Silver “Spoofed” Below $28-Strike W/Large Call Option Position

Did you know? You can get the Sprott Money Weekly Wrap Ups, Ask The Expert, special promotions and insightful blog posts sent right to your inbox.

Sign up to the Sprott Money Newsletter here.

With less than one day left in what some long-time silver industry veterans are calling the most important COMEX options expiration and delivery period in silver history, the price appears to have been “spoofed” again. This time to right under the $28 level.

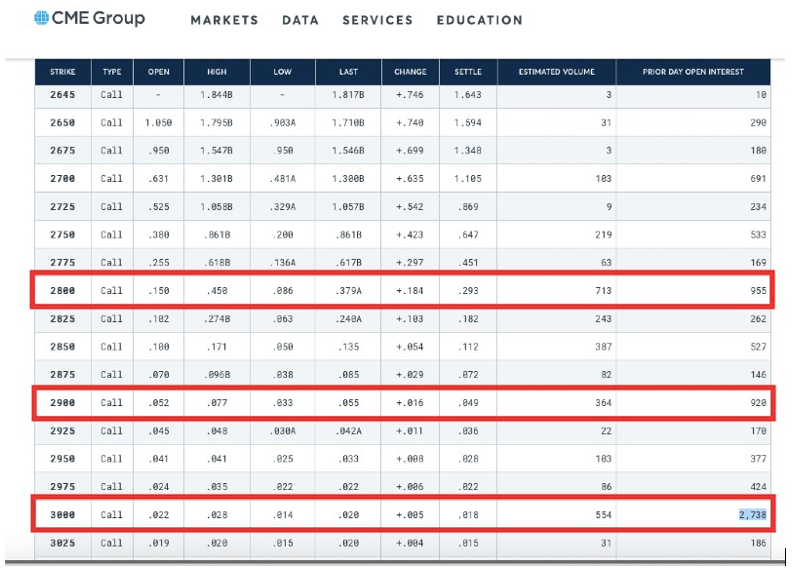

Of course the significance of the $28 level is tied to the COMEX silver options board, where there's a large call option open interest on the 28-strike that expires this Tuesday, February 23rd.

Traditionally, the banks are short the options, which means that if that's indeed the case again this time, they would have to start paying out on those calls if the price of silver rises above $28 by expiration later today.

For those who have been following the silver market for a while, that’s usually when silver sees one of those infamous “spoofs,” that former CFTC commissioner Bart Chilton confirmed in detail in this shocking interview.

Watch: https://www.youtube.com/watch?v=JnY2bVd77MU

Yet that the current commissioners of the CFTC remain stunningly oblivious to.

Perhaps how Tuesday’s trading plays out will be the most current barometer of just how tight the banks’ control of the silver price still is at this point.

Because according to past history, you would expect that they’d be throwing in the kitchen sink to keep the price of silver below $28 today (let alone $29 where there’s another large call option position, or $30 - where there’s a REALLY large open interest).

In either case, it should be an exciting day of trading in the silver world. Especially just one day before the latest COMEX silver delivery period begins too.

Watch: https://www.youtube.com/watch?v=SVlxtx8lJcU

For a primer of what to expect, click to watch the video now!

By Chris Marcus of Arcadia Economics

Chris is also the author of the recent book:

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.