Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

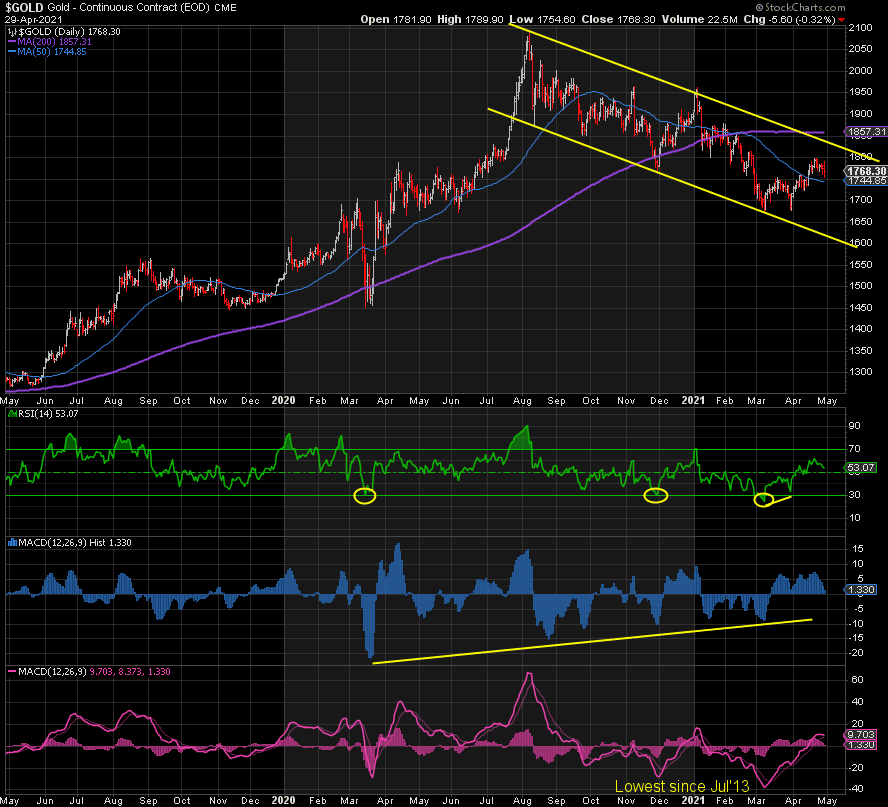

Nothing has changed over the past week. The Fed remains dovish, and in spite of its transitory speak about inflation, prices continue to soar. Biden calls for even more stimulus, but it’s doubtful all of it will make it through the Senate. Meanwhile, the parameters for Gold remain the same. Resistance is at 1800 and support is at 1740-50.

