Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Back in July 2020, I appeared on a podcast with Tom at Palisades Radio, where I forecast the peak in Gold and Silver in August. The Fed had already cut QE by 88% and fiscal stimulus was set to follow with government handouts due to expire on August 1st. Gold and Silver peaked days later, and we have been sideways or lower ever since.

I am sharing this because I believe the opposite is about to occur, courtesy of the Fed, much like in March 2020. I’m expecting another Fed 180, similar to Powell’s about-turn in December 2018, to stimulus on steroids by September or October this year or sooner, which will trigger a rally to new record highs in Gold, Silver to around $40, and GDX to circa $60. The alternative for the Fed is systemic collapse and the beginning of the Greatest Depression. While I believe that’s inevitable, history suggests the Fed will ride to the rescue and we get one more final melt-up in everything but the dollar.

Given the massive deficits and debt, a recessionary economy, rising unemployment, falling tax receipts, and soaring expenditures, the U.S. has only two choices: outright default on the debt or inflate it away by devaluing the dollar. Throughout history, politicians have always chosen the latter, printing and devaluing the currency. I don’t expect this time to be any different.

In fact, I expect the Fed to print trillions more than they did after the repo crisis in March 2020. When that happens—or before—metals and miners will go ballistic!

Speaking of “when”, my best guess remains the September to October timeframe at the latest, when stocks are typically at their most vulnerable to a sharp drop. The signals I’m watching for the next Fed 180 are as follows:

- Inflation falling year-over-year (check)

- Rising joblessness and unemployment (check)

- Weak, even recessionary economic data (check)

- A panic dump in stocks, 1987-style (Q2)

- A dump in housing prices, soaring foreclosures (pending)

- Blowout in credit spreads, cost of borrowing (check)

- Some event as an excuse to reverse policy, e.g., lockdowns, global cyberattack, Chinese invasion of Taiwan

While I don’t expect all of these to play out, you can see that many of them are already under way or pending. The geopolitical events are impossible to time.

That’s the big picture, and at current levels, if you don’t own “some” physical metals, now is a good time to buy given where Gold & especially Silver are heading, even if we see lower lows first. The risk-reward is heavily skewed to the upside. We’re far closer to the bottom than the next peak.

In the short-term, we have either bottomed out in both the metals and miners or we have one more positively divergent lower low to come. Another sharp drop in stocks could drag metals and miners lower temporarily prior to launch.

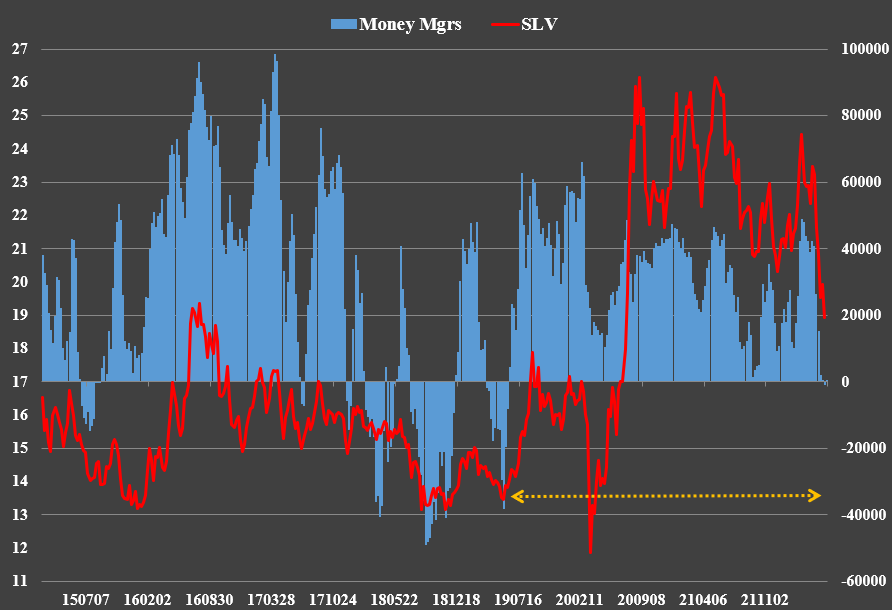

However, the COT data is extremely bullish. Positioning of the Funds and Banks is back to levels consistent with the low of 1675 in Gold, yet we’re in the mid 1800s. In Silver, the Funds are actually short and the Banks are now long. The last time the Funds were short was in June 2019 when Silver had a $14 handle.

What we need from a technical perspective is a change in trend to the upside, which means a higher high followed by a higher low and a close above 1911 in Gold, 23.50 in Silver, 34 in GDX.

Sentiment remains buoyant, more so in Gold than Silver, which suggests that lower lows are still a risk prior to takeoff.

For greater confidence that the lows are in place and we’re heading up to new highs, just wait for a change in tone from the Fed. A more dovish tone would signal a change in policy is coming, much like Powell’s comments in Q4 2018 before a complete 180 in monetary policy:

“The really extremely accommodative low-interest rates that we needed when the economy was quite weak, we don’t need those anymore. They’re not appropriate anymore. Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral. We may go past neutral, but we’re a long way from neutral at this point, probably.” – Jerome Powell, October 3rd, 2018

“Where we are right now is the lower end of neutral. There are implications for that. Monetary policymaking is a forward-looking exercise, and I’m just going to stick with that. There’s real uncertainty about the pace and the destination of further rate increases, and we’re going to be letting incoming data inform our thinking about the appropriate path.” – Jerome Powell, December 18th, 2018

Within months, the Fed Funds rate was back to zero.

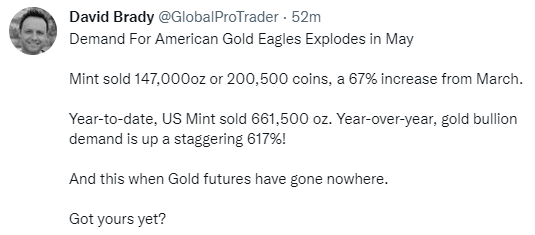

The only problem with this strategy is that Gold & Silver may be unobtainable at that point. They have been vacuumed away by the smart money. If you doubt this possibility, it is what happened post March 2020 and the shutdown of mines and refineries worldwide. Then there’s this information released today:

Demand for physical metals is clearly robust already. Premiums remain extremely high. One can only imagine what happens when the Fed pivots again.

In summary, the risk of the lower lows remains in place, but the signals are lining up for a spectacular rally in metals and miners beginning in September or October or sooner, imho. You won’t want to miss that!

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.