Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

As the new year begins, few assets are performing better than copper. So the question becomes, is this just an anomaly or is this the start of a major new uptrend in commodities?

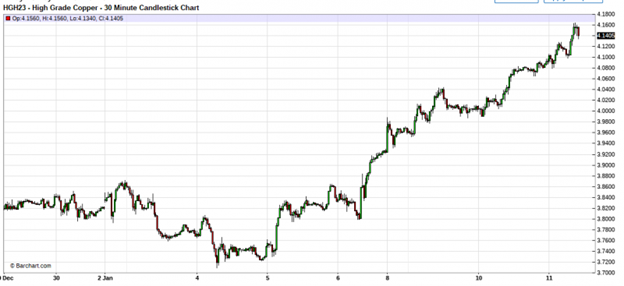

Let's start with some charts. First, here's the current front month Mar23 copper contract since 2022 ended and 2023 began. As you can see, it's up 8.3% year-to-date...which is only seven days.

Next, let's take a wider view in order to assess whether or not this rally has any longer-term technical implications. It would certainly appear that it does. Note the breakout above $3.90-4.00 as well as the pending "bullish cross" of the 50-day moving average and 200-day moving average.

And now let's stretch out even wider and take a look at the weekly chart. What does it reveal? In a similar chart pattern to COMEX gold and silver, you'll note that copper is back into its flag/consolidation range after finding support late last year right where it should have found it, in the area around $3.20.

So what's going on here? Is this a signal of a renewed bull market in commodities? Is this a sign that Chinese commodity demand is increasing now that their failed "Zero Covid" policies have been ended? Could copper and other metals break out to the upside later this year and begin to accelerate higher in price?

The answers to these questions are: Yes, yes and yes.

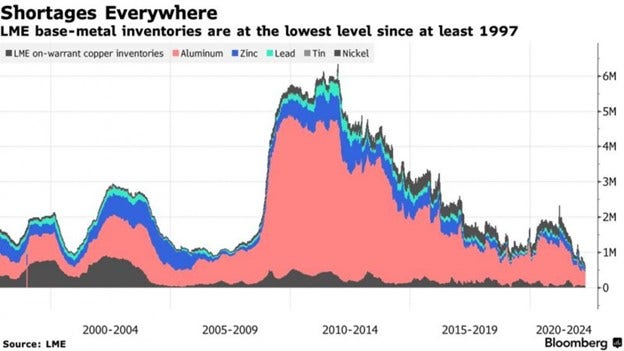

We wrote about some of this last week in our annual macrocast and I encourage you to read it now if you haven't already. What's most interesting about commodities in 2023 is that the next rally will take place against a background of sharply-falling and rapidly-dwindling global stockpiles. From that macrocast post, here's a chart of the five major industrial metals and their respective inventory levels on the London Metals Exchange:

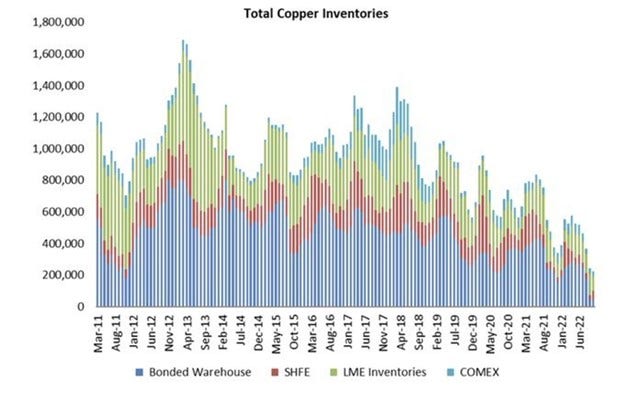

But let's look more closely at copper. Here's a chart that shows copper inventories around the world. As you can see, this is not just a London issue. Copper stocks are falling globally and they have been for over a decade.

So now scroll up and look again at those price charts. Are they telling us something? Are they warning us about what's to come?

Well, consider this, too. There's a guy named Zoltan Pozsar who works for Credit Suisse. He made his bones analyzing and studying the short-term credit markets but, since the Ukraine War began and the U.S. subsequently sanctioned Russia by freezing their foreign currency reserves and excluding them from the SWIFT system, Pozsar has written extensively about the coming of a "new Bretton Woods" system, where gold, oil and other commodities will be remonetized. Here are a few links:

- https://www.yahoo.com/video/credit-suisse-strategist-says-were-172900306.html

- https://www.bloomberg.com/news/articles/2022-09-11/zoltan-pozsar-sees-a-new-dollar-regime-his-longtime-collaborator-disagrees#xj4y7vzkg

- https://www.yahoo.com/lifestyle/why-shouldn-t-underestimate-china-000000158.html

So what if Pozsar is correct and physical commodity demand is about to soar in the months ahead? That's where it gets interesting. If you're a precious metal enthusiast, then you already know how The Bullion Banks have overleveraged and rehypothecated physical gold and silver for decades. They've done this with the expectation that neither metal will ever be remonetized. Maybe they're right. But what if they're wrong?

And what if I told you that it's not just physical gold and silver that have been overleveraged and rehypothecated? Copper is in this same boat. Not as heavily as gold but more so than silver. How "interesting" could the situation become if physical copper demand drains those dwindling global stockpiles? Well, let's refer to Pozsar's most recent research piece where he refers to this possibility as an "existential threat" to the banking system. You can read the entire post here: https://plus2.credit-suisse.com/shorturlpdf.html?v=5hig-YP34-V&t=-7k6igsca7azmsnjxid59q5wex

In summary, soaring copper prices to begin 2023 are very likely signaling something but what that "something" is has yet to be determined. However, rest assured we'll be watching copper prices very closely in the weeks and months to come and any breakout to the upside may be the final warning sign that epochal changes are underway.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.