Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

When Gold is stuck in a straight jacket, I find that the best thing to do is take a step back and look at the big picture and consider the various scenarios based on the current data. In doing so, I consider both the bearish and bullish cases below.

Fundamentals

Fundamentals are focused on fiscal and monetary stimulus. Politicians on the left and right are still trying to find agreement on a $1 trillion infrastructure package ahead of the July 4 two-week break of Congress. Should they fail to do so, that could put further pressure on Gold in the short-term.

Meanwhile, the Fed continues to print dollars to buy $120 billion of treasury debt and mortgage-backed securities. Powell has made it clear that there are no plans to taper QE in the near future until the economy and employment pick up. But we’re hearing more noise from various speakers that inflation could be higher and more persistent than expected and that this may warrant a rate hike sooner rather than later. At the same time, Powell has also reaffirmed his belief that inflation is transitory, a position that is being hotly debated right now.

Given that greater fiscal and monetary stimulus were the primary triggers of Gold’s rally post the March 2020 lows, not knowing whether we are going to get more or less stimulus will, in isolation, make it difficult for Gold to move much higher. Agreement on more fiscal stimulus would likely change that.

The other variable to consider is inflation, which has soared in recent months. If it proves to be more than transitory that would benefit Gold, but only to the extent that the Fed just continues to be hawkish with respect to tapering QE and raising interest rates sooner rather than later and yet does nothing.

Inter-Market Analysis

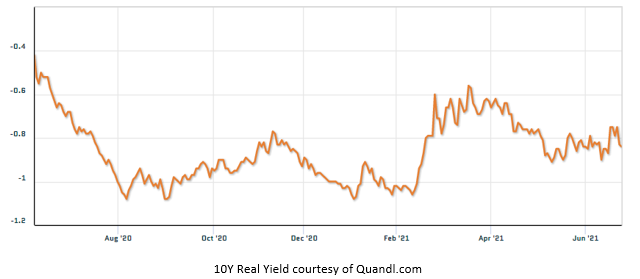

Real yields continue to move sideways for now and provide little information on the next direction for Gold.

As outlined above, should inflation continue to rise and the Fed does next to nothing in response, save perhaps cap bond yields, there is an asymmetric risk to the downside in real yields and upside in Gold. On the contrary, if inflation does subside, it’s a question of which falls faster, inflation expectations or bond yields to determine where real yields are headed next. In my opinion, the Fed cannot raise interest rates or allow bond yields to rise for very long unless they plan to crash the “Everything Bubble”.

