Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

A quick and easy report today, focusing on the technicals.

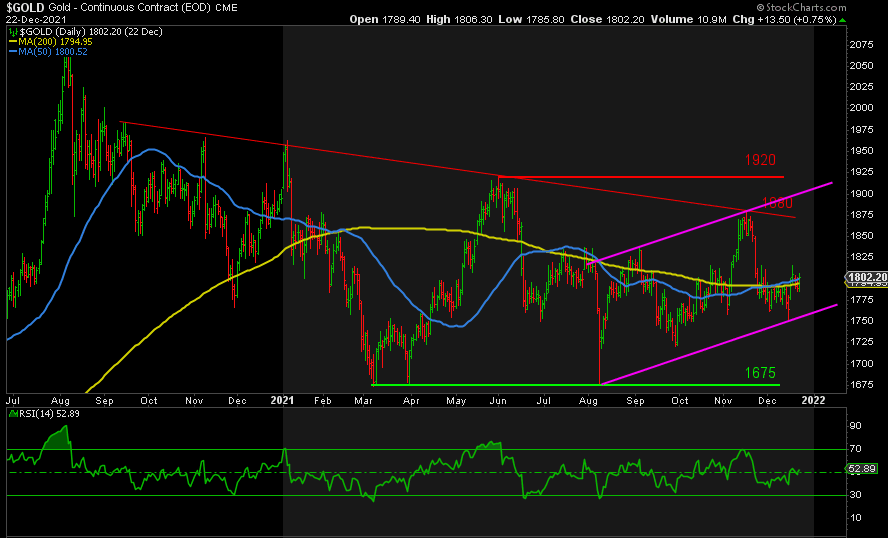

GOLD

Little has changed in Gold. Stuck in no man’s land right now between 1760 and 1816 in the short-term and 1675 to 1880/1920 from a bigger picture perspective. The fact that both moving averages are basically flat and sitting on top of one another says it all. The RSI is also neutral.

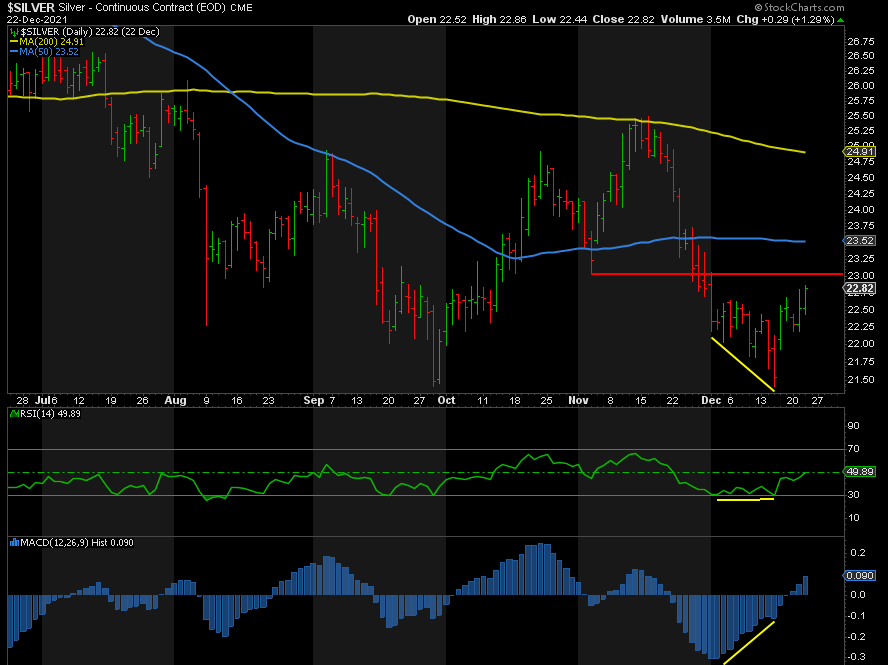

SILVER

Silver continues to rally following its positively divergent double bottom at 21.41. But it’s now running up against resistance at 23-23.10, courtesy of the low on November 3 and the 38.2% Fibonacci retracement of the entire decline from 25.47 to 21.41. 21.41 could be “the low” and if it holds, I’m only looking north.

