Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

You need to get ready for the next run above 2000 in Gold and possibly 30 in Silver. Miners will soar even higher in percentage terms. What look for? Peak DXY and peak bond yields. The Banks are record long Treasury Bond futures. They believe yields are going much lower. They are the smart money. Lower yields are only beneficial for Gold and Silver.

The DXY is approaching its 200-day moving average at ~106. Could it fall a little short of that or go a little higher, sure, but the rebound I forecast back on January 4 is coming to a close soon. If the near perfect inverse relationship with Gold continues, a peak and fall in DXY virtually guarantees much higher Gold and Silver prices. I am looking for the 90s next, perhaps even sub 80, in the DXY. Where would Gold and Silver be then?

What is the trigger for these moves? My guess is a sharp drop in inflation announced in March, followed by a possible “pause” signal from the Fed on rate hikes at the March FOMC. Note that this means we could see lower prices yet across the complex over the next 2 to 3 weeks, but I suspect the PMs and miners will see the writing on the wall ahead of that. We’ll see.

This is the backdrop for where I see the precious metals and miners sector going in the next few months. Let’s look at the targets on the downside for the lows in each and the potential upsides once the rally takes place.

GOLD

First, how did we get here? DXY rallied on a dovish ECB, pushing the euro down and DXY higher. Far stronger than expected Non-Farm Payrolls and CPI data did the rest. But the technicals on both the daily and weekly charts clearly showed this was coming, Gold was just waiting for the catalysts.

Note the extreme overbought conditions and multiple negative divergences in the RSI and the MACD Histogram (blue) while price was going higher. In addition, we had the biggest peak in the MACD Line (magenta) since the peak at 2079 in March 2022. The breakdown of the ending diagonal / bull flag was the just confirmation that the rally was over for now and the pullback had begun.

Fast forward to now. The RSI has erased the overbought condition and is approaching the extreme oversold 30 level. The MACD Histogram is coming off its lowest level since June 2021 when Gold was at 1775 and is now turning upwards. The MACD Line has fallen off a cliff and is now tagging its support line. Simply put, the conditions are ripe for a rebound sooner or later, or something far bigger. My target on for the next peak in Gold is ~2200.

As for where we bottom out, my targets remain 1820, 1800, or worst-case 1750. We have already broken the 50DMA and a test of the 200DMA is possible next before we head higher.

