Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

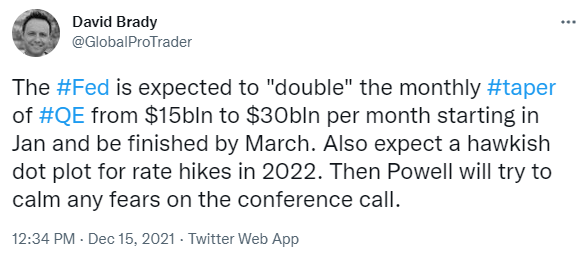

Ahead of the FOMC meeting yesterday, I posted this on Twitter:

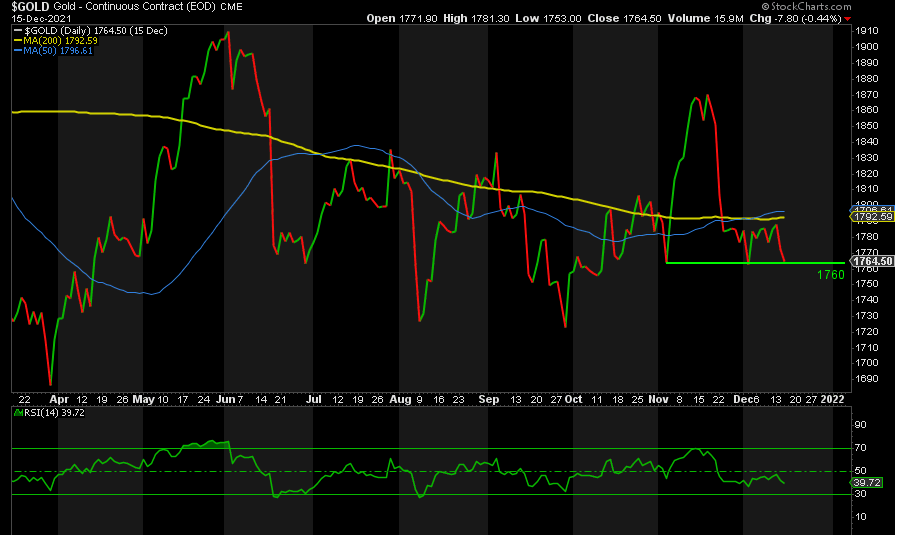

This is exactly what happened. Gold and the rest of the markets had already priced this in. Gold dropped to a low of 1754 just prior to the Fed’s announcement. Then we got a “sell the rumor, buy the fact” response immediately after the Fed’s press release. Gold is now testing 1800 as I type. The 50-day and 200-day moving averages are just below there.

On top of that, Gold held 1760 support on a “closing” basis for the third time in a row. 1760 represents the 61.8% retracement of the rally from 1673 to 1912 and the 76.4% retracement of the rally from 1721 to 1820.

Last weekend, I warned of at least a short-term bounce based on the COT data. Now that has played out. The question is, have we finally hit bottom courtesy of the Fed’s Policy Error yesterday or do we have another leg down to come? Honestly, I don’t know the answer to that question yet. The Banks remain short. The big dump in stocks is yet to come too.

At the risk of repeating myself, we need to take out the prior high of 1880 with confirmation above 1920 and close above those levels. On the downside, it is much easier. A close below 1760 would signal a test of ~1675 support again. As for me, I continue to buy the dips because wherever the bottom turns out to be, above or below 1675, the move up to 2300+ is inevitable, imho.

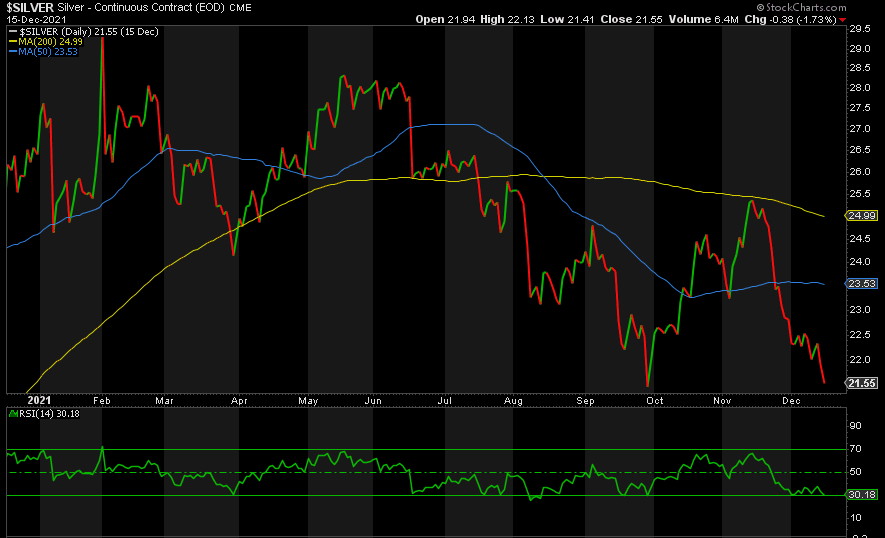

We may have gotten a positively divergent double bottom in Silver yesterday. It has now jumped from 21.40 to 22.55. Both the 50-day and 200-day moving averages are resistance levels on the way, but we need to take out the prior high of 25.50 on a closing basis to feel confident that we’re on our way to 30+ next.