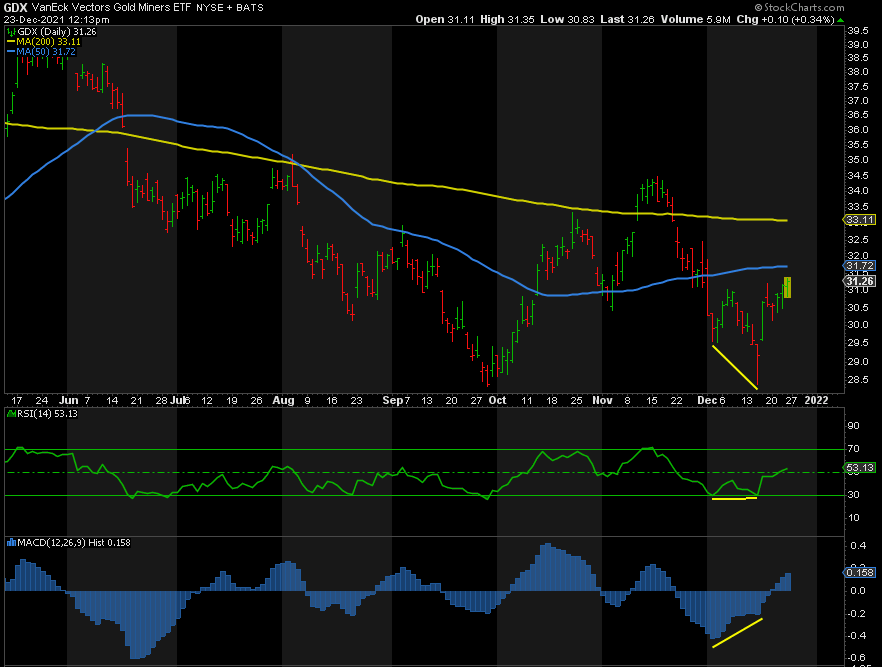

GDX

GDX also continues to benefit from its positively divergent double bottom, but it’s now running up against its 50-day moving average at 31.70. Support is at 28.40.

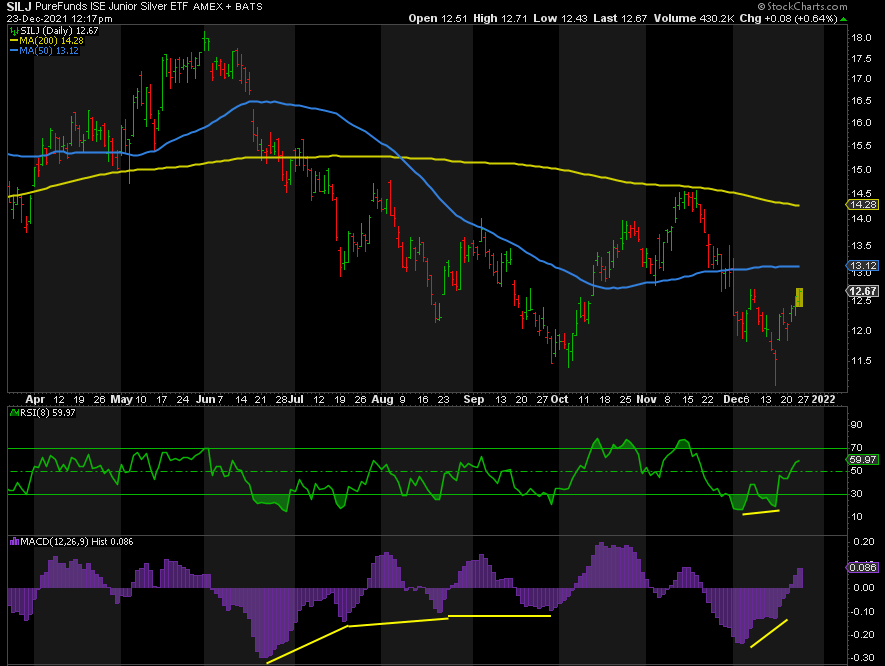

SILJ

Same story, different asset. SILJ is testing resistance at 12.72 for the third time. If it gets through there, then the 50-day moving average is waiting just above 13. Support is at the prior low of 11.12.

