Are Tariffs Causing a Gold Shortage?

Over the past few weeks, much has been said and written about how the current threat of tariffs from the U.S. could lead to shortages of deliverable gold and silver on COMEX. But are tariffs and the threat of tariffs the real explanation for the unusual things we're seeing in the precious metals markets?

Why Is There a Spread Between Spot and Futures Prices?

What are those "unusual things" we’re seeing? A current and widening spread between the spot and futures prices. Under "normal" conditions, that spread in gold might be just a few dollars, but recently it has been as high as $40 or more. What's the deal?

Let's start by revisiting the last time something like this happened. By early 2020, The Bullion Banks had gotten complacent with regular and daily gaming of the EFP (Exchange For Physical) component of the gold pricing system. Typical daily EFP volumes of 3,000 trades per day were replaced with totals sometimes exceeding 30,000. Here's an article from 2018, when we first noticed the surge in these Exchange For Physical trades.

Historical Parallels: Lessons from the 2020 Gold Crisis

Again, EFP trading peaked with a daily high of 38,469 on March 12, 2020. What happened after that? Covid fears swept the planet and quarantines and lockdowns soon followed. All of the gold that had been pledged for future delivery was suddenly and urgently needed in New York, yet with no planes in the air, there was no way to get it there. The price spread between spot and futures exploded to over $100, and the COMEX seemed to be teetering on the edge of collapse.

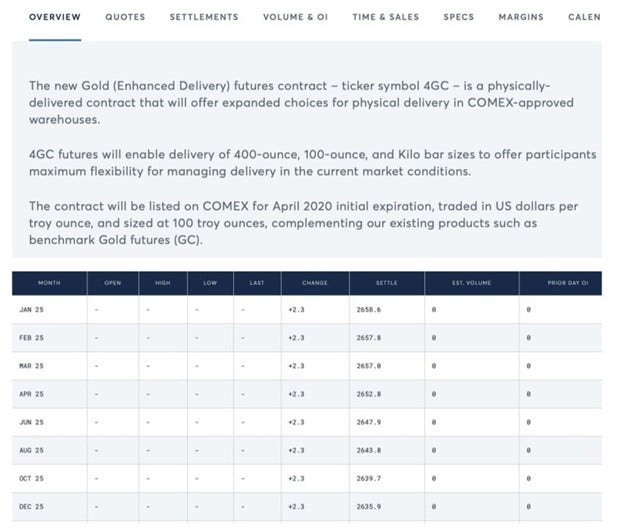

To assuage delivery fears, the CME worked a deal with the LBMA and opened a new contract that was deliverable in fractional ownership of London bars. This seemed a specious idea at the time, and the contract was never utilized, with its open interest barely moving off of zero. Here's another link from the Wayback Machine, and if you read it, you'll certainly find some parallels to our current time.

Gold Market Manipulation and COMEX Delivery Demands

The situation in 2020 eventually calmed after massive and record COMEX delivery totals in April, June, and August met the metal demand. The logistical problems were addressed and confidence was restored in the just-in-time delivery system within the fractional reserve pricing scheme. Until now.

Beginning in December of 2024, the spread between spot gold and futures began to widen. The spread between spot silver and futures began to widen too. However, after a mid-December futures price smash following a hawkish FOMC meeting, the spreads disappeared and all appeared normal again...until January. Now spreads have widened again, and it's getting a lot of attention in the global gold community.

So, what's going on? Why is there such a stark spread between the spot price of gold ($2822 as I type) and the front month Apr25 futures contract ($2862 as I type)? This spread should be closed by a simple arbitrage of buying gold and spot and selling the futures contract against your purchase. Think of it this way: Buy at $2822 and sell at $2862. Take delivery of your order and deliver it against your short. Execute this trade in large enough size and the spread closes—plus you make A LOT of easy-peasy cash.

But the spread remains, which means that no one is making this simple, supposedly riskless trade. Why? That's the question.

Is the NY/London Gold Pool Collapsing?