SILVER

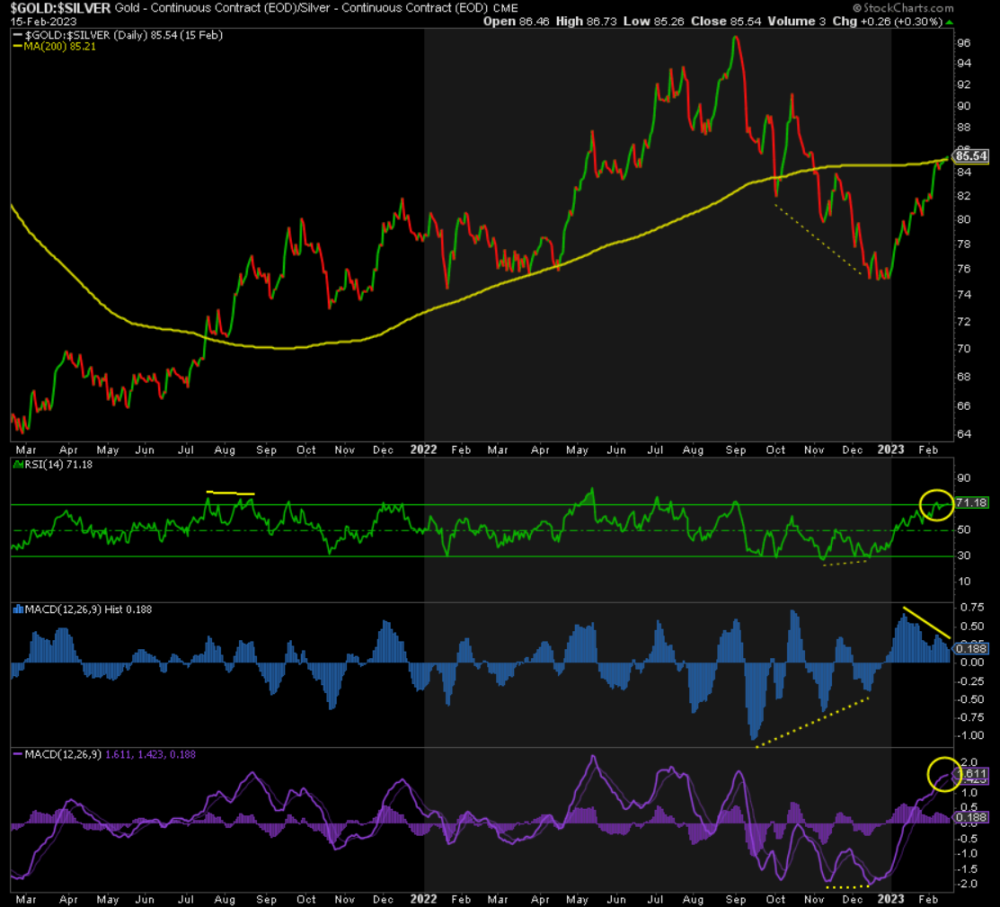

Switching to Silver, let’s start with the Gold:Silver ratio, or “GSR”:

It has reached my target of the 200 day moving average and now the RSI is extreme overbought an negatively divergent. The MACD Histogram is already falling and is negatively divergent also. The MACD Line is turning down from a peak. All of this tells me Silver is about to outperform Gold on the upside.

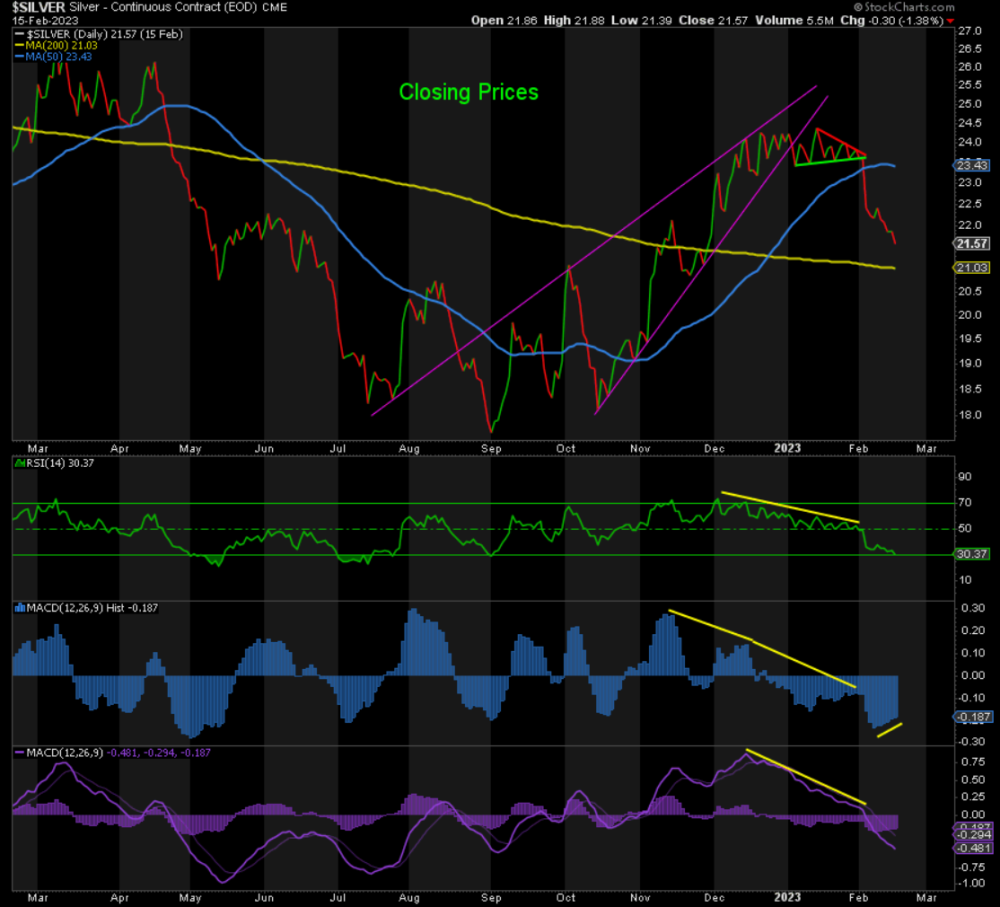

Silver has been beaten down even more so than Gold, which explains the rising GSR above. However, it is now also more oversold on every indicator and is fast approaching its 200-day moving average. This just reinforces my expectation that Silver will outperform Gold when the turn comes, be it at the 200DMA or slightly lower, a fake breakdown.

