The past three weeks have brought a decent rally in the COMEX gold price as fading rate hike expectations and geopolitical concerns have driven a consistent bid for both physical metal and the digital derivative. Lately, though, the usual suspects have been hard at work, capping price near $2000/ounce and driving it backward.

We'll show you this on the charts later in this post. For now, though, let's begin with a look at the latest Commitment of Traders (CoT) reports. What do they reveal about how The Banks have responded to this latest run up in price?

Gold Prices Today

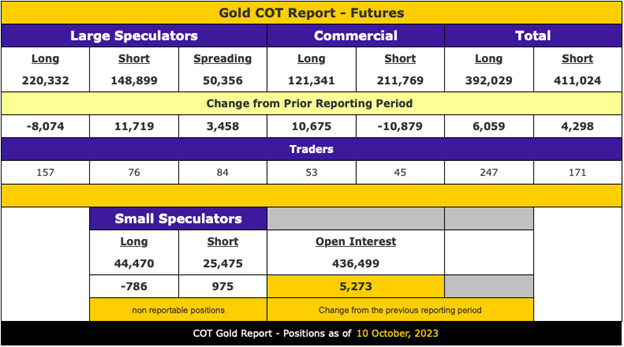

As you may know, the CoT surveys are made at the COMEX close each Tuesday and then reported 74 hours later, on Friday afternoon. The most basic and oldest format is called the "legacy report," and that is what is shown below. This is taken from the survey of October 10. On that day, the front month Dec23 COMEX gold contract closed at $1875.

The "Large Speculator" category mainly consists of hedge and commodity trading funds. As of Tuesday, October 10, this category was NET LONG 71,433 contracts. As an aside, this was the smallest NET LONG position held by The Large Speculators since early November of 2022 and early December of 2018. Both occurrences were followed by strong rallies.

On the other hand, the "Commercial" category of producer/hedgers and bullion bank trading desks held a NET SHORT position of 90,428 contracts. This, too, was the smallest NET SHORT position by this category since early November of 2022.

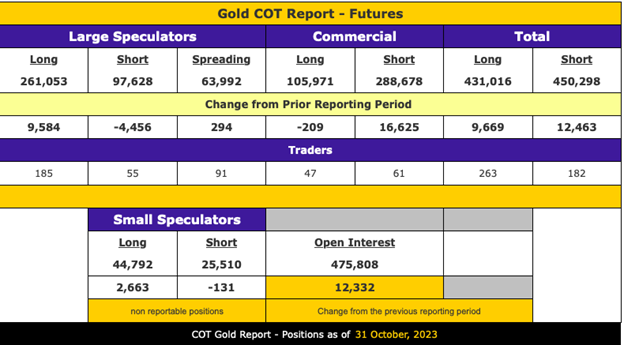

Over the next three weeks, the COMEX gold price consistently rallied, and by the CoT survey of last Tuesday, October 31, price stood at $1994 for a gain of 6.35%. Not too shabby. However, the gains would have been substantially greater had the bullion bank trading desks not actively moved to contain price by matching nearly every new Speculator long with one of their new shorts. Examine the October 31 CoT data below:

What do we see? Note the total position changes in just the past three weeks. The Large Speculators have more than doubled their NET LONG position to 163,426 contracts while the Commercials have doubled their NET SHORT position to 182,207 contracts.

And you can see this on the price chart below. After rallying through the period of October 10 through October 20, price has since stalled at/near $2000.

Now look even closer...

Over the past ten trading days and while price has stalled, note the consistent downward bias during COMEX trading hours. The chart below is of 30-minute candlesticks, and the arrows denote the 7:00 a.m. CT candle of each day. (COMEX gold trading opens each day at 8:20 a.m. ET or 7:20 a.m. CT.)

That chart doesn't quite give you the full picture, however, so let’s zoom in a little closer. Below are just the past six trading days, beginning with Monday, October 30. The blue arrows overlay the Asia and London physical trading periods. The red arrows overlay the New York futures trading periods. As is clearly shown, the world buys physical and price rises. The bullion banks then sell paper on COMEX and price falls.

What does all this mean to you, the precious metal investor and stacker?

Once again, The Banks are playing their games. Their plan is to wait out The Specs by absorbing all of the Spec bids. Once momentum fades or if/when the geopolitical situation cools, The Banks will look to tip over the price and force a mass Spec liquidation. This eventual Spec selling will allow The Banks to buy back and cover their shorts. Price will reset lower, the CoT will rebalance, and the stage will be set for the next round of gaming.

Of course, the opposite could happen too. Perhaps events in the Middle East will spin out of control and a new wave of Speculator buying might enter COMEX gold. If that's the case, price will rally…but again only to be met with even further Bank selling and shorting.

Conclusion on the Price of Gold

The primary point of today's post is to alert you to the fact that NOTHING HAS YET TO CHANGE IN THE COMEX GOLD MARKET. The bullion banks manage and manipulate price via their monopolistic market-making role and, as such, mitigate sharp rallies. They're content to see the gold price annualize at +10% over the past twenty years, but anything beyond that is contained and driven backward.

As such, no one should ever chase price to the upside in acquiring physical gold. A better strategy is to wait for the inevitable pullback that always seems to follow any substantial price rally.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.