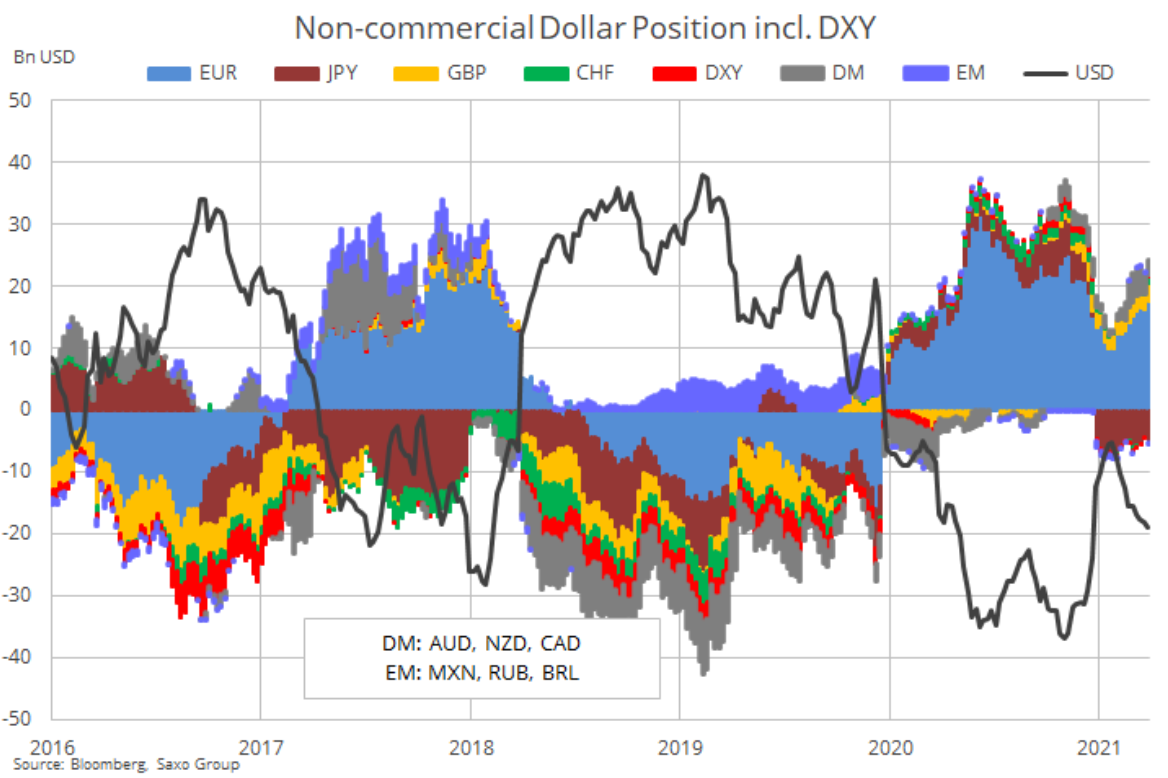

The USD has staged a rebound from its lows, but it has become overbought in the short-term. A negatively divergent higher high is possible before a deeper pullback occurs.

The rally in the dollar was primarily driven by hawkish talk from the Fed and a short squeeze in the massive short position on the dollar worldwide:

However, from a big picture perspective, there are still plenty of shorts out there which maintain the risk of a stronger rally to come once the pullback from overbought levels in done. I say this because dollar strength tends to weigh on Gold but not always. There have been instances where they rise together. Real yields are a far more reliable gauge of Gold’s direction than the dollar.

At this point, I have outlined some of the factors to be aware of that affect Gold, but given the level of uncertainty with respect to each, we need to turn to tools that focus on Gold itself.

Technical Analysis & Fibonacci Levels

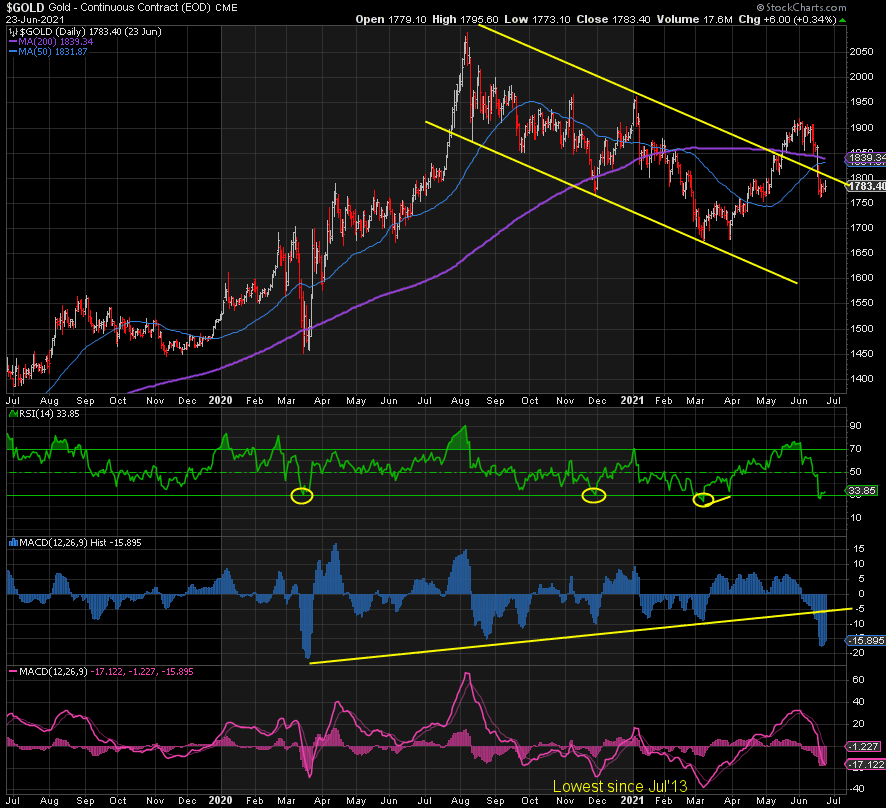

The daily chart shows that in order to suggest the bottom is in, we need to break back above the 50 and 200 day moving averages at 1831 and 1839. Ahead of that is resistance at ~1800 also.

