Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

At present, the simplest interest rate analysis states that rates are rising as the Fed finally moves to combat inflation. And maybe Occam’s Razor is correct. But what if there’s more here than meets the eye?

So let’s go in a different direction today. Instead of the usual precious metal discussion, let’s instead look over the horizon and consider a few possibilities that aren’t being fully discussed in the mainstream financial media.

First of all, if you’ve not yet listened to this detailed podcast featuring Grant Williams and Luke Gromen, you should do so at your earliest possible convenience. I’ve known both Grant and Luke for years, and both of them always do a wonderful job of relaying complex information in easily understandable terms. To that end, the monetary impacts of the current geopolitical situation are going to be myriad and long lasting, as Grant and Luke explain here: Podcast Link

As they point out, the game changer in all of this was the US/EU decision, made over the weekend of March 5-6, to exclude Russia from the SWIFT system of international payments and subsequently freeze Russia's foreign currency reserves. This use of the financial "nuclear option" made it clear to all those perceived to be friends or foes that the U.S. dollar and treasury bonds were now "weapons" in this—and any future—geopolitical crisis.

Now let's check a chart of the yield on the benchmark U.S. 10-year treasury note in the time since. Heading into the first weekend of March, the yield had been falling slightly. In the days since, a steady selloff in bonds has driven the rate up by 63 basis points or a full 36%, from 1.74% to the current 2.37%.

So what's going on here? Is this simply inflation pressure and the impact of the Fed finally ending its 2020 QE program? Maybe. That's certainly what the mainstream financial media is telling you.

But what if that chart above also reveals a steady selling pressure from sovereign holders of U.S. treasuries now that the U.S. has openly displayed a willingness to use its reserve currency status as a weapon? Put it this way...If you're China or some other country whose long-term interests may not entirely align with what the U.S. likes and wants, would you be willing to continue with the current status quo of holding dollars and treasuries in your foreign currency reserves?

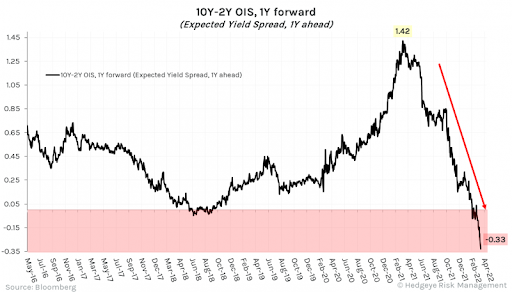

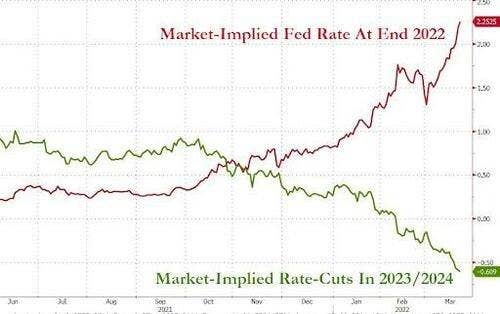

Currently, almost every sell side analyst and economist expects the Fed's rate hikes to become a "policy error" that eventually inverts the yield curve and leads to recession. Into this recession and drain of liquidity, the Fed will be forced to reverse policy and cut rates by 2023. You can see this in the two charts below. The first shows the current expectation of an inverted curve and negative spread of 33 basis points between the U.S. 2-year and 10-year by this time next March. The second chart shows the difference between this year’s rate hike expectations and next year's rate cut expectations.

OK, that's all well and good. But that sort of static analysis doesn't consider the game theory possibilities of the current geopolitical situation. So let's consider a different possibility today.

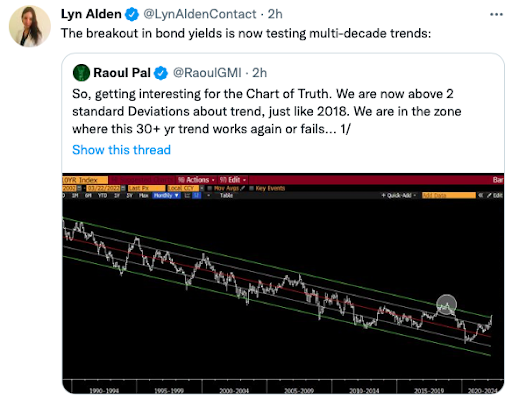

What if, instead, long rates do not stop rising as the U.S. economy slows? What if sovereign selling pressure in the bond market continues and increases in the months ahead. Longer treasury rates are getting very close to a breakout point. What kind of accelerated selling might materialize if the trend shown below is decisively broken?

As detailed above, the expectation is for long-term rates to reverse and head lower, leading to an inversion of the yield curve. Again, though, what if they don't? What if the current selling pressure in treasuries continues and the yield on the 10-year note rises through 3.00% and then moves to 4.00% and beyond? If you don't think this is possible, then you need to stop reading right now and listen to that Williams-Gromen podcast before you continue.

If we are in the early stages of a new multi-polar monetary system, the imposition of a "Powell Put" for the bond market will have to be much sooner and much greater than anyone in the financial punditry world is currently considering. As total U.S. debt continues to soar—with new issuance and refunding in the trillions—lower rates and sovereign buyers are a necessity. What if, in this brave new world, Powell's Fed ultimately becomes the U.S. treasury buyer of last resort?

In this very-likely scenario, the U.S. government and Federal Reserve would be forced to fully embrace the ideas of Modern Monetary Theory (if they haven't already). Fiat cash creation would increase exponentially, and the end of this great Keynesian experiment would rapidly draw near. It's very difficult to envision any other possible outcome.

So, as we wrap up, what does this mean for you, the precious metals investor? It means your physical metal is about to get even more valuable. Unless you're looking for a dip to buy, the day-to-day price changes actually become somewhat meaningless. All that really matters is that you've got your metals and no one can take them from you.

As we wrote in our annual macrocast, the only thing predictable about 2022 was that it was going to be "wildly unpredictable and volatile". Well, here we are. Your best plan is to continue to monitor the situation, think for yourself, and prepare accordingly.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.