abundance. But physical metal is NOT abundant. What's abundant is the phony-baloney stuff, and the acceptance of this garbage as a replacement for the real thing is what gives The Banks the power to continue manipulating price, regardless of the fines, settlements, and convictions.

However—AND THIS IS THE KEY—no manipulation or Ponzi scheme goes on forever. All frauds eventually collapse under the weight of accumulated deceit. The same will one day be true for physical gold and silver.

And this is WHY the historical fact of gold price manipulation matters. If you recognize that price is manipulated, you must also recognize that the manipulation will ultimately fail. When it does, all of those who hold synthetic gold exposure will discover that they own no actual gold at all. Instead, they are simply now creditors and counterparties to another in the long list of Big Bank frauds that have plagued the global financial system for decades.

Knowing this, buy gold. Buy the real thing. Take delivery and store it in a safe place. Do not trust your bank or your broker/dealer to come your rescue when the inevitable day of reckoning arrives.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.