Gold is clearly deeply oversold, it reached its lowest level since March and every time it falls below 30, it tends to rally from there. The MACD Histogram also reached its lowest point since March 2020. However, my ideal scenario for a bottom would be a positively divergent lower low, whereby the price falls to a lower low but the RSI is higher.

From a support perspective, 1770 is the 61.8% retracement of the entire rally from 1673 to 2089. 1734 happens to be the 85.4% Fibonacci level.

Taken alone, this is all bullish. However, a break of 1673 opens up a deeper dive to 1500. Let’s cross that bridge if and when we come to it. I consider this a very low probability at this time.

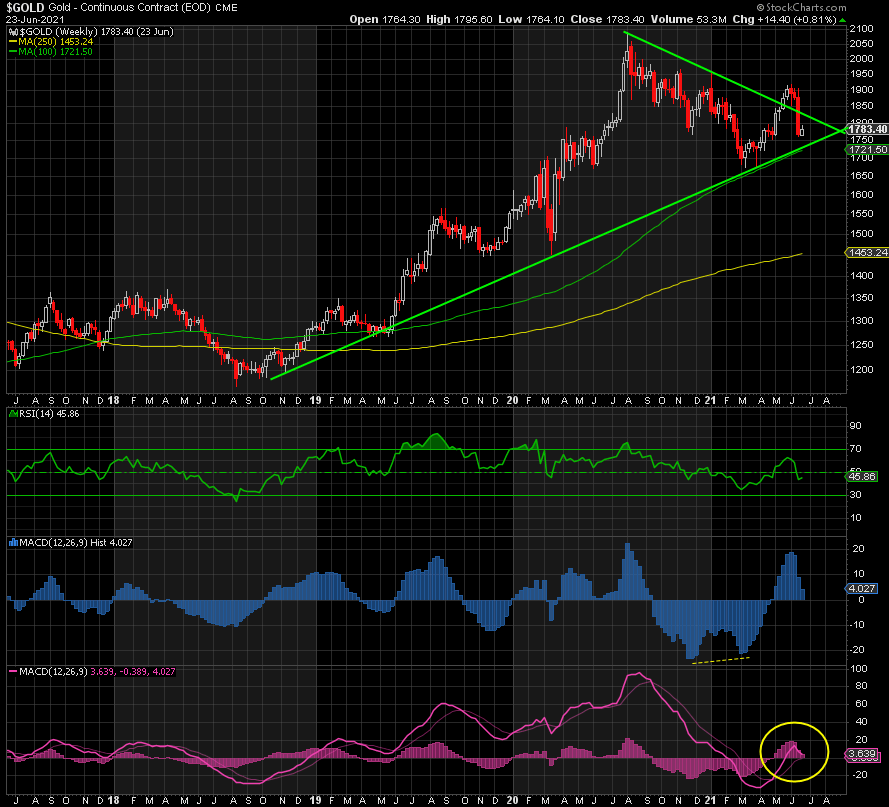

The weekly chart for Gold shows support at ~1730, where the trendline since the bottom in 2018 rests. Meanwhile, 1800-1815 is the resistance zone.

I’m closely watching the weekly MACDs. The MACD Histogram is back-testing support at 0 and the MACD Line is back-testing its signal. If they hold and turn up, this suggests “at least” a strong rebound next.

Sentiment

One of the best contrarian indicators, especially in precious metals, is showing increasingly pervasive bearish sentiment. I am seeing numerous calls for 1500 or lower now. This is no surprise given the hammering Gold has taken since 1920 and 1906 based on next to nothing from the Fed. However, the odds favor that this is just another case of price chasing, people talking from the heart instead of the head. Bearishness is bullish.

Conclusion

Anything is possible, Gold could go lower, much lower, but the balance of data and the associated probabilities strongly suggest that the risk-reward from here is weighted to the upside, especially if we get that positively divergent lower low. All that remains is the catalyst for such a move. Perhaps it is the advent of Basel III.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.