Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

It's only late March and yet this is already the third time this year I've felt compelled to write about copper. Why? Because as physical copper supplies begin to dwindle, there will very likely be a secondary impact in other metals like silver.

I guess we should start with links to the other posts on copper from January and February:

- https://www.sprottmoney.com/blog/Watching-Dr-Copper-January-11-2023

- https://www.sprottmoney.com/blog/Keeping-Copper-In-Focus-February-07-2023

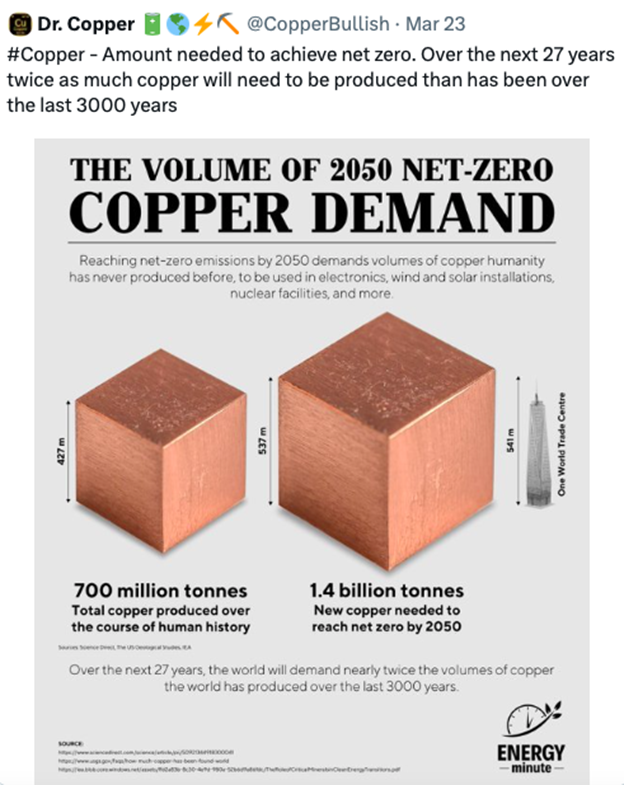

The keys to this story are the supply/demand fundamentals. Copper is a very important industrial metal and conductor of electricity. As such, demand for it going forward this decade is expected to surge. Chew on this infographic for a moment:

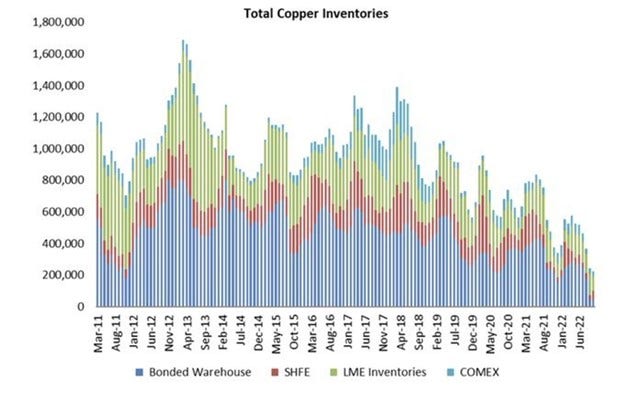

Further spicing the situation is growing demand for immediately-available copper. The chart below shows that above-ground and readily available stockpiles of physical copper have been falling for the past decade.

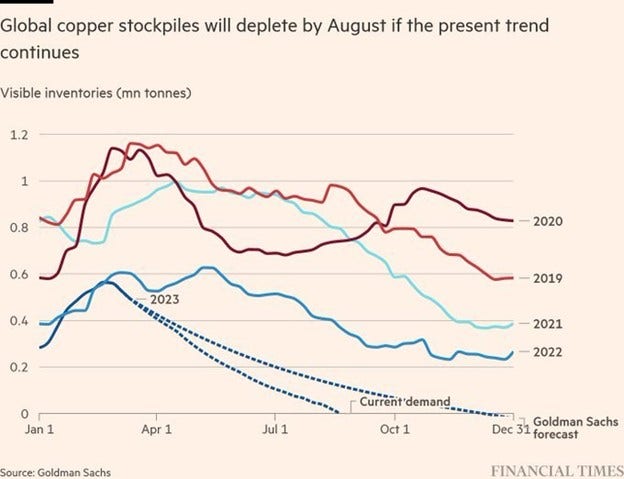

The situation has now worsened to the point where Goldman Sachs is projecting that ALL of the available above-ground global stockpiles may be depleted as soon as this August.

And now here's where it gets interesting. Awareness of this issue is growing, and the coverage of it is going "mainstream". For example:

- https://www.mining.com/web/goldman-sachs-expects-commodities-supercycle/

- https://www.forbes.com/sites/markledain/2023/03/26/copper-supply-is-a-serious-problem-and-everyone-involved-in-clean-energy-needs-to-listen

- https://www.mining.com/copper-price-rises-on-lower-supply/

Recently, we've all been reacquainted with the process and panic of a "bank run". These develop when bank customers suddenly fear for their savings (supply of cash) and seek immediate withdrawal (demand for cash) of their funds. The brewing supply/demand dynamic in copper presents a similar situation.

As mainstream awareness of the physical shortages grows, we should expect major industrial users of copper to seek immediate delivery. Why? These companies know they can't continue with product manufacturing without this key component. Therefore, they will seek to secure as much physical copper as they can get their hands on...before it's all gone.

And it's not just manufacturers. Did you see this story from earlier in the year? Trafigura is the largest commodity trading firm in the world. As such, they're on the hook for future delivery of physical metal. Read this link. They are not taking any chances:

This next link, from a few days ago, shows that Trafigura's concerns have not eased:

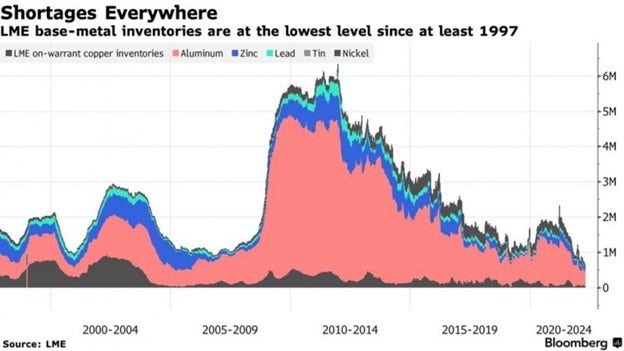

So why does this matter to a precious metals investor? It matters because silver is a close cousin to copper in terms of industrial usage and demand. The prices of copper and silver are often closely correlated on the price charts, and like copper, silver and the other base/industrial metals are seeing similar drawdowns in above-ground supplies.

On the long-term price chart, you can see where copper is very near all-time highs. How far might price run if/when it breaks out into "uncharted territory"?

And finally, let's plot copper and silver together over the same period shown above. You can plainly see the long-term correlation. You might also note that silver currently appears to be undervalued by about half. Which begs the question: what happens to the price of silver if a "run" on copper develops and the copper price breaks to new all-time highs?

(copper in candlesticks, silver as a blue line)

So be sure to keep an eye on the copper price in the weeks and months ahead. You might keep an eye on this space, too, as you can be certain that this third copper post of 2023 won't be the last.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.