The RSI is extreme oversold but it is likely to become even more so, setting up a positively divergent lower low. However it plays out, Silver is close to a major low. The MACD Histogram is already turning up from its lowest level since May.

The MACD Line fell from its highest level since the March 2022 peak and is now at its lowest since July. The ingredients are in place for blast off soon.21-20 is the support zone for Silver. My next target on the upside is the prior high at ~30.

GDX

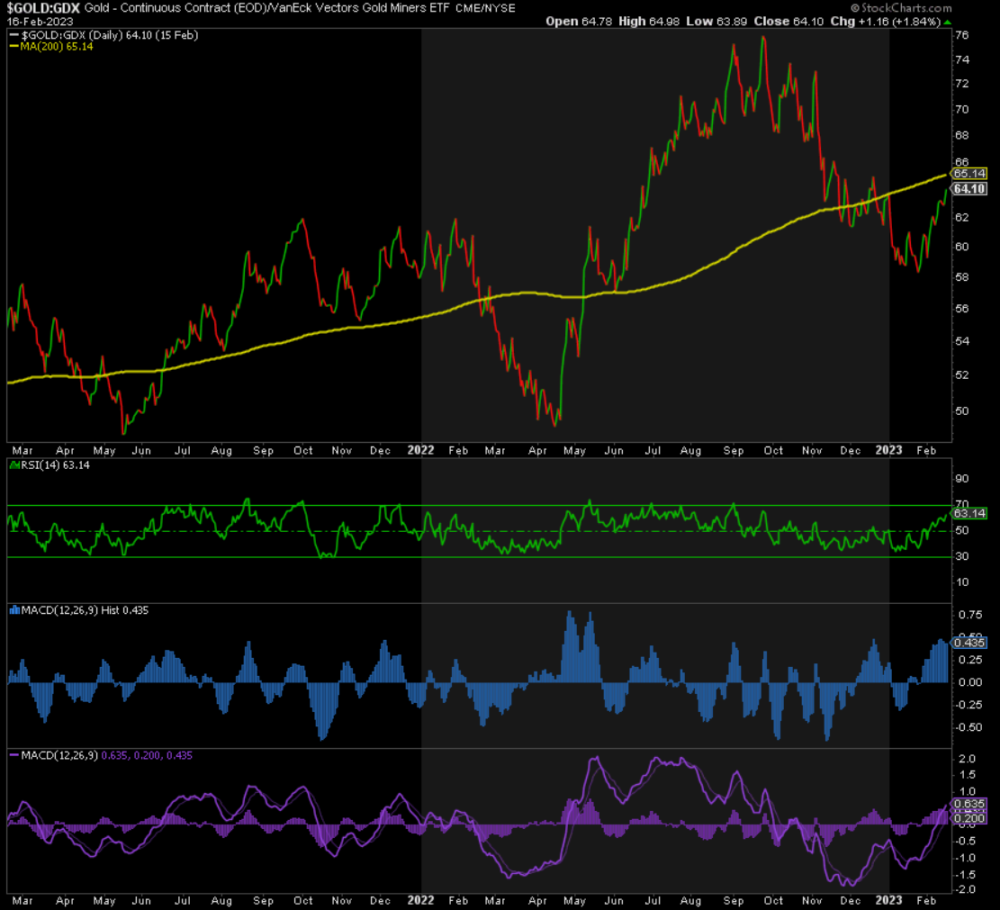

The Gold:GDX ratio, or “GGR”, is fast approaching its 200DMA now too. The RSI is also approaching the extreme overbought level of 70 and the MACD Histogram is already turning down. This bodes well for outperformance in GDX relative to Gold when the rally begins. No surprise there.

