Peak Bond Yields to Signal Peak DXY and Bottom in Metals and Miners

Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

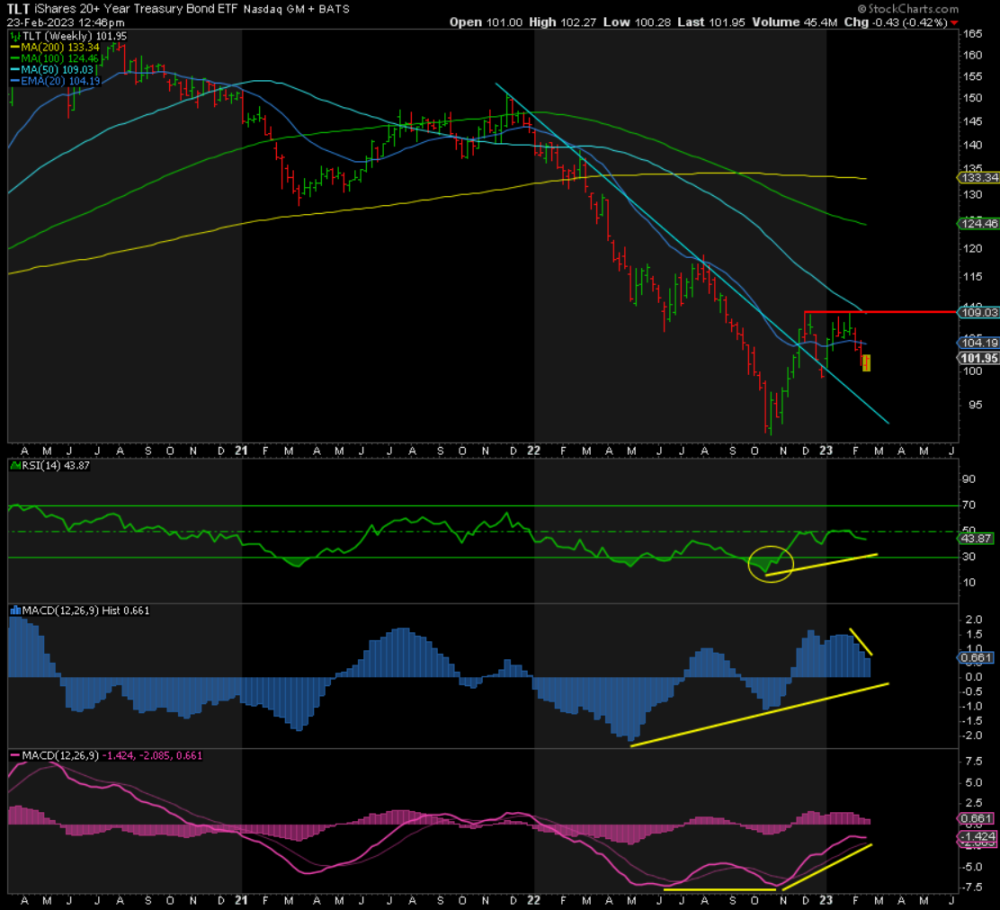

BONDS / TLT

October 24 was the day TLT bottomed at 91.50 on a closing basis, 90.95 intraday. The same day, the 10Y closed at a peak of 4.23% after closing at 4.33% on an intraday basis the day before.

Focusing on the closing prices, I believe we’re in an A-B-C correction from the peak at ~109 on December 7. Waves A and B have been completed and now we’re heading down in wave C. A standard wave C = wave A retracement signals the bottom in TLT at ~98.72 on a closing basis (~98.65 on an intraday basis). By contrast, this is around 4.11% in the 10Y or lower.

The daily RSI in TLT is heading towards an extreme oversold level of 30. We may even get a positive divergence when it bottoms.

The MACD Histogram has been trending down in the short-term, but having come off its lowest level since March 2020, the set-up is clearly there for a positively divergent lower low.

The MACD Line is likely to continue its trend lower, but the weekly MACD Line below negates this because it is clearly heading higher, confirming the entire thesis of lower yields ahead.

In fact, the RSI and both MACDs are coming off their lowest levels on record in TLT, going back to TLT’s inception in 2002, with plenty of room on the upside.

In summary, TLT could go a little lower and the 10Y yield a little higher, supporting the DXY, before they all head in the opposite direction very, very soon. Best guess, the turn begins in the first half of March.

This would coincide with bottoms across the complex in precious metals and miners, if not before.

As always, a stock market crash or some other exogenous surprise are the only caveats, but based on the data in hand, Gold, Silver, and the miners are getting ready for blast off!

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.