As 2023 ends, let's take a quick stroll down memory lane to see if there are any clues as to where gold and silver prices are headed in the new year.

Sometime early next month, I'll compose and post my forecast for 2024. I've been publishing these annual forecasts for the past seven or eight years, and I do so for two primary reasons:

- to hold myself accountable for mistakes, errors, and misjudgments;

- to have a permanent record of what I was thinking as the previous year began.

If you'd like to go back and review this year's "macrocast", here's the link. Maybe you'll find it to be of interest?

There are a couple of things I got wrong. For example, the yield on the U.S. 10-year note really did get to 5% and copper prices never soared, as physical copper stockpiles remain robust. However, what about the economy, Fed policy, and the precious metals? Did I get those wrong, too, or was I just early?

I'm thinking it's the latter—I was simply early. Last January, I thought the U.S. economy would be showing signs of slowdown by June or July and that the Fed would respond by "pausing" their rate hike scheme and then "pivoting" toward rate cuts. I expected this to prompt gold prices to surge, and my guess was that the COMEX gold price would tap $2300 sometime before year end.

As I wrote this on December 18, we can recall gold prices briefly exceeding $2100 two weeks ago, but it certainly appears that we're not making $2300 "sometime before 2023 draws to a close". So, what happened? Was I wrong or just early?

The Fed's Impact on Gold Prices

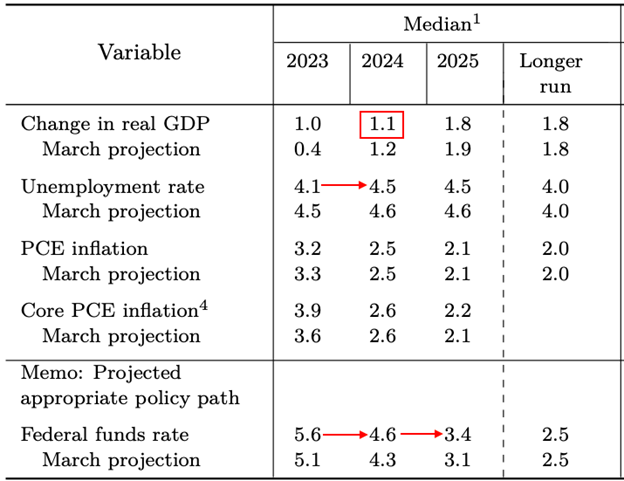

Back in June, it appeared that we were right on track. The bank liquidity issues of March and April had spooked the markets, and it appeared that the U.S. economy was slowing right on schedule. At the June FOMC meeting, the seventeen FOMC members submitted their guesses to an updated Summary of Economic Projections (SEP), and what did it show? The expectation was for FOUR rate cuts in 2024 and FIVE rate cuts in 2025.

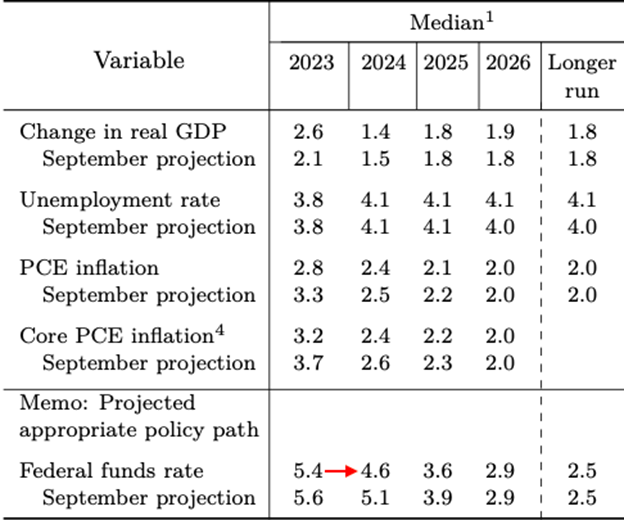

But then the economic data seemed to improve, and all the rate cut expectations were put on hold. The FOMC met again in September, and at the conclusion of that meeting, the updated SEP projected just TWO rate cuts in 2024 followed by FIVE in 2025. Suddenly, "higher for longer" was all the rage and precious metal prices sank to multi-month lows.

In the time since, the data has begun to weaken again as the lagging effects of the record pace of rate hikes begin to be revealed. The U.S. economy is slowing and unemployment is creeping higher, all while CPI inflation is coming down. As such, at the just-completed December FOMC meeting, the group again revised their SEP to THREE rate cuts in 2024 and FOUR rate cuts in 2025. See below:

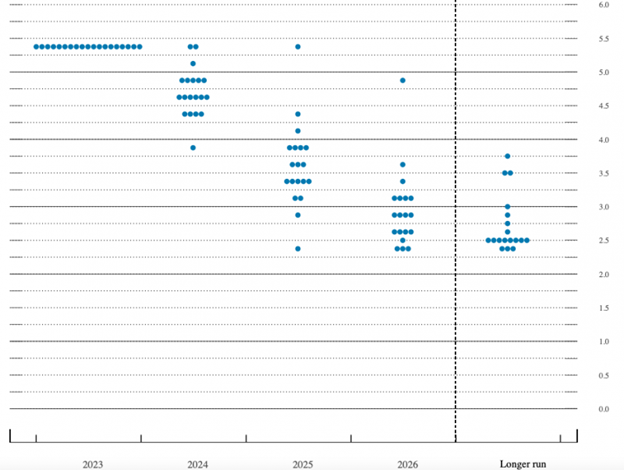

And take a look at what's called the "dot plot". Each dot on the table below represents a guess from one of the 17 governors on the FOMC. As you can see, there are still two governors who see ZERO rate cuts in 2024. However, this is countered by ELEVEN governors who project at least THREE. Further, look at where the majority see rates in 2025:

So, at this point, it's safe to assume that the Fed WILL be cutting rates in 2024. It's just a matter of WHEN they start. At present, there seems to be a 50/50 chance that they get started cutting as early as March. We'll see about that. Again, though, the Fed itself is telling you that it expects to be cutting rates in 2024.

This draws us back to the question posed earlier in this post. Was I wrong about the gold price reaching $2300 in 2023? Yes, I was. However, was I just early? I think that's the case, too. As the Fed begins cutting rates in 2024, the gold price will break out and move toward $2300, likely by the middle of the year. That comes about six months too late to save my 2023 forecast, but as it's often said, I'd rather be early than late.

More on this in the new year, and the next "macrocast" will be ready by early January. In the meantime, thanks for reading these columns in 2023. I hope you found them to be helpful and insightful as we navigated a very difficult and challenging year.

Happy holidays, and we'll see you in 2024!

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.