As you can see, GDX has hit my target for the bottom of Wave 2 somewhere between 29-26. So we are already in the buy zone but could fall a little lower yet. The RSI is approaching extreme oversold levels at ~30. The MACD Histogram is already turning up. The MACD Line is hitting its trendline support. Sound familiar? It should, GDX is getting ready for launch too imho. My next target on the upside in wave 3 is 40+.

SILJ

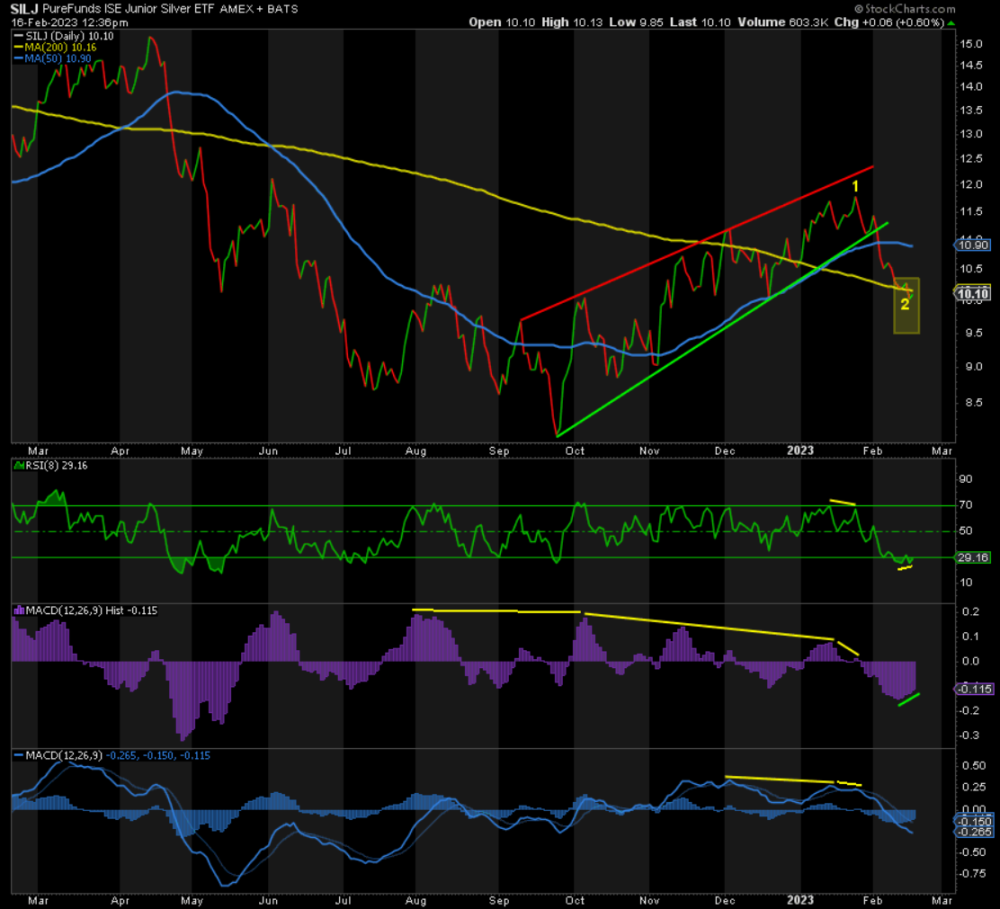

Dare I say it but SILJ may have already bottomed out yesterday. We have a positively divergent, extreme oversold RSI yesterday and follow through to the upside today. The MACD Histogram is already turning up. It’s only a matter of time before the MACD Line follows suit. We have hit my Wave 2 target box on the downside. While I don’t rule out “slightly” lower prices yet, the rally in Silver miners has already begun or its pending. My next target on the upside is 30+.

In conclusion, the entire sector is getting ready to go much higher imho, with Silver outperforming Gold, Gold miners outperforming Silver, Silver miner outperforming Gold miners, and junior miners outperforming senior miners. The triggers may be a few weeks away but like in October 2008 and August 2018, I expect them to bottom out ahead of that, and then just accelerate to the upside once the CPI comes out and the Fed moves towards a “pause” thereafter. Only a drop below 1618 in Gold negates this entire bullish thesis, but the chances of that are remote, to put it mildly. The only other caveat is a stock market crash, but seeing is believing when it comes to that.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.