Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

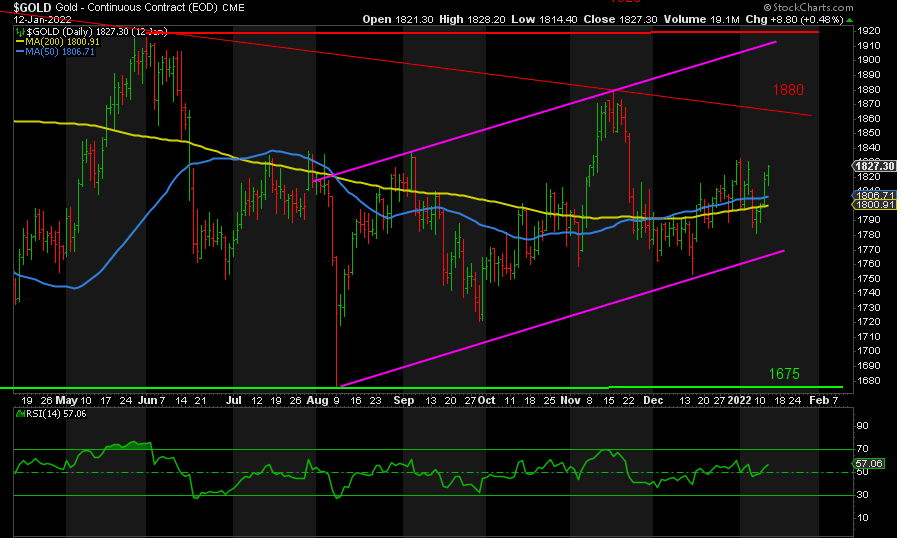

GOLD

Gold is trying for a higher high above 1833. But even if we get there, we still need to take out resistance between 1860-80. Support is at 1780 and below there 1760. Essentially, Gold continues to trade around the moving averages.

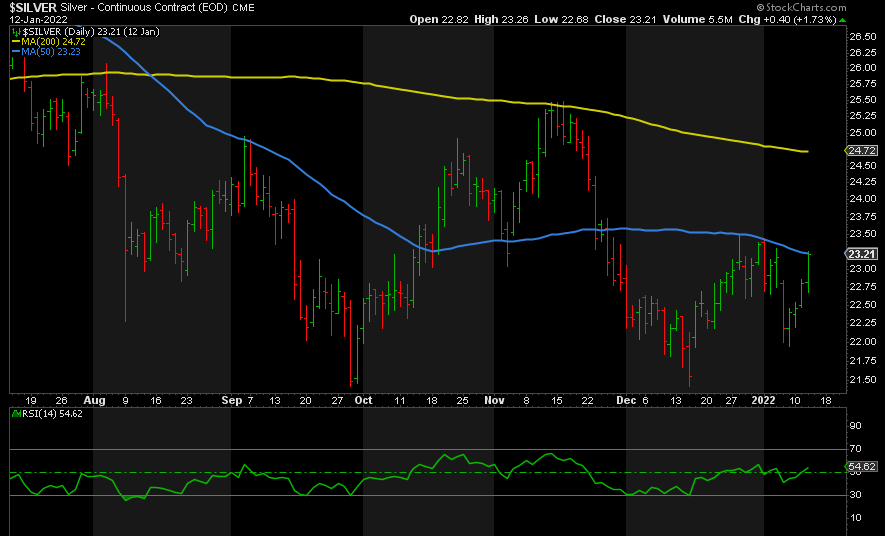

SILVER

Seeing more-or-less the same thing in Silver with the 50-day moving average continuing to cap any move up. Above there, the 200-day moving average awaits. Support is at ~22.

No need to go through GDX and SILJ; they’re in the same boat too. Today I prefer to look at what the bigger markets are signaling.

Looking to invest in silver? Check out our collection of silver bars and coins here.