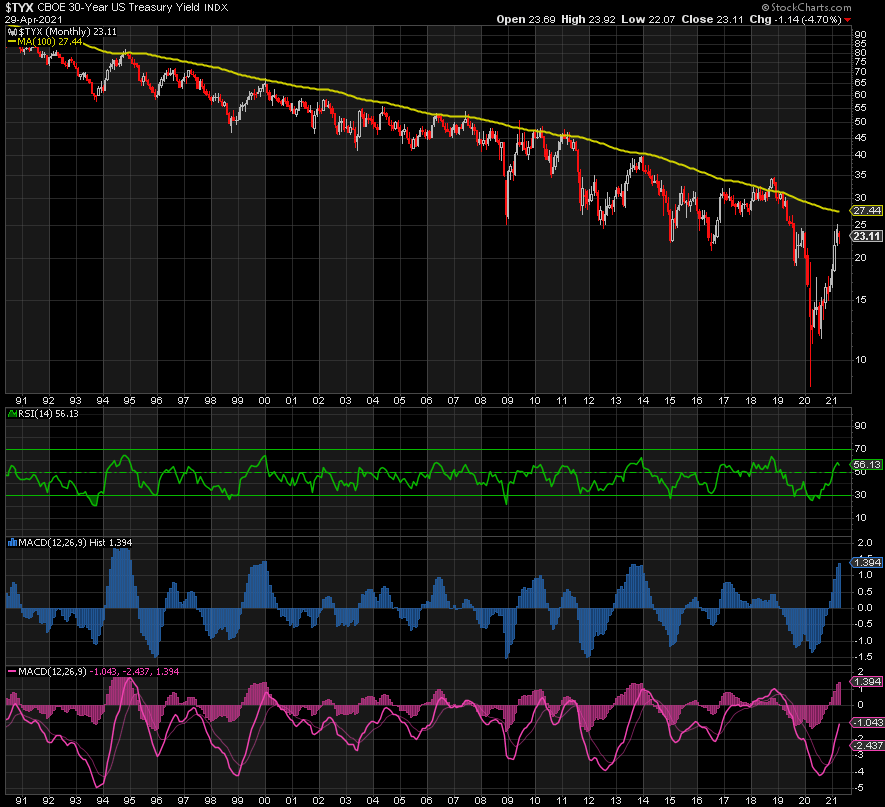

Yields are rising again…

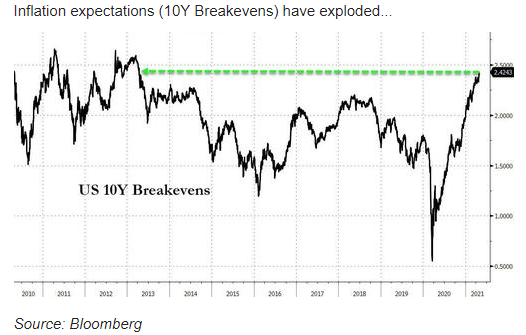

… but so are inflation expectations:

Real yields are flat to lower recently, supporting Gold’s move off its lows. While Powell says rising inflation is temporary, all evidence is to the contrary. While yields cannot be allowed to get out of hand and risk the collapse of everything, inflation will continue to rise as the printing presses remain plugged in and supply chains break down. This is the foundation for the coming surge in precious metals. I don’t see the 30-Year T-Bond going beyond the 2.75-3.00% resistance zone.

As long as Gold holds 1740, where the 50-day moving average also happens to be, a break of 1800 could signal take off. Confirmation would be a sharp move up through the 200-day moving average. In the meantime, don’t spend all day looking at the price going sideways. Wait for a break one way or the other.

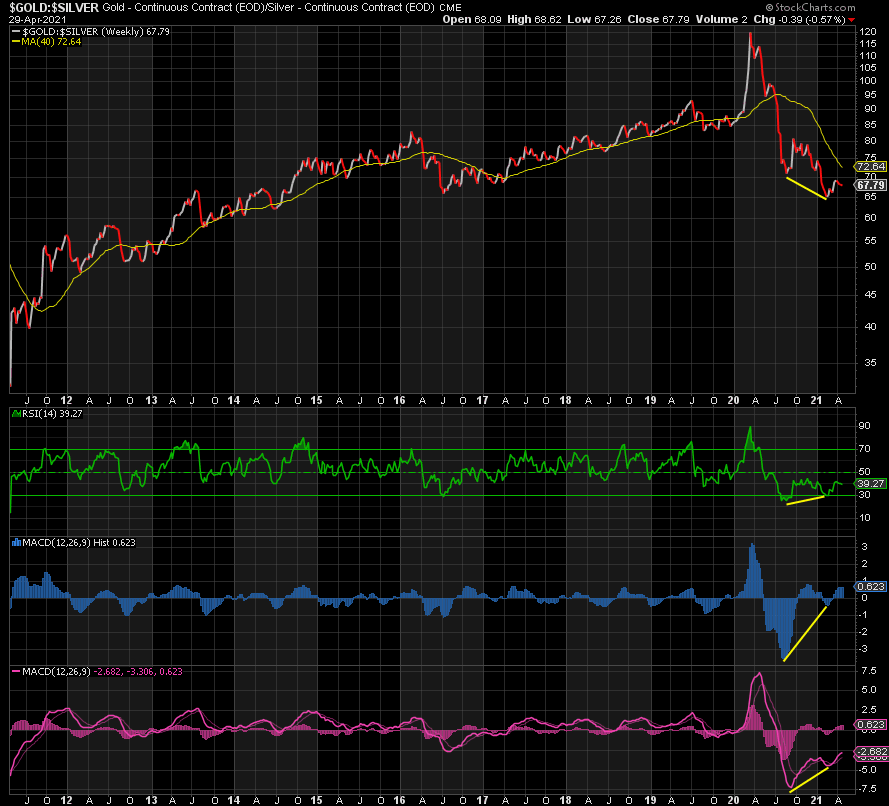

Silver may continue to underperform Gold in the short-term but will blow past it once the rally takes hold.