The obvious answer is that the trade is NOT riskless. If you buy at spot and sell the future, you are essentially promising to deliver your gold in April. This is no problem if you have full confidence that you'll have your gold delivered to you before April. This is a major problem if your gold is not delivered to you by April—and that's where we stand now. See this article from last week that was printed in the veritable Financial Times of London.

The mainstream explanation for the delivery delays (and, by extension, the spread premiums) is that the threat of U.S. tariffs is leading to a mass exodus of gold from London, leaving the vaults there close to empty. But is the explanation really that simple?

Fractional London Bar Contract: A Useless Relic?

If it were, perhaps that "Fractional London Bar" contract from 2020 would suddenly be of use. However, as you can see below, there remains ZERO open interest in the contract, which seems odd given that the contract stipulates that you could "take delivery" in London. That would seem to allay the supposed "logistical concerns."

Gold Demand Surging: Breaking the NY/London Gold Pool

So, what's really going on here? Frankly, I think they're out of gold. Don't get me wrong, there's still gold in the world and some gold is always available for sale at the right price. However, what I think we are now seeing is the breakdown and dissolution of the NY/London Gold Pool. What's that? Some history...

After the Bretton Woods Agreement, the U.S. promised to back its currency with gold, exchangeable at $35/ounce. This worked until the late 1950s when it was discovered that some countries with increasing dollar reserves were exchanging those reserves of the actual gold. By 1958, the total U.S. gold stockpile had fallen from 25,000 metric tonnes to just 16,000 tonnes, and it was scandalous. There were hearings and investigations on Capitol Hill, and much grinding of teeth followed.

What was the proposed solution? The London Gold Pool. Through this agreement, the U.S. was no longer going it alone in defending the $35/ounce price. Instead, seven other countries pledged some of their own physical gold and, along with the U.S., promised to keep the price peg going. Its workings were simple. If the price moved above $35, The Gold Pool would sell enough gold to drive price back down. When price fell below $35, The Gold Pool would buy their gold back.

This scheme persisted for seven years until the buying pressure became untenable. The physical supply provided by The Gold Pool was exhausted, and price broke the peg. A freely trading price, along with a continued drain of the U.S. reserves, prompted U.S. President Nixon to suspend dollar convertibility and "close the gold window" on August 15, 1971.

The NY/London Gold Pool came into existence in 1975 with the creation of gold futures in New York. This alchemized form of "gold with instant liquidity" was deliberately created to leverage the existing supply of gold and drive the idea that gold was plentiful. See this excerpt from a December 10, 1974 memo from the U.K. Treasury Department to the U.S. Department of Treasury:

Fifty years later, this Fractional Reserve and Digital Derivative pricing scheme is seemingly on its last legs. Three years of record central bank gold demand has emptied the London Vaults, and now the only metal available for delivery comes with a 4–8-week queue. Not that you weren't warned about this eventuality. Analysts, myself included, have warned about the drain of the London vaults for years. In fact, here's Bloomberg commodity analyst Ken Hoffman warning about "the empty London gold vaults" a full ten years ago!

The problem of the empty vaults first showed up in early 2020, and the Covid "logistical crisis" was used as cover. Now here we are in 2025 and the same "logistical crisis" theory, caused by tariffs, is being put forth as an explanation. But I'm not buying it, and I think we're being gaslit.

Instead, just as in 1968, the rush to exchange dollars for gold is breaking the pricing scheme. Demand for physical gold outstripped the eight countries of The London Gold Pool, and demand for physical gold is breaking the NY/London Gold Pool today. What you are seeing in widening spreads and record COMEX delivery demands are simultaneously the death throes of the current system and birth pangs of the new one.

Why You Should Own Physical Gold Now

What should you do in response to all of this? Well, quite obviously, you should definitely get your hands on some physical gold while you can. The breaking of the London Gold Pool saw the gold price rise from $35 to $800 over the course of the decade that followed. What price follows the breakup of the current NY/London Gold Pool is unknowable. However, it's unlikely to be $2820. That much is certain.

Buy gold and buy silver today to safeguard your wealth and hedge against economic uncertainty. Protect your portfolio with precious metals, a time-tested strategy for preserving value during market volatility.

Investing in gold and silver provides financial security and helps diversify your assets in an unpredictable economic climate.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.