Elastic Band in Everything is being Stretched to the Limit

All conditions are in place for a massive move higher in Gold and Silver. (List) But that doesn’t mean the bottom is in place. In order to have a high degree of confidence that the worst is behind us, we need to see a break of resistance, a higher high, and a higher low. I’ll go through the levels I’m watching to break to suggest the rally we have been waiting for is finally underway. But first, given the frustration of the bulls and the drunken stupor of the bears, let me re-iterate the multiple reasons why I believe the risk-reward in Gold and Silver is so heavily skewed to the upside.

Silver Prices

Daily RSI is at its lowest level since July 14, 2022, when it was at 18.23. It was followed by a positively divergent lower low at 17.40 on Sept 1, 2022, just 73 cents lower. This began the rally to 26.23, a gain of 50% is less than a year. The risk at 18.23 was 73 cents, or 4% lower, compared to a gain of 50% to follow. This is the definition of risk relative to reward at extreme lows and highs.

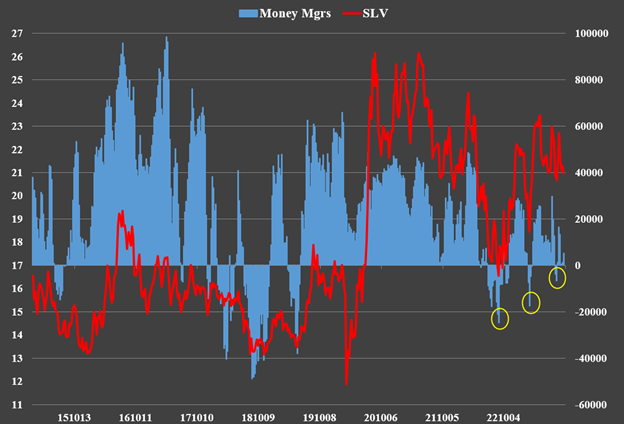

Sentiment in Silver has seldom been more bearish. It’s even worse than when it bottomed in September 2022. Silver is more bearish than when it hit $11 in March 2020. Although this does not signal the bottom is in, it tells us that it is not far away.

From a positioning perspective, the Hedge Funds were barely long on Sept 26th, ahead of this dump in Silver. They’re almost certainly short at this point, and the Banks are long. Like sentiment, this is bullish, too.

The DXY is making new negatively divergent higher highs on the daily chart. The daily RSI is already falling from its highest level since the peak at 114.75. The same goes for extreme bullish sentiment. The Hedge Funds are loading up long on the dollar. All of which is bearish for DXY but bullish for the metals and miners.

The weekly RSI in the DXY is at 67. A reading of 70 would likely signal the peak.

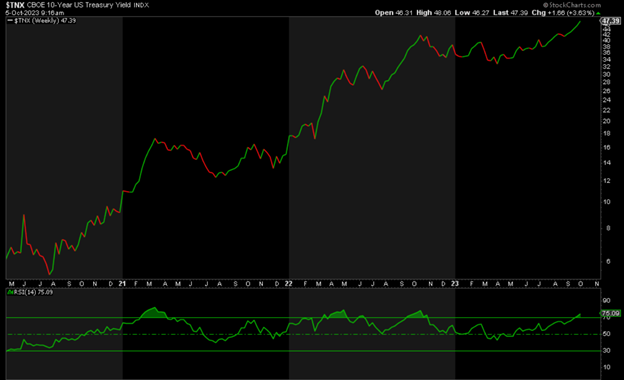

Meanwhile, the 10-Year Yield is also making negatively divergent higher highs in its weekly chart across all indicators. It is also extremely overbought at 75, from a yield perspective.

From a price perspective, sentiment in bonds has seldom been lower in the past 10 years. Hedge Funds are near record short bonds, expecting higher yields, and the banks are almost equally long, expecting lower yields. This is bullish for bond prices going forward, meaning lower yields. When yields peak and fall, so goes the dollar, and up go the metals and miners.

While the data is heavily weighted to the downside in bond yields and the DXY, this does mean the top is in yet. The same goes for Gold and Silver in the opposite direction. In order to have a high degree of confidence that the bottom is in for the metals, we need to see a break of resistance followed by a higher low and a higher high.

The projection below is for illustration purposes only:

The first resistance to break is 22.14, the prior low. Then, we need a higher low, followed by a higher high. A break of resistance at 24 would likely seal the deal that the low is in. Once we’re above the high of 26.43, 30 plus is next, IMHO.

In the meantime, Silver can still go lower. But a risk of another $2 or so compared to $10-40 higher is a no-brainer for me.

As for Gold Prices

Given how extremely oversold Gold has become, I’m expecting a bounce and a positively divergent lower low prior to take-off. Support is around 1815-1820. The first key resistance to break on the upside in 1910-1915, followed by a higher low, then a higher high. The next resistance is 2000-2010. Finally, once we take out the record high, 2400-2500 is next, in my opinion, on the way to 3000. However, if and when I see that positively divergent lower low, I’ll be buying with a stop below the low.

Our Final Thoughts on Precious Metals Prices

In conclusion, everything is lining up for a massive rally in both the metals and miners, but we’re still waiting for confirmation that the low is in. But what we do know is that the risk on the downside is becoming more minuscule relative to the upside to come. So, while the Bears gorge on the few scraps left, I’m content sitting and waiting for the breakout to the upside, which, given the extent of the correction and its duration, promises to be spectacular.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.