Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Another deal to extend the debt limit of the U.S. government appears to have been reached. If that's a surprise to you, then I guess you haven't been paying attention over the years.

The farce of the "debt ceiling" is simple political theater and nothing more. For decades, cynical politicians have used the imagined "catastrophe of default" as a tool to stoke division and score political points, usually just before major elections. Both sides of The Uniparty will ultimately claim victory, allowing their partisans to rejoice while the public at large gets fleeced.

Completing the absurdity is the fact that the U.S. is now back to a "date certain debt ceiling". This means that, going forward, there is no hard dollar debt cap. Instead, the U.S. Congress can now simply borrow and spend until January 1, 2025...with no restrictions! And why do these hypocrites do this? Because if they set the new debt limit at just $1T higher, the politicians will blow through that first $1T like crap through a goose, and then we'll be right back at the "ceiling" by early 2024...and next year is an election year. NO WAY, NO HOW they can allow that! The peasants and sheep might actually notice just how quickly $1T gets flushed down the toilet these days. So, instead, you get this shameful date certain deal. Where are the pitchforks?

Now, of course, it's not a done deal yet as the full House and Senate must vote to approve this scam before it becomes official. Maybe it will get voted down like TARP did the first time back in 2008? We can only hope. However, and as with all previous exercises in this melodrama, some version will pass eventually, and the debt wheels will keep spinning faster and faster and faster.

Your best plan for managing through this madness?

1. Laugh at the inanity of it all

2. Continue to prepare for the inevitable conflagration

The other big stories this week will center around the employment situation in the United States. Over the past two months, there has been a distinct trend to the headlines and price reaction. First up will be the latest JOLTS jobs data that's due on Wednesday at 10 a.m. EDT. The past two months have seen an increase in layoffs with decreasing job openings. Upon the release of the data, COMEX gold prices rallied each time. Here are two links where this was discussed:

However, and unfortunately, in each case the price of COMEX gold was almost completely reversed lower after the release of the latest unemployment report (the BLSBS) a few days later. With that latest U.S payrolls data coming this Friday, you might be wise to temper your enthusiasm for any Wednesday rally until you see the Friday numbers for unemployment and jobs.

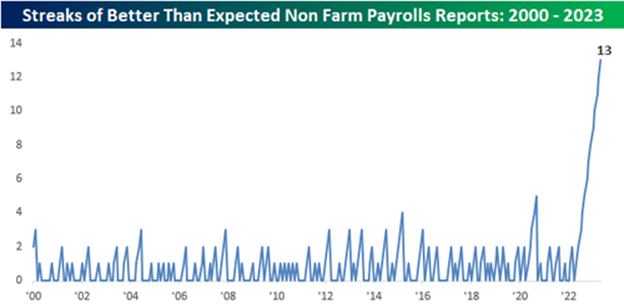

The jobs guess for the month of May typically includes more out-sized seasonal and birth-death adjustments, so do not be surprised if the total "jobs number" that gets gleefully reported on Friday somehow manages to exceed expectations for the record 14th consecutive month.

Once this week is behind us, we can begin to focus upon the next FOMC meeting that is pending for June 13-14. At the conclusion of the last meeting, the probability of another fed funds rate hike stood at 0%. Today it's about 65%. And you wonder why COMEX gold is down $100 over the past four weeks? Once this next meeting is behind us, perhaps we can once again turn our focus to the eventual rate cuts that will spark gold prices to new highs?

In the meantime, best of luck managing your sanity through the volatile week ahead. Let's get it behind us and then begin to prepare for what will be a very interesting back half of 2023.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.