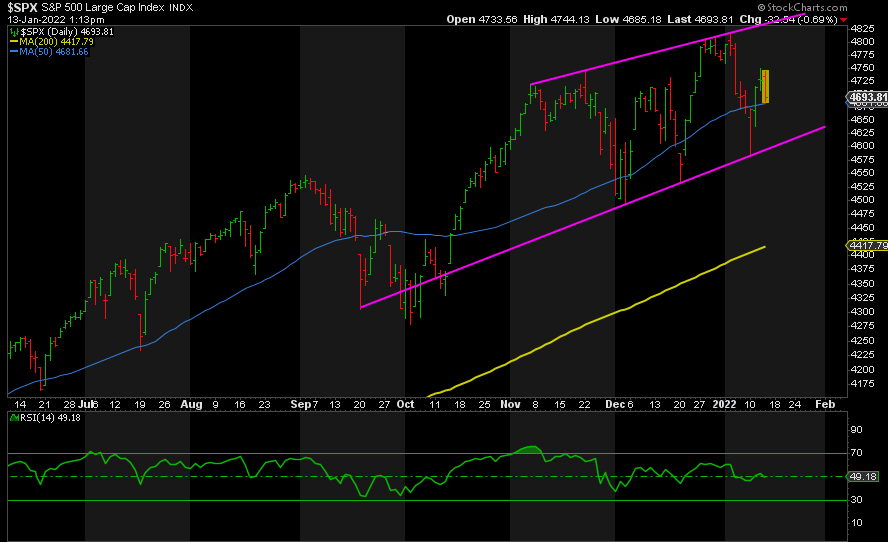

S&P

The S&P remains in a big bear flag pattern that allows for either another negatively higher high before lower again or a move straight down on a break of 4580. I’m still looking for a drop to the 200-day moving average or slightly lower whichever scenario plays out. Then I expect the Fed to dump its hawkish stance and switch back to QE on steroids, leading to the final melt-up in stocks before the Greatest Depression begins in earnest next year.