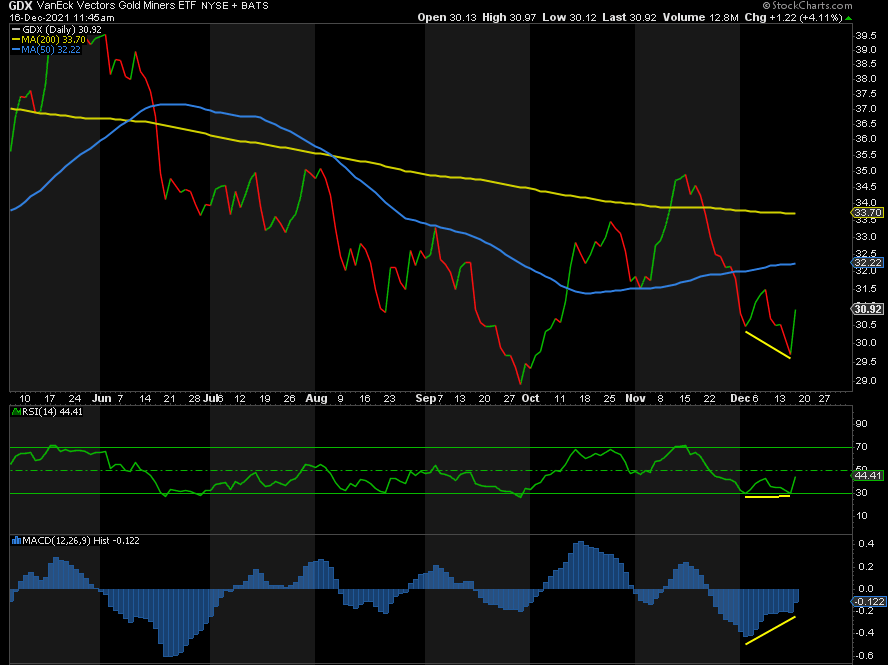

Prior to the close yesterday, I posted this with respect to GDX:

You can see what happened next:

While encouraging, we have not broken any meaningful resistance yet. We need to at least take out the prior high of 35.10. Support now is at 29.70 and 28.90 on a closing basis.

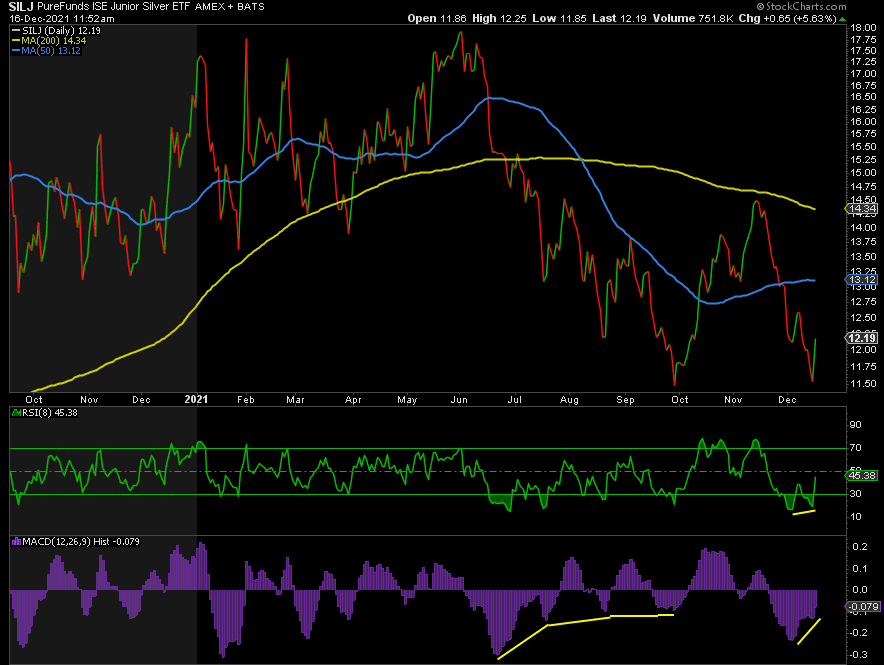

We got a fake breakdown of support in SILJ on an intra-day basis yesterday, but more importantly, we also got a positively divergent double bottom at ~11.50. That is now key support. The resistance to break is the 200-day moving average and then the prior high of 14.50. Then we can start thinking about 25-30.

In summary, we are enjoying a strong bounce off the lows yesterday, but it remains to be seen whether we have seen the bottom or this is just another dead cat bounce. The Banks remain short and the drop in stocks is still ahead of us. That said, I continue to buy the dips for the rally ahead, especially in 2022.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.