The Case for Gold

The fate of the stock market and the outlook for gold are more intertwined than most realize. A major headwind for gold has been the consensus comfort level with potential returns from mainstream investment strategies. While gold has performed well over the past few years, gold's outperformance is still a well-kept secret. If a general bear market sets in, many more individual and institutional investors will look towards gold and related mining stocks. In the meantime, macroeconomic and valuation factors continue to build in gold's favor.

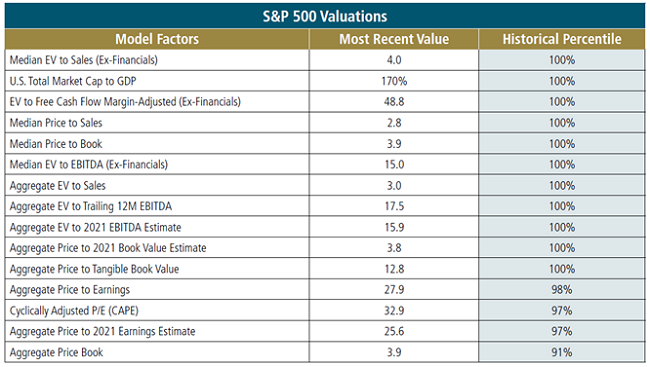

In our opinion, the electoral victory of the Democratic Party in the November U.S. elections adds another bullish factor to the case for gold. We believe that fiscal stimulus measures likely to be enacted under a Democratic Administration and Congress will lead to wider deficits than would have been the case under a Republican Administration or a split congress. In the short term, the financial markets view these developments as very bullish for a post-COVID economic recovery, a possibility that is already being priced into financial asset valuations. The stock and bond markets are the most expensive in history and vulnerable to even the slightest disappointment (Figure 1).

Figure 1. Equity Valuations are at All-Time Highs

Source: Bloomberg, Yale/Robert Shiller, John Hussman. Data as of November 2020.

Contrary to Rosy Market Expectations

There are several negative outcomes possible from the current precarious alignment of rosy expectations and high valuations:

- The recovery may fail to materialize as expected; it may not happen as soon as widely expected, or it may fall short in terms of the expected increase in GDP (gross domestic product).

- Inflation may become problematic. The U.S. Federal Reserve (Fed) is on record as stating that monetary policy would remain easy, even if inflation rises above the target 2%. History shows that once inflation begins to take hold, it is not easily tamed and may persist for years. The cost of taming inflation, as demonstrated in the early 1980s, was a multi-year bear market.

- The recovery may occur in line with high expectations, but because it has already been priced into valuations, stocks have no further reason to climb and may become vulnerable to slight or large disappointment from expected perfection. "Buy the rumor, sell the news." could be appropriate advice.

- Rising interest rates are toxic for high valuations, even if they signify an economic rebound. More likely, rising rates will be symptomatic of a brewing fiscal crisis. In either case, the Fed is likely to fight rising rates with accelerated balance sheet expansion.

- Tax receipts are heavily dependent on an ever-increasing stock market because a very high percentage of this largest source of government revenue is tied to the exercising of stock options as part of executive compensation packages. For this reason, a bear market would threaten an even greater fiscal deficit than the most pessimistic estimates.

"You Can't Have Your Cake and Eat It."

According to legendary investor and 50 year veteran of financial markets Jeremy Grantham of Grantham, Mayo, Van Otterloo & Co. LLC:

"The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak."

Grantham believes that we are in the midst of "one of the greatest bubbles in history," which is sure to lead to substantial capital losses. We believe that when that happens, gold will be revalued upward significantly in U.S. dollar terms.

It is impossible to predict exactly when investor disenchantment with equities will set in. Grantham was three years early in calling the top of the Japanese market in 1989, but 30 years later, it still trades below its bull market peak. A bear market in U.S. equities seems inevitable within a short enough time frame to warrant acquiring meaningful exposure to uncorrelated assets such as gold.

Even if fiscal and monetary policy succeeds over the near term to keep the financial asset bubble inflated longer than we expect, a strong case can be made for further advances in the gold price simply because, at near-zero interest rates, bonds can no longer counterbalance possible equity risks. If only 1% of the $100 trillion of managed investment assets were to migrate into gold to fill the bond vacuum created by low interest rates, it would equate to demand for the entire amount of global mine production of gold for the next six years. Persistent low bond yields could lead to a double or triple rise in gold prices even in the absence of a financial market meltdown. (We discuss this point at greater length in our last report, Gold, The Simple Math.)

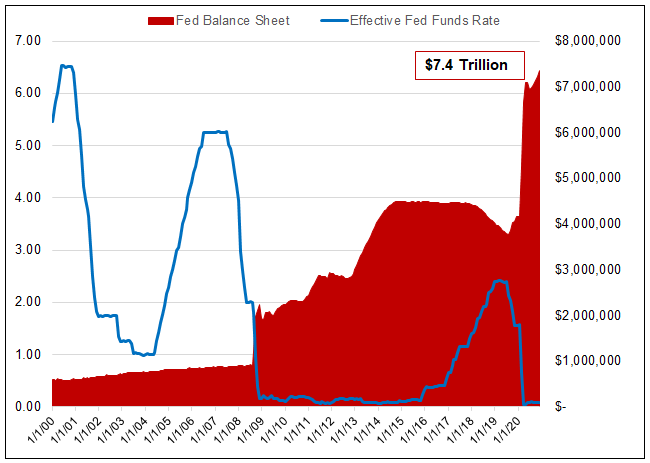

The Fed is Trapped

The recent drift towards higher interest rates combined with a weakening U.S. dollar is a poison for lofty financial asset valuations. The Fed is trapped. A spiraling deficit and the knowledge that any major uptick in interest rates will topple the financial markets and thwart the incipient post-COVID economic recovery, the Fed balance sheet's only recourse for financing the deficit. 2021 Fed balance sheet growth will exceed any forecast in print. In effect, the Fed must choose between a bear market in stocks or a bear market in the U.S. dollar. The latter is the path of least resistance. Once that choice becomes clear, gold will benefit and eventually financial assets will suffer.

