Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

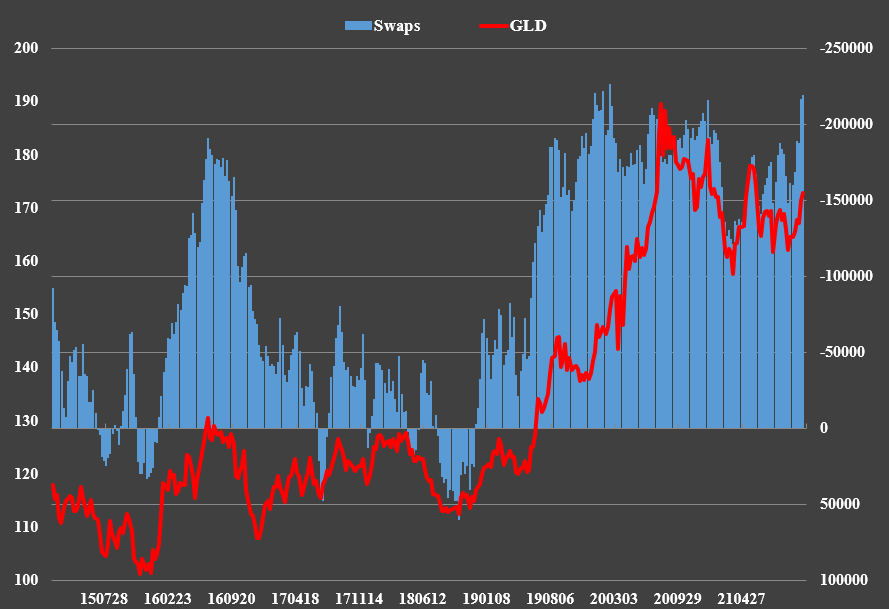

Right off the bat, Thanksgiving is here and we need to be on the lookout for manipulation to the downside by the Bullion Banks. They have been loading up short in the past two weeks and are massively short Gold and the complete introduction of Basel 3 is just a month away. In fact, they are holding a record short position, except for one other period when it was higher: February 18, 2020. We all know what happened a couple of weeks later.

The Banks can create futures contracts at will and dump them on the market to drive down the price. Then they cover their shorts at lower prices, making enormous profits. Such manipulation has the greatest effect when the market is illiquid, such as around holiday periods when trading volumes are far lower. Thanksgiving and the Friday thereafter provide just such an opportunity. It takes fewer contracts to drive down prices and trigger stops, creating momentum to the downside. I am not saying it is definitively going to happen, but it is something to be prepared for.

The rise in 10Y real yields to -1.00% recently after hitting a record low of -1.19%, coupled with the continued strength of the dollar, have contributed to Gold’s reversal of $100 to 1780. With the airwaves flooded with concerns about inflation, it appeared to me to be time to look in the opposite direction and consider a short-term deflationary scare. What could cause that? A sharp drop in stocks triggered by new lockdowns starting in Europe and spreading to North America. This on top of the Fed starting to taper its QE into economic weakness - a recipe for disaster in my opinion. But once stocks fall by 10% or more, watch the Fed do a complete 180 once again to stimulus on steroids. Then precious metals and miners will head up to new highs.

The decline in stocks comes first and that could cause a further spike in real yields and the dollar, dragging down Gold et al in the process. Then when the Fed shows up, or likely sooner, precious metals and miners take off.

In the meantime, watch for the following in this order:

- Risk of short-term drop in Gold over the next few days

- Rebound thereafter

- A sharp drop in line with the peak and fall in stocks in the next few weeks

- The beginning of a spectacular rally to new highs when the Fed reverses policy or even ahead of that.

In the meantime, Happy Thanksgiving to everyone. Enjoy the break.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.