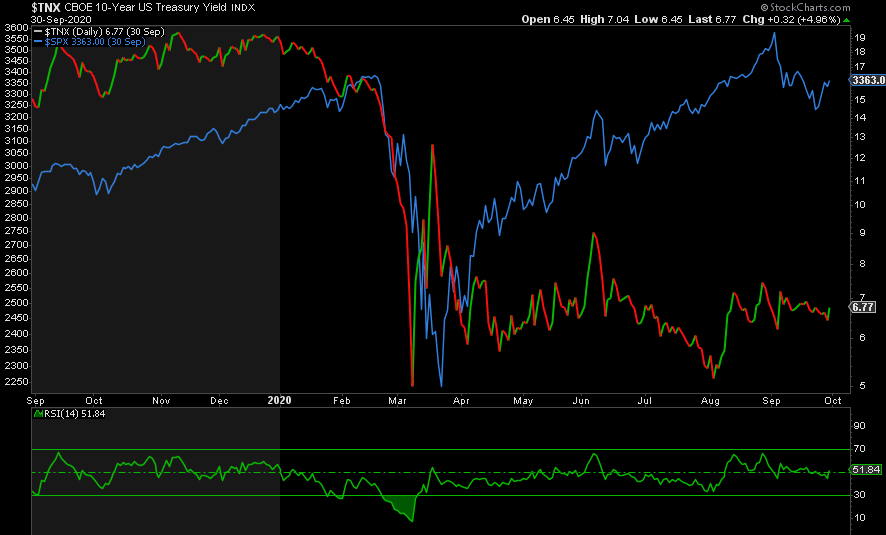

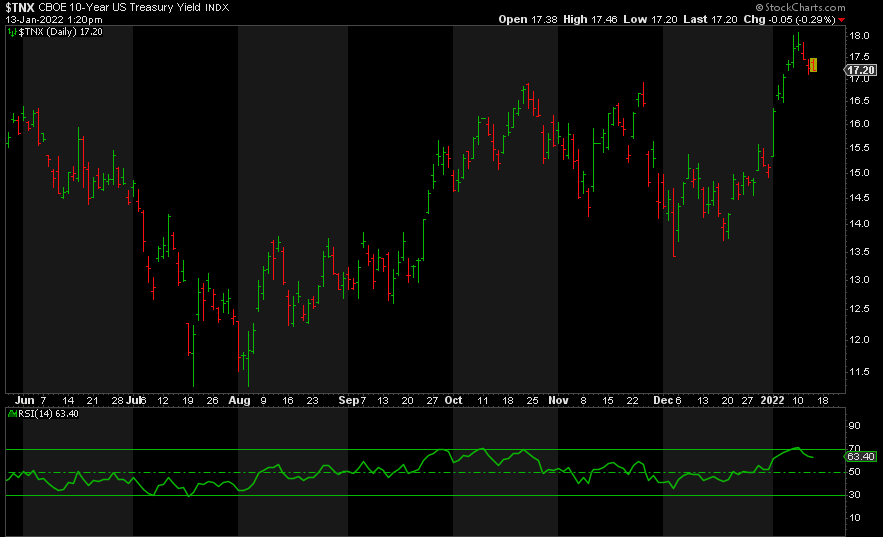

10-Year Treasury Bond Yield

With the pullback in the 10Y yield, we now have a near perfect set-up for a negatively divergent higher high in yields around 1.90-2.00% for the next dump to ~0.40%, the low in March 2020. This will likely coincide with the dump in stocks. Case in point, the symbiotic dump in both stocks and yields in March 2020:

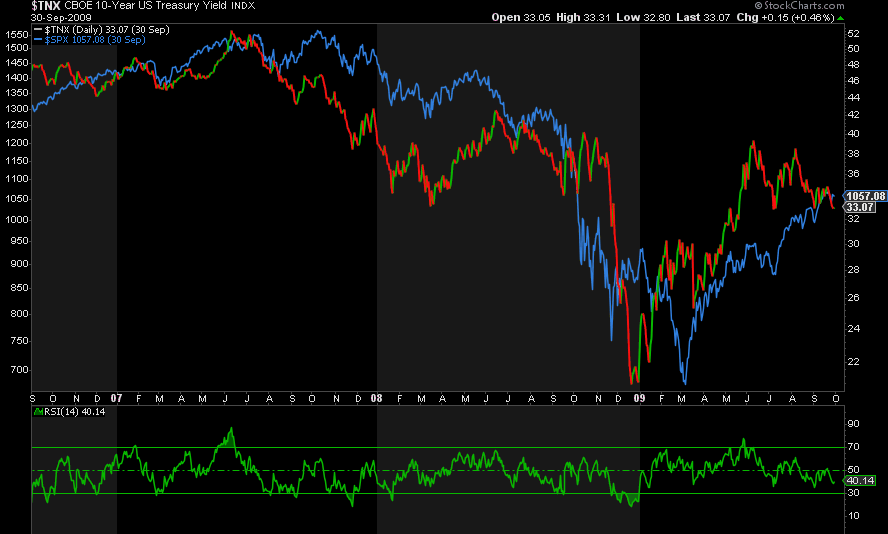

The Global Financial Crisis from 2007 to 2009 is an even better example:

Why do yields fall along with stocks? Because cash flows run out of stocks as people sell and look for safety by buying bonds, pushing down yields.

Once the Fed steps in to reinflate stocks for the final time, yields will go back up but they’ll be capped at 2% or lower in the 10-Year. Massive dollar printing in an already high inflation environment is akin to pouring gasoline on a fire. With nominal bond yields capped and inflation skyrocketing, what happens to real yields? They crash. What moves inversely to real yields? Precious metals and miners.

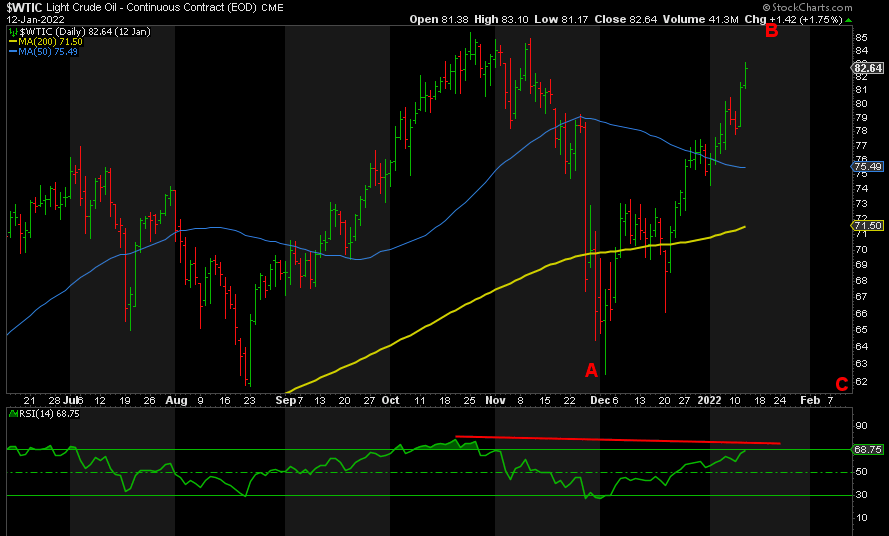

OIL

Just like bond yields, oil has the perfect set-up for a negatively divergent higher high before falling to my target zone of 58-63. This would be another deflationary event compounding that provided by the dump in stocks and reinforce my expectations for far lower bond yields. Once the Fed steps in with massive liquidity, oil is heading up to triple digits prior to the crash in 2023, imho.