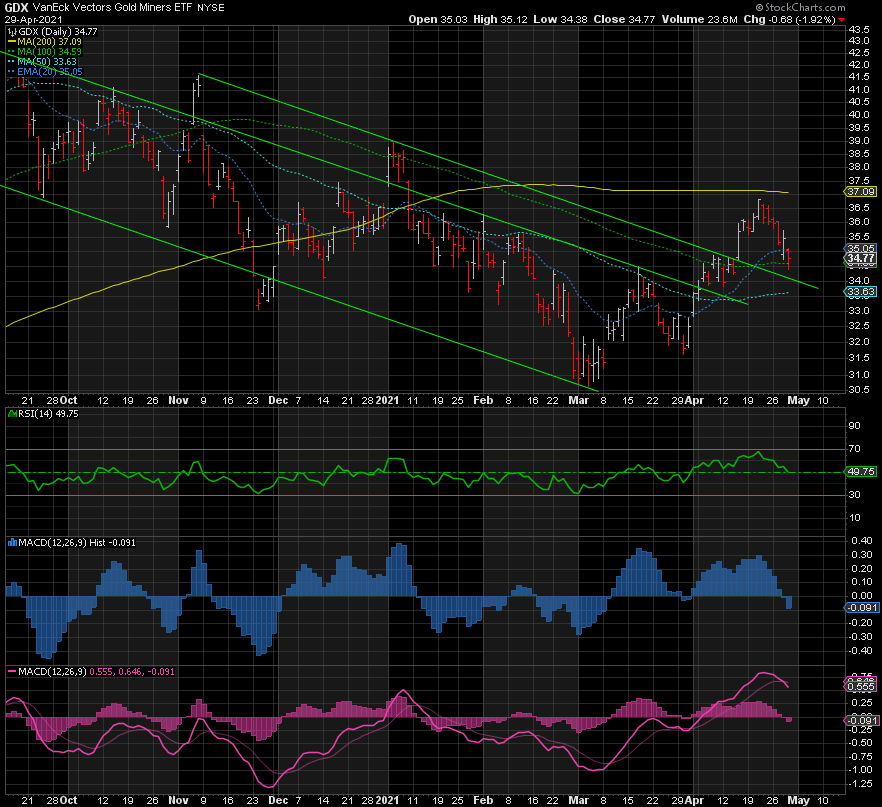

GDX has already broken out of its downtrend and now appears to be backtesting former resistance. A break back down below 34 would signal a fake breakout and tends to be extremely bearish. Until that happens, the 200-day moving average is the next target on the upside.

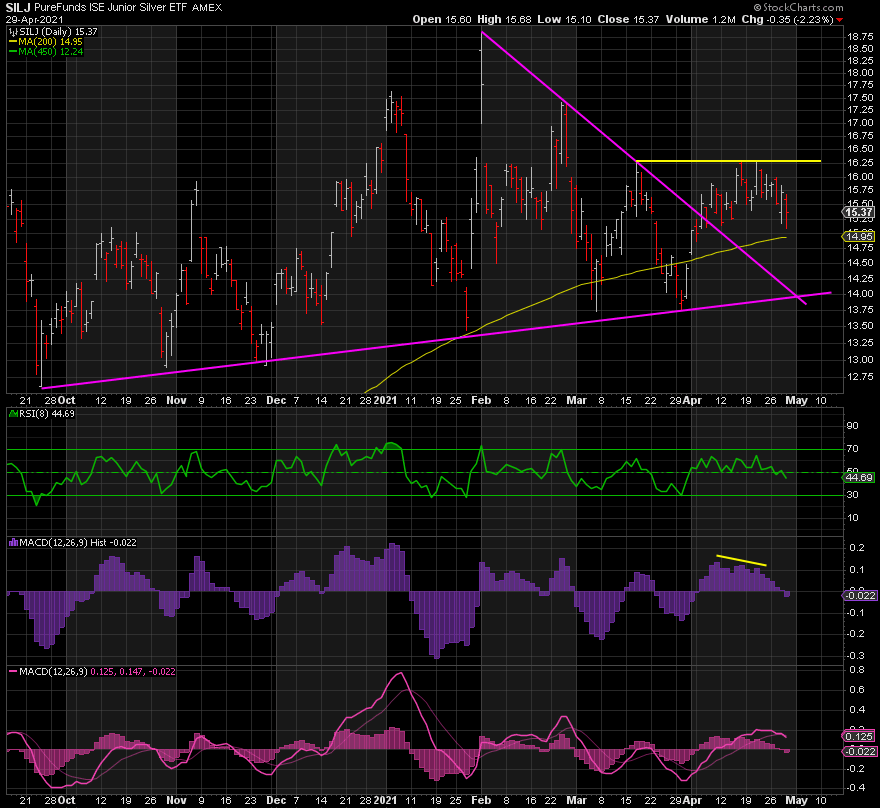

SILJ is the easiest chart of all. A break of the triple top at 16.29 and it’s CYA-time! However, it risks a possible move down to support at 14 first. The 200-day moving average just below 15 could put a stop to that.

I wish I had more to say this week, but who wants to hear a running commentary on how paint dries. We have our levels to watch, and given the long slow grind lower following the slingshot to 2089 in Gold, I’m sure that when they break we’re going to get some rapid moves to the upside, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.