Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

As Q3 begins, the narrative of higher U.S. interest rates and a soaring dollar continues. But what will the narrative be by the end of Q3? Answer that question and you'll know where COMEX precious metals prices are headed.

The year 2022 has certainly not been much fun for us precious metals enthusiasts. However, as the year began, we all knew that the Fed was embarking on a schedule of higher interest rates and lessening QE, so really none of the price action thus far should come as a surprise. In fact, it's played out pretty closely to what we wrote in our annual forecast back in January:

One part of that forecast called for the possibility of COMEX silver briefly dropping below $20 and filling a gap on the weekly chart. In January, we speculated that this drop was likely to "mark the lows of the year":

And here we are...

So now the year is half over and things look pretty lousy. The prevailing mindset continues to expect more and more fed funds rate hikes combined with a higher and higher U.S. dollar index. And maybe that's right. Maybe Jerry Powell and his Fed are correct in assuming that the U.S. economy is "strong" and "robust". He sure has been saying that a lot lately...as if he's trying to talk it into existence.

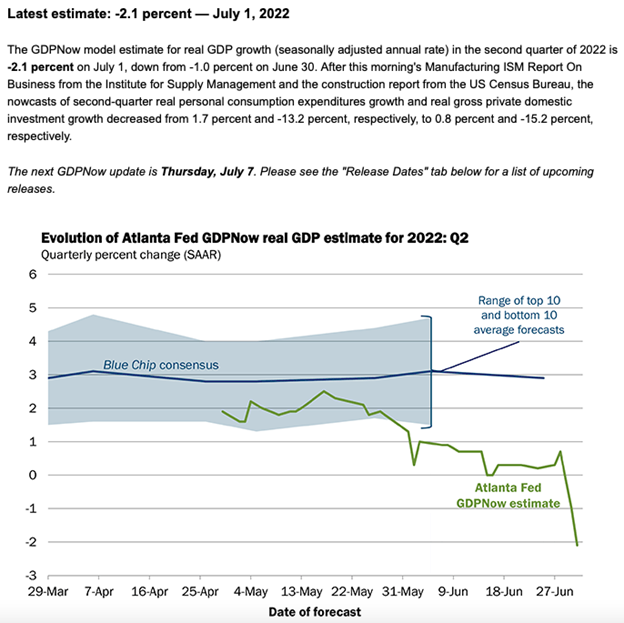

But actual facts and reality are beginning to get in the way. As you know, the U.S. economy officially contracted at a -1.6% rate in Q1 and the current GDPNow forecast from the Atlanta branch of the Federal Reserve suggests an even deeper contraction as Q2 comes to a close:

Now I'm no eight-figure Wall Street economist, but I do have a degree in economics, and I was taught years ago that the definition of a recession is two consecutive quarters of economic contraction. In fact, that's still how online dictionaries define the term too:

So, the U.S. economy is about to be officially labeled as being in "recession", and into this malaise, the Fed is expected to hike the fed funds rate by at least 100 basis points this quarter. LOL. Well, we'll see about that, won't we?

What if, instead, by the end of September the global markets are beginning to assess possible fed funds rate cuts and "Powell Pivot II"? Already, the eurodollar and fed funds futures markets are beginning to sense this possibility, and it certainly appears that the Fed has been slow to initiate their ballyhooed "quantitative tightening" program too:

System Open Market Account Holdings of Domestic Securities Twitter

— Michael Burry Archive (@BurryArchive) July 1, 2022

Two years ago, Jerry Powell used his speech at Jackson Hole in August to announce a new Fed policy of "inflation averaging". Last year, Jerry suggested that QT and rate hikes would be on the table for 2022. Well, what if he uses this year's speech to signal a turnaround in the Fed's tightening plans and a move back toward easing and more QE? Could the tables turn that fast? Of course they could.

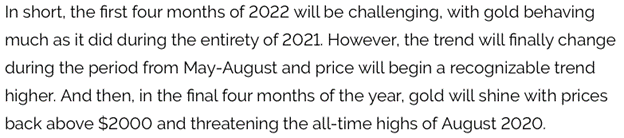

And if that happens, our January forecast of a late-year rally off the summertime lows is going to look pretty good. Here's another snippet of what we wrote back in January:

So go ahead and grimace, wail, and grind your teeth. You’re certainly justified in doing so as it has been a frustrating start to the year. But narratives can change pretty quickly, and so can the general direction of markets.

When Q4 begins in October, let's be sure to refer back to this post. There's a pretty good chance that the general direction of COMEX precious metal prices will have changed, and with it, our overall sentiment in the sector.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.