DXY

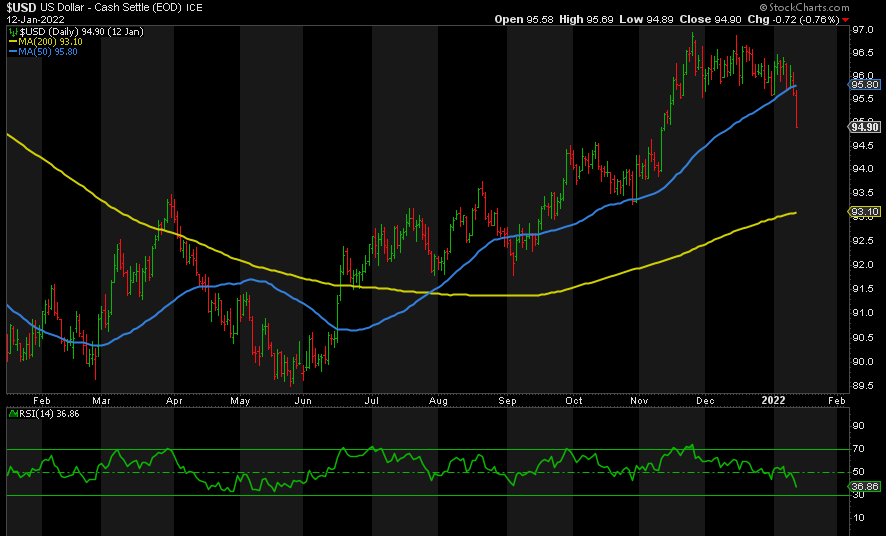

Lastly, but certainly not the least, the dollar…

To say that there is plenty of room for a negatively divergent higher high in the DXY (dollar index) is putting it mildly. In fact, it may have already topped out.

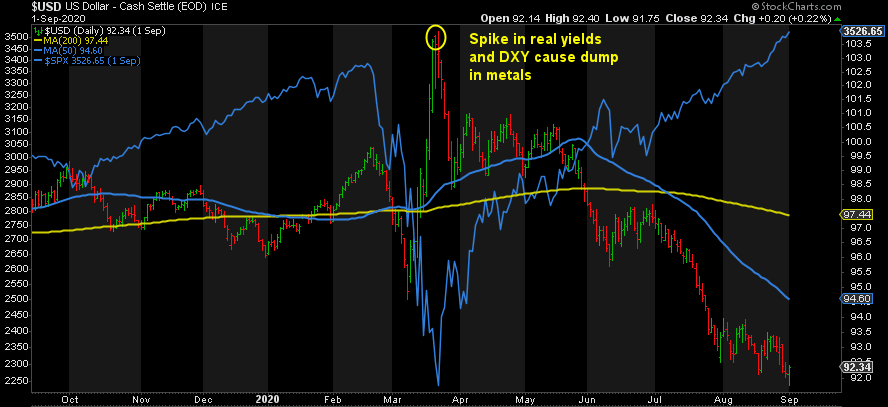

In March 2020, the dollar spiked higher as stocks crashed. But once the Fed intervened by slashing interest rates to zero and pouring $3 trillion in stimulus onto the markets, down the DXY went:

There’s little reason to expect it to be any different this time around. In summary, one more higher high is still a risk should stocks dump, but thereafter, 89-91 for the dollar and new record highs for Gold.

CONCLUSION

The big markets, bond yields, stocks, oil, and the dollar are all signaling a strong probability of new highs before they dump collectively ahead of the Fed’s final ride to the rescue. At the risk of repeating myself, Gold will either go down with the ship initially and then take off or pull another October 2008 and just go straight up in anticipation of the Fed’s intervention. Either way, 2300+ for Gold and spectacular gains in the metals and miners ahead. All ahead of the Greatest Depression beginning in 2023 (2024 latest), imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.