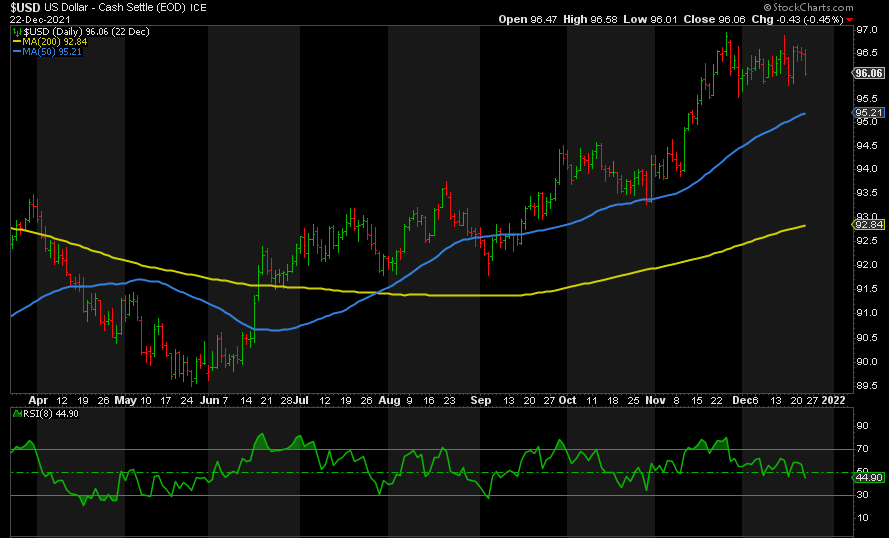

DXY

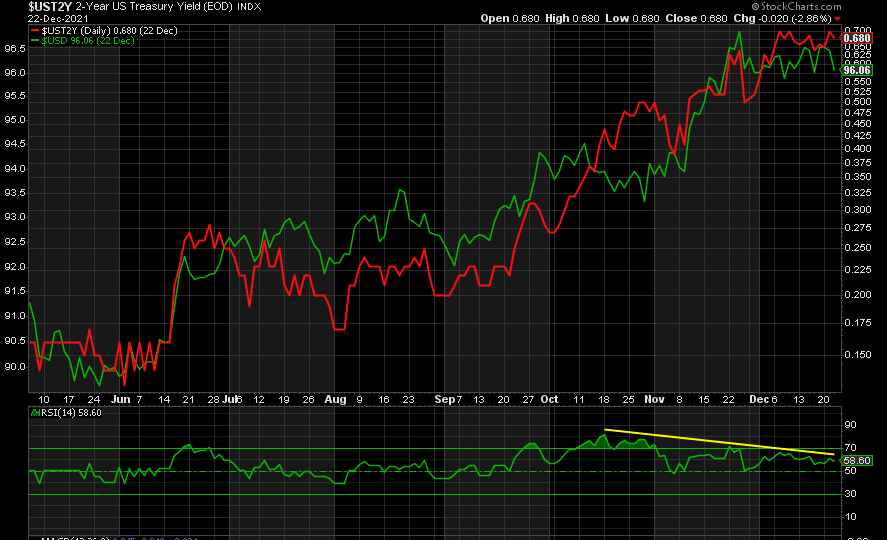

I’m still not convinced that the peak is in for the DXY. The extreme overbought condition in the RSI has corrected to below neutral with a relatively small decline in price. My ideal scenario is a negatively divergent higher high before it tanks towards 89.

Negatively divergent higher highs in the 2-Year bond yield also suggests that the dollar’s days are numbered, assuming the tight correlation between the two continues.

