Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

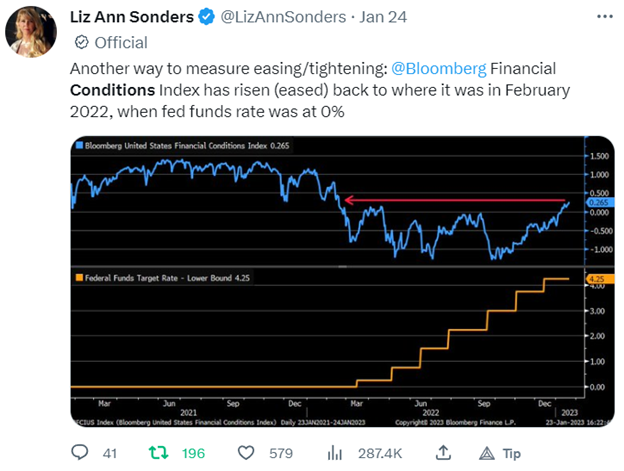

Fed Chair Jerome Powell raised rates by 25 basis points as expected and forecast at least two more rate hikes. But that wasn’t the highlight of his conference call. It was his statement that “financial conditions have certainly tightened.” This was jaw-dropping for two principal reasons. First, it’s simply not true. Financial conditions are as easy as they were when the Fed Funds rate was at zero:

Then there’s what Powell stated at the last FOMC in December:

“Officials seek to reduce inflation by slowing the economy through tighter financial conditions—such as higher borrowing costs, lower stock prices, and a stronger dollar—which typically curb demand.”

He’s been saying that tighter financial conditions are necessary to reduce inflation since at least his Jackson Hole speech back in August. Yet, despite the easiest financial conditions in a year, he signals he plans to do little about it save for two more rate hikes of 25 basis points and ongoing QT. He’s completely contradicted himself and overturned the Fed’s primary policy to lower inflation.

How did the markets react? Yields fell, stocks jumped, and the dollar tanked, making financial conditions even easier and spurring more inflation. A complete 180 on his part.

I cannot explain this about-turn, but unless Powell tries to walk this back—and soon—it’s risk for everything but the dollar for the foreseeable future and rampant inflation.

The DXY fell back to its lowest level since April.

Gold broke the double top at 1950 and reached 1972. The next big resistance level is at 2000. Support is at 1915.

Silver has broken out of its short-term downtrend and is approaching resistance at 24.40, with the prior peak at 24.77 next. Support is at ~23.

In summary, unless and until Powell pulls another 180 back to his original position and jettisons any grain of credibility he has left, the trend remains firmly up in Gold, with Silver likely to play catch-up after a period of underperformance relative to big brother. In the meantime, the dollar remains stuck in quicksand.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.