Over the past few years, the once-impeccable credit rating of U.S. sovereign debt has been downgraded by several prominent ratings agencies. Only Moody's stood firm against economic reality and maintained their U.S. credit rating at AAA. However, as of late last week, even this firm has been forced to succumb to the reality of life at the end of The Great Keynesian Experiment.

We must first acknowledge what a long, slow, and arduous process this is. The ratings agency Standard and Poor's (S&P) first downgraded U.S. debt all the way back in 2011. That seems like an eternity ago! At the time, it seemed like the other ratings agencies would quickly fall in line and follow S&P's lead. Nope. It took twelve years for Fitch to make a similar move. Twelve years! Now finally the third agency, called Moody's, made a move last Friday. They didn't cut their U.S. rating just yet. Instead, they simply placed the U.S. on watch for a possible downgrade. Seriously. You can't make this up. Twelve years after S&P cut the U.S. to AA+, Moody's is just now getting around to considering a possible ratings cut in the future.

First of All, What Does this Mean?

In the short term, not much. Maybe long-term interest rates will be forced to rise a little as U.S. debt is suddenly perceived to be "riskier". But that's a stretch. More important is the simple recognition of what we've preached at TF Metals Report since 2010. Namely, that the end of this current debt-based monetary system is a mathematical certainty. It's not a function of IF it will collapse under its own weight. It's a function of WHEN.

So, how close is that "when"? That's hard to say, simply due to the exponential rate of demise. Think of Hemingway's description of bankruptcy. Or maybe consider Mr. Creosote in the opening scene of Monty Python's “The Meaning of Life”. Just one more wafer-thin mint...

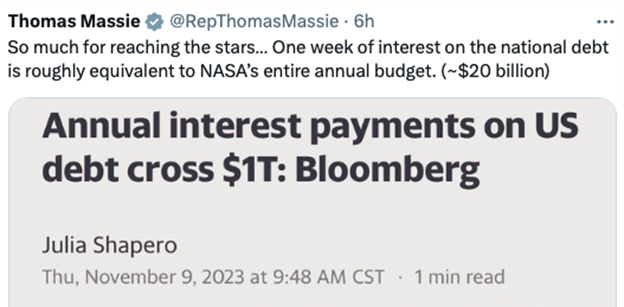

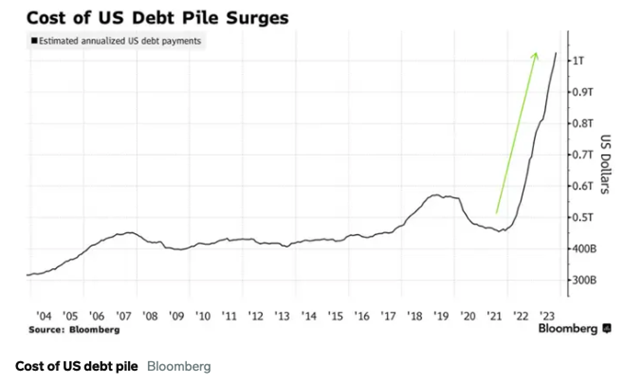

The current interest cost of servicing the accumulated U.S. government debt just reached $1T/year. Think about that for a minute. Just to pay interest on the national debt, it now costs the U.S. over $1T annually. Per taxpayer, that's about $6,000. Or think of it another way. The total interest cost is about $20B/week, and $20B is about the size of the annual budget of NASA.

With persistent inflation, trillion-dollar annual budget deficits, and higher interest rates, it's not as if the annual cost of servicing the accumulated debt is going to fall anytime soon. In fact, it's difficult to see any reversal of this trend:

In order to manage the situation and stave off collapse for as long as possible, the U.S. Federal Reserve will eventually install a plan of Yield Curve Control, similar to what was tried in Japan over the past decade. By holding long rates at a fixed level, the exponential growth in U.S. debt service cost will slow to a more linear progression, but it won't reverse the overall trend. There is precedent for this policy, as the Fed has tried this before, utilizing Yield Curve Control to manage and "pay down" the exorbitant levels of debt accrued during World War Two.

What To Expect for Price of Gold?

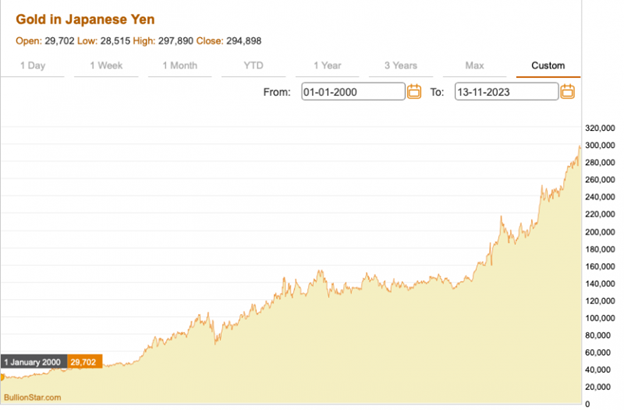

Again, though, Yield Curve Control will only slow the rate of growth in interest costs. The policy will not reverse and lower the costs. Why? Because the total pile of accumulated debt will continue to grow over time. Even the supposedly "non-partisan" Congressional Budget Office now projects the total U.S. debt to reach as high as $50T by the year 2033. It's easy to project how all of this will lead to a higher gold price in U.S. dollar terms. Over time, does the gold price finally move above $2000 and stay there? How about $3000? Is that level possible? To answer these questions, maybe we should refer to Japan and its now-failed effort at Yield Curve Control. The chart below is the price of gold in Japanese yen. Note that since the year 2000, the price has moved up tenfold and has more than doubled in just the past three years. As the U.S. continues along its path to fiscal disaster, this is the future for gold in U.S. dollar terms too.

Embracing Gold Amid Economic Uncertainty

The true lesson for today, though, is in that chart above. Japanese investors who recognized early on where their government's fiscal and monetary policy was leading them have been spared disaster by converting yen to physical gold. In the U.S. (and in Canada), now is the time to act in the same way. Acquire physical gold and hold it instead of fiat currency.

Gold has proven time and again to be your only protection against monetary madness, and it will do so again as we move toward the end of The Great Keynesian Experiment.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.