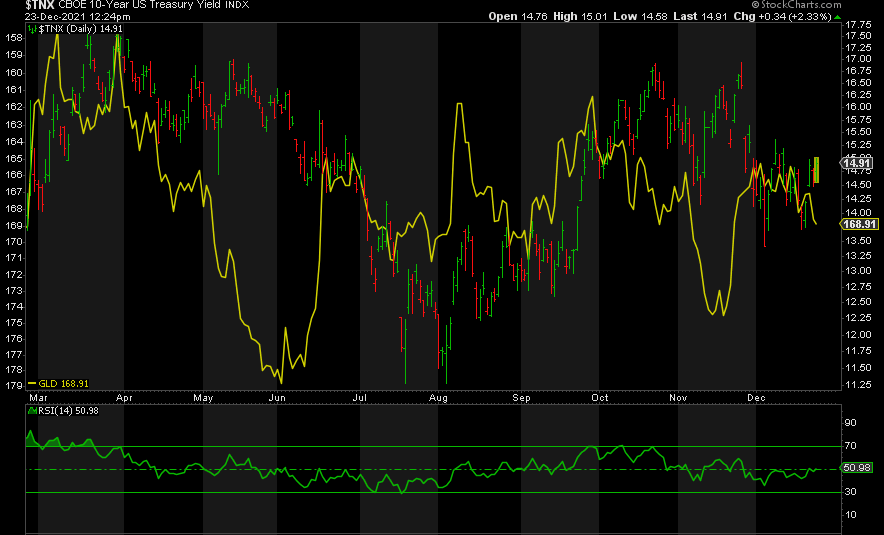

10-Year Bond Yield

The 10Y yield continues to trade more or less sideways with a bias to the upside in the short-term. That said, I’m going to continue to rely on the Banks’ big net long position in bonds which signals far lower yields are coming sooner or later, which should benefit the metals and miners.

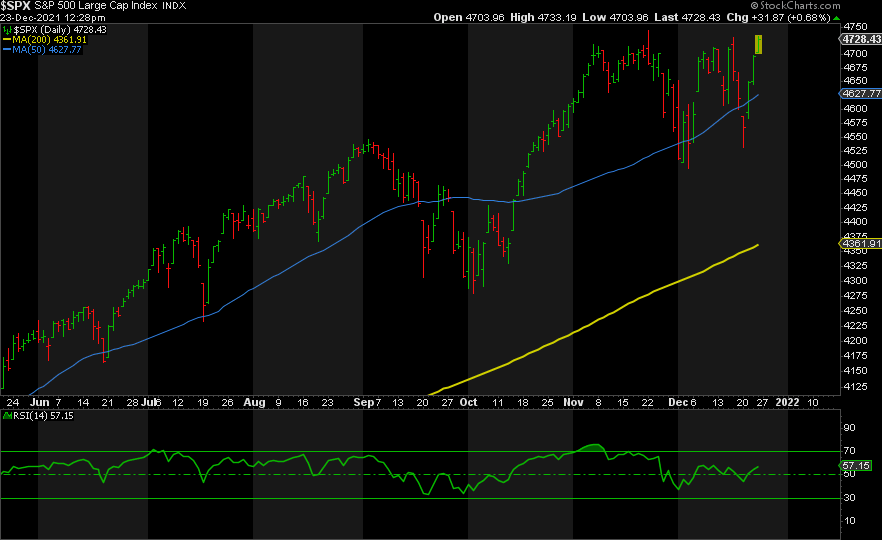

S&P

We’re getting the forecasted move up to ~4900 and, ideally, it will be a negatively divergent higher high triggering the dump in stocks I am waiting for in January or February. I expect the Fed to step in and reverse their policy error on QE once stocks fall ~10%. Metals and miners will soar at that point, at the latest, but the rally may have already begun too.

I wish everyone a joyous and memorable holiday period and a prosperous New Year with the prospect of a spectacular rally following a dismal 2021.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.