Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

There are two primary scenarios that I’m seeing right now. Both ultimately resolve to the downside. The first is that Gold rallies from here to the resistance zone between 1920-1960 before falling again. The second is that we take the direct route down to lower lows by taking out support at 1675. With the Bullion Banks now clearly in control, I’m leaning towards the latter.

As forecast, the Bullion Banks capped the nascent rise in Gold last week at 1837 and then sent it packing down to 1785 as I type. Until we see stocks fall and/or the Federal Reserve increase their monthly QE, coupled with new fiscal stimulus, the ball is in the court of the Banks.

A break of 1675 would open up a possible drop to the 1500s or, on a worst-case basis, the 1400s before we bottom out.

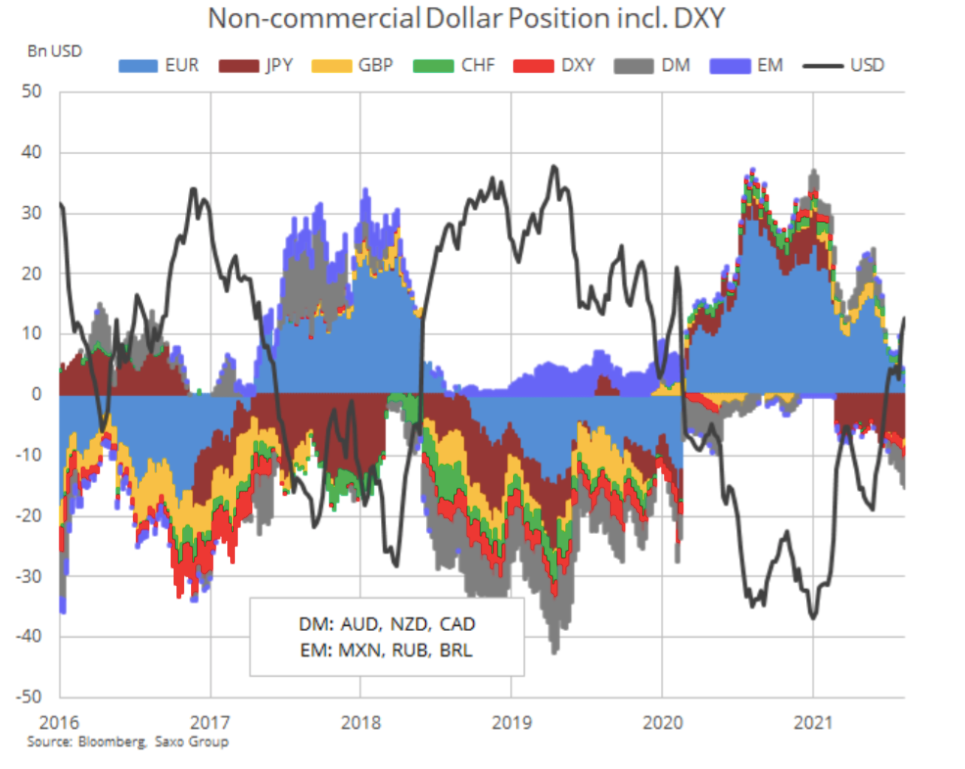

The resurgent DXY is not helping matters either. 91.78 was tested again on the downside and held for the third time.

Given that the Commercials continue to increase their short dollar position and we have not reached an extreme peak yet, the DXY is more likely to rally to new highs next.

My primary target on the upside is 96.50. Such a move would continue to weigh on metals and miners.

As for miners, there is a trapdoor below 30.68 in GDX. Should we break down, we could see a drop of 20-30% to ~20 on a worst-case basis.

Please keep in mind that whatever the lows turn out to be, I am expecting new highs to follow. Much like the rallies that followed equally depressed lows at 1045 in December 2015, 1124 in December 2016, and 1167 in August 2018. This time around it would be north of 2089 in Gold and over 50 in GDX.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.