Collapsing U.S. Productivity Changes Everything - Peter Diekmeyer (02/01/2019)

Jan 2, 2019

U.S. private sector productivity rose by 2.3% during Q3, according to the Bureau of Labour Statistics, following a massive hike in deficit spending by the Trump Administration.

These data matter.

If each of us produces more each year, we make ourselves richer … but more importantly, through the progressive income tax system, we also make each other richer.

However, longer term, annual U.S. productivity gains have slipped from an average of 2.3% during the seven decades starting in Q4 1948 to just 1.1% in the decade following the start of the 2007 financial crisis.

Worse, there are growing signs that U.S. labour productivity is not just slowing, it’s in a freefall.

That means, far from making each other richer, Americans are making each other poorer.

Consider:

Why is productivity collapsing?

The idea that American productivity is collapsing seems ludicrous. This, during a time of an increasingly educated population, exploding technology and communications power, as well as the proliferation of AI, mobile devices and robotized manufacturing processes.

However, a range of forces are pushing in the opposite direction:

• The U.S. Federal Reserve’s low interest rate policies have made it more profitable for businesses to buy back stock than reinvest in technology.

• Bail-outs of large U.S. banks, automotive companies and other key sectors have stifled private sector innovation for a generation.

• Increased government borrowing has enabled vast, inefficient bureaucracies at the U.S. federal, state and local levels to avoid reform.

• America’s seniors are draining productive resources from the economy by collecting pensions and healthcare benefits they never fully funded.

Americans producing less with more

The reason that the collapse is not reflected in the official data is in part due to the fact that the BLS measures only private sector hourly productivity.

This does not reflect the growing drag on potential growth stemming from the increasing resources transferred to the more than 100 million working age Americans who are unemployed, out of the labour force or in jail.

Worse, the BLS calculations rely on the flawed GDP totals produced by the Bureau of Economic Analysis.

As John Williams of ShadowStats notes, the results are likely overestimated, because the deflator the BEA uses does not fully account for the loss in purchasing power in the U.S. dollar—the unit of measure used in its calculations.

The chart below (produced by Williams) shows U.S. GDP growth as measured by official sources.

The following chart shows GDP growth as calculated using a GDP deflator, corrected for an approximately two percentage point understatement.

Using this adjusted measure, the U.S. economy is no bigger than it was two decades ago. Yet America’s population has shot up by 15% since then.

This suggests the country’s per capita productivity has fallen by 0.75 percentage points per year on a straight-line basis since then.

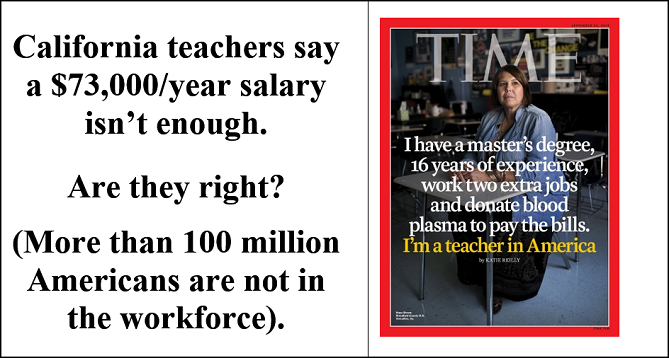

America’s most important work. But are California teachers worth $73,000 a year?

The productivity drain stemming from bloated state, local and federal government spending, which now accounts for more than 60% of U.S. GDP, is particularly troubling.

As Ludwig von Mises pointed out in Socialism: An Economic and Sociological Analysis, public sector planners—even brilliant ones—are simply unable to allocate resources effectively because they lack access to effective price signals.

The inefficiencies are startling.

U.S. governments routinely transfer massive subsidies to the big banks. The Department of Defence can’t account for trillions of dollars of missing funds. Ongoing regressive U.S. Federal Reserve interest rate policies transfer huge wealth to the top 10% of income earners.

Government resource allocation challenges become particularly clear at the micro level.

For example, Time Magazine recently ran an excellent article on how the country’s public-school teachers, like most Americans, have seen the purchasing power of their take-home pay decline.

There is no free market in education. With few effective price signals, California’s central planners are thus unable to determine whether they should raise taxes to increase pay for teachers earning $73,000 a year (plus benefits and a pension plan).

Adding to the complexity is the fact that millions of American college graduates who could teach—at far lower salaries—are underemployed or wasting time doing graduate studies.

A Soviet-style collapse?

America’s freefall in productivity is likely even worse than the estimates provided above.

That’s because—as we have pointed out—BEA data also don’t account for the massive debt and unfunded liability increases needed to juice up existing economic growth.

If those effects—which suggest that U.S. GDP is as much as 30% smaller than experts claim— are included, they could herald a coming slow-motion, Soviet Union-style collapse in the American economy.

Indeed, one of the worst problems in the old Russia-led empire was that sloppy Communist Party data made it impossible to confirm whether problems existed … and if so, where.

America is now facing the exact same challenges.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Comments