Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Powell announced a 25bp hike today and that QT would continue to reduce the balance sheet on autopilot. Powell also said that there was only one more rate hike of 25bp and then they’re likely done. His key comment was on the effect of recent liquidity issues in the banking sector. He stated that this would likely mean tighter credit standards, or fewer loans, which could curtail demand and help bring down inflation. All-in-all, it was a dovish message. My takeaway was this was as close as Powell could come to “pause” in interest rate hikes. In essence, he suggested as much by signaling the end of the Fed’s tightening policy at the next FOMC on May 3. There is nothing to suggest that inflation is heading much higher between now and then. While the DXY could go higher in the very short term and Gold and Silver lower, the writing is on the wall for higher everything but the dollar and bond yields in the coming weeks and months.

GOLD

Gold is coming off extremely overbought levels on both the RSI and the MACD H. It’s also extremely bullish, a contrarian indicator. While the Fed laid out the red carpet for Gold to head higher, I believe we have one more drop to $1,900 before taking off to new record highs.

The only caveat is a bigger fall to $1,800 and the 200-day moving average before launch. This is a very low probability unless $1,880 is broken to the downside.

Either way, it’s just different routes, same destination, UP!

The weekly chart also supports a decent pullback given the multiple negative divergences across all indicators.

If and when that pullback plays out, I’ll be buying the dip. If fundamentals trump technicals and sentiment, then I’ll buy on a break of $2,015, Monday’s peak.

SILVER

While Silver is not as overbought as Gold, the MACD Histogram in blue signals at least a short-term pullback is coming, but the RSI suggests it could go a little higher first.

Silver needs to close above $24.37 to confirm it's on its way to $30.

GDX

GDX will follow Gold. Either we get a pullback to $1,900 or $1,800 in Gold, which means we fall to $28 or a lower low in GDX. A close above $31.11 would confirm the move up towards $40+ has begun.

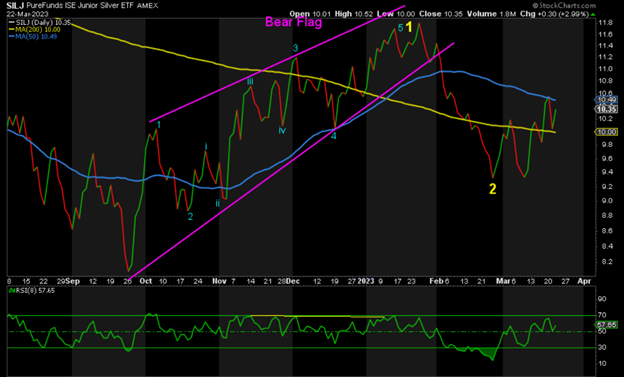

SILJ

SILJ, like Silver, just needs one more drop before taking off imho. SILI could drop to as little as $10 or down to prior support at $9.33. A break of $10.70 and we’re off to a minimum of $20 next imho.

The Fed opened the door for higher metals and miners, but the technicals and sentiment suggest one more dip. The DXY and bond yields will likely be the deciding factors.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.