Figure 2. The Spiraling U.S. Deficit

Source: Bloomberg. Data as of 12/31/2020.

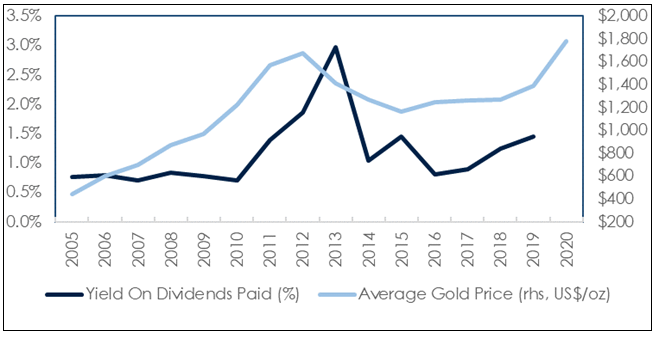

Gold Miners are Extremely Attractive

Gold mining stocks possess very strong fundamentals. At the current gold price, earnings are robust and dividends are increasing. Many companies are generating substantial free cash flow (FCF), which will lead to further dividend increases. Many mining companies are providing dividend yields higher than the yields of bonds and many equities (10 YR U.S. Treasuries yielded 0.91% and the S&P 500 Index1 1.55% at yearend, 12/31/2020).

For example, Barrick Gold Corporation currently yields 1.56% (as of 1/20/2021) but stands to generate free cash flow of $20 billion by 2025, compared to an enterprise value of slightly over $40 billion. It seems highly likely to us that room for substantial dividend increases exists. Barrick is not an isolated example. Figure 3 shows ample potential for further dividend hikes by the group at large.

Figure 3. Gold Price vs. Dividend Yield by a Selected Group of Larger Gold Stocks

Source: Bloomberg, GMR. Group of stocks includes Agnico Eagle, AngloGold Ashanti, B2Gold, Barrick, Evolution, Gold Fields, Kinross, Kirkland Lake, Newcrest, Newmont, Northern Star and Polyus.

Surplus cash will also lead to share buybacks. Alamos Gold has announced a program to repurchase up to 10% of shares outstanding. Newmont Mining expects to repurchase $1 billion of its shares in 2021, after repurchasing $990 million of its own stock in 2020. Kirkland Lake Gold repurchased $732 million of its own shares in 2020 and has continued its buyback into early 2021. Helped by record levels of free cash flow generation, we expect other gold miners to follow suit in 2021.

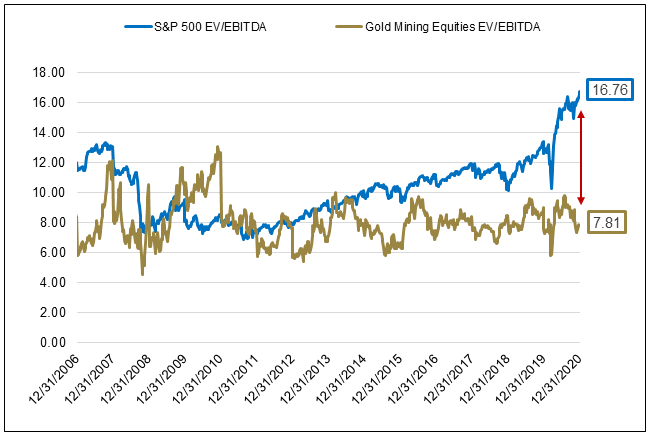

Gold mining shares represent unprecedented value in comparison to conventional equity alternatives. On valuation, gold mining stocks trade at a 50% discount to the S&P 500 Total Return Composite Index. Gold miners trade at EV/EBITDA2 of 7.81x compared to the equal-weighted S&P 500 of 16.76x, the widest spread in 10 years.

Figure 4. Gold Mining Equities vs. S&P 500 Index: EV/EBITDA

Source: Bloomberg. Data as of 12/31/2020. S&P 500 Total Return Composite Index is measured by the SPXEVEBT Index, and Gold Mining Equities are measured by the GDMEVEBT Index. You cannot invest directly in an index. Past performance is no guarantee of future results.

Finally, gold stocks represent inexpensive leveraged calls on the excellent possibility of further rises in the gold price. A $100 increase in the gold price, or 5.4%, would lead to a ~20% increase in pre-tax cash flow, based on an estimated industry-wide cash cost of $1,000/oz.

Stocks and bonds seem to offer little upside along with substantial downside risk. They make sense only if you believe, along with Fidelity Portfolio Manager Mark Schmehl, that "valuation…is a useless tool" (October 30, 2020). Gold is still disrespected and attracts the interest of only a few contrarians. The rationale for investing in gold seems offensive to momentum investors, Artificial Intelligence constructs, machine trading and the prevalent rose-colored consensus macroeconomic world view. That thought should prove comforting to grizzled veterans of the investment world such as Jeremy Grantham and others like him still standing, including this writer.

| 1 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. (TR indicates total return and reflects the reinvestment of any dividends). |

| 2 | Enterprise value to earnings before interest, taxes, depreciation and amortization. The EV/EBITDA ratio is a popular metric used as a valuation tool to compare the value of a company, debt included, to the company's cash earnings less non-